What is the revenue growth rate??What is the connection between YoY, QoQ and MoM??

Revenue Growth Rate (Revenue Growth Rate) is how much a company's revenue has grown or shrunk by comparing revenue over two different periods of time.。

What is revenue growth rate?

Revenue Growth Rate (Revenue Growth Rate) is a comparison of a company's revenue performance over two different periods (annual, quarterly, or monthly) to see how much a company's revenue has grown or shrunk。

The term "revenue" in the revenue growth rate refers to all the sources of revenue a company receives when doing business, but without deducting costs such as raw materials, labor, expenses, taxes, etc.。"Growth rate" is to compare revenue over time to see if the company is growing or regressing.。

This indicator is very important for investors because it is easy to see if the company you want to invest in or have invested in has any growth potential and whether it will give us a return on share price appreciation in the future.

How to Calculate Revenue Growth Rate?

To check the company's revenue growth rate, we need to select two different periods, but comparable revenue comparisons。For example, this year compared to last year's revenue, this quarter compared to last quarter's revenue, or this month compared to last month's revenue。

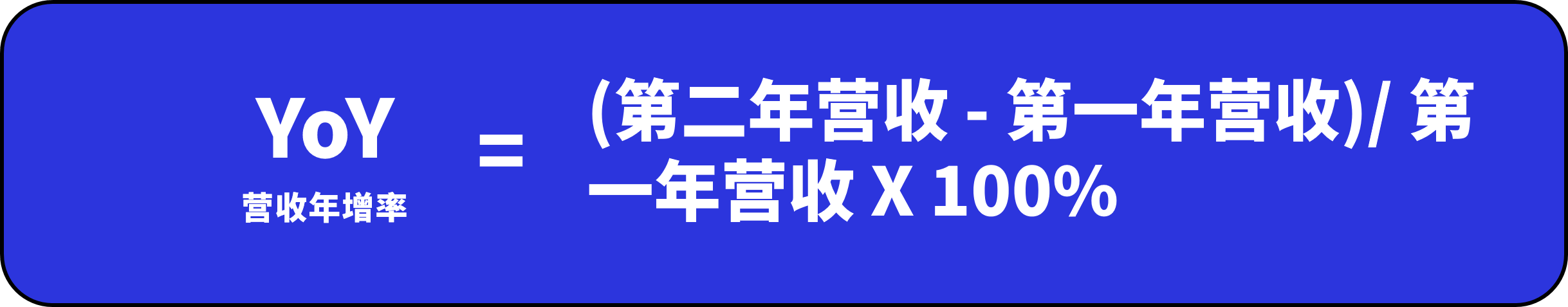

Annual growth rate (YoY)

The annual growth rate (YoY) is a comparison of revenue performance over the same period for two consecutive years.。

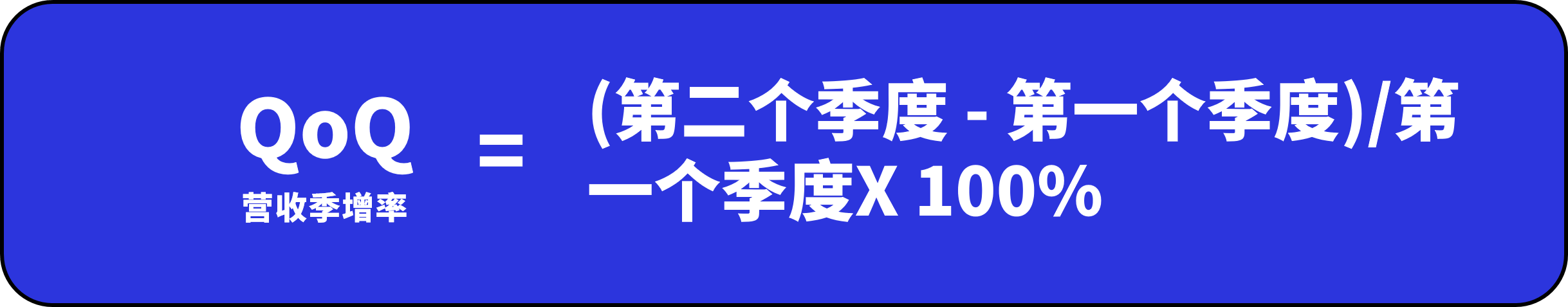

Quarterly growth rate (QoQ)

The quarterly growth rate is compared with the performance of two consecutive quarters.。

When using the quarterly growth rate, the quarterly revenue incurred by 10,000 is deducted from the quarterly revenue incurred first, such as the third quarter minus the second quarter revenue, or the fourth quarter minus the third quarter revenue.。

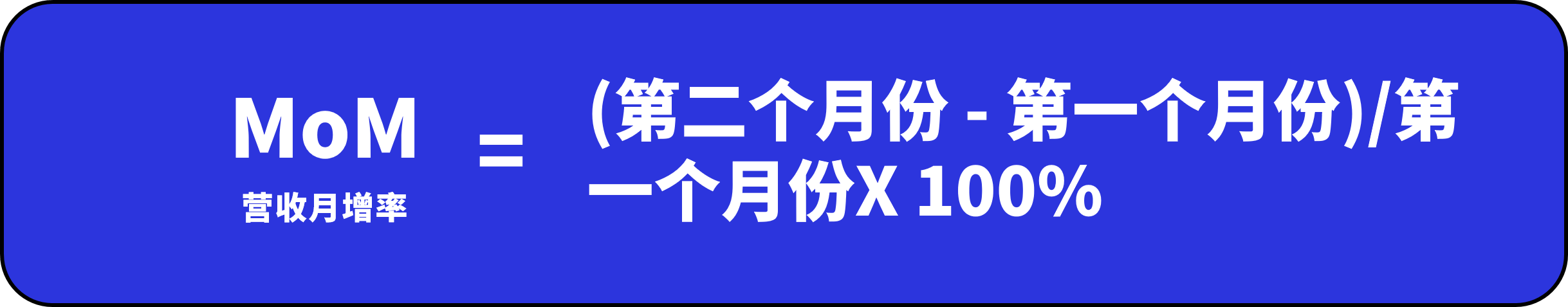

Monthly Growth Rate (MoM)

The monthly revenue growth rate is to compare the revenue performance for two consecutive months.。

Please note that the revenue for the later month should be deducted from the revenue for the earlier month.。

Why annual growth rates are most commonly used?

Typically, a company's financial reports are eventually compiled into a year for reference, so the annual growth rate is the most commonly used growth rate formula。In addition, the weakness of quarterly growth rates becomes apparent in the event of companies with significant cyclical differences in performance。

For example, the leisure tourism industry has a peak season and a low season, and the volume of business can vary greatly during the low season, so if you compare the quarterly growth rate, the growth rate results may be difficult to see the company's growth.。

In this case, the annual growth rate is a better choice.。Similarly, there is a weakness in the monthly increase rate, which is that the difference in the number of days in the month, especially in February, which has fewer days, is more difficult to compare with January or March.。

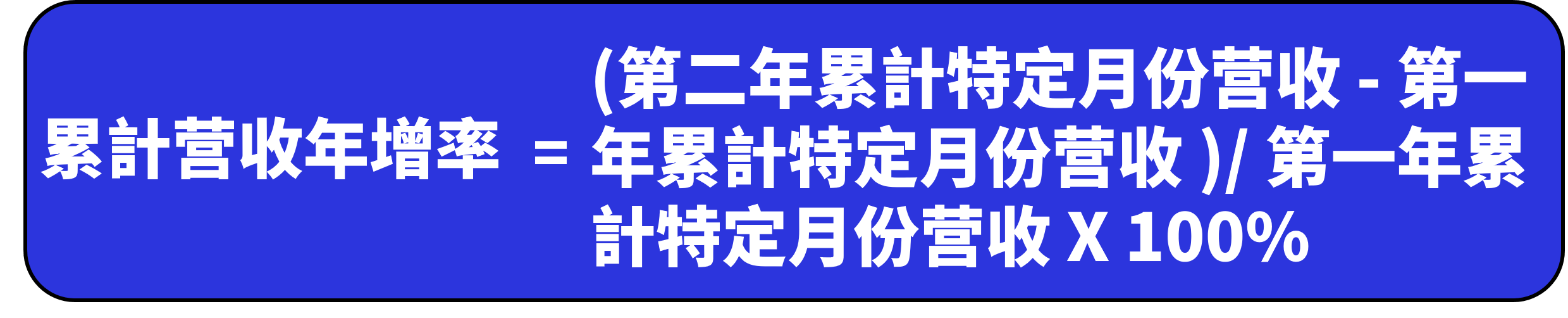

What is the cumulative annual revenue growth rate.?

The cumulative annual revenue growth rate is the cumulative revenue of two different years.。The company's quarterly results are presented on a quarterly basis, so in the second and third quarters, in addition to the quarter's revenue performance, the cumulative performance from the beginning of the year until the end of the quarter is also reported, known as cumulative revenue.。

For example, Company A announces its second-quarter results, and in addition to showing revenue performance for the quarter, it also discloses cumulative revenue data for a total of six months from year to year; if it is the third quarter, there will be cumulative nine months of revenue data。

How to evaluate a company in terms of revenue growth rate?

In fact, there is no specific standard for revenue growth, so when measuring revenue growth, we can compare it with the company's past revenue growth rate, or with peer competitors.。

When the revenue growth rate shows greater than zero, it means that the company is growing, and when the growth rate shows less than zero, it means that the company's revenue performance is regressing.。

If you calculate a zero growth rate, it means that the company's revenue performance has not changed.。

However, a company's revenue performance cannot be maintained forever, so it is necessary to evaluate the growth rate of the latest revenue performance from time to time.

How to Use Revenue Growth Rate to Pick Stocks?

The easiest way is to see if the company's revenue growth rate has improved, or even improved significantly。After all, a growing or improving company has a better chance of rising its share price in the future, and vice versa。

In addition, we can see from the company's revenue growth rate for several consecutive years whether the company's growth has accelerated or decreased。If the growth rate has already begun to slow down, or turned negative, it means that the company has gone downhill and the share price may fall in the future。

At the same time, not all companies always record stable revenue performance, and the nature of some businesses is destined for their revenue performance to fluctuate wildly.。Representative industries, including upstream oil and gas, construction and other fields, these companies are mainly waiting for contracts to be issued, so the quality of the market will directly affect their revenue accounts.。

Revenue growth does not represent a rise in share prices.

It is important to note that continued revenue growth does not necessarily mean that the stock price will rise。

For some blue-chip stocks with very limited growth potential, while their revenues will continue to grow slightly year-over-year, the increase may not keep up with some innovative new sectors, such as small and medium-sized technology stocks.。

For such companies, investors may focus more on dividend payout capacity than revenue to ensure a balance of risk in the portfolio。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.