Three Black Crows Candlestick Pattern - What Is And How To Trade

Learn all about the Three Black Crows candlestick pattern.What is, how to trade, and all the best trading strategies.

The Three Black Crows is a Japanese candlestick pattern used primarily for technical analysis as a bearish reversal signal. Below is a detailed explanation of this pattern and its trading strategies.

The Three Black Crows is a bearish reversal pattern that typically appears after an uptrend, indicating rejection from higher prices. This pattern suggests a potential downtrend and is a classic example of a reversal pattern.

How to Identify the “Three Black Crows” Candlestick Pattern?

The Three Black Crows consists of three consecutive bearish candles:

- Three Consecutive Bearish Candles: Each candle has a lower close than open.

- Large Candle Bodies: The bodies of the candles are relatively large compared to their wicks.

- Small or Non-existent Wicks: The wicks are usually short or absent.

_150084826_825.png)

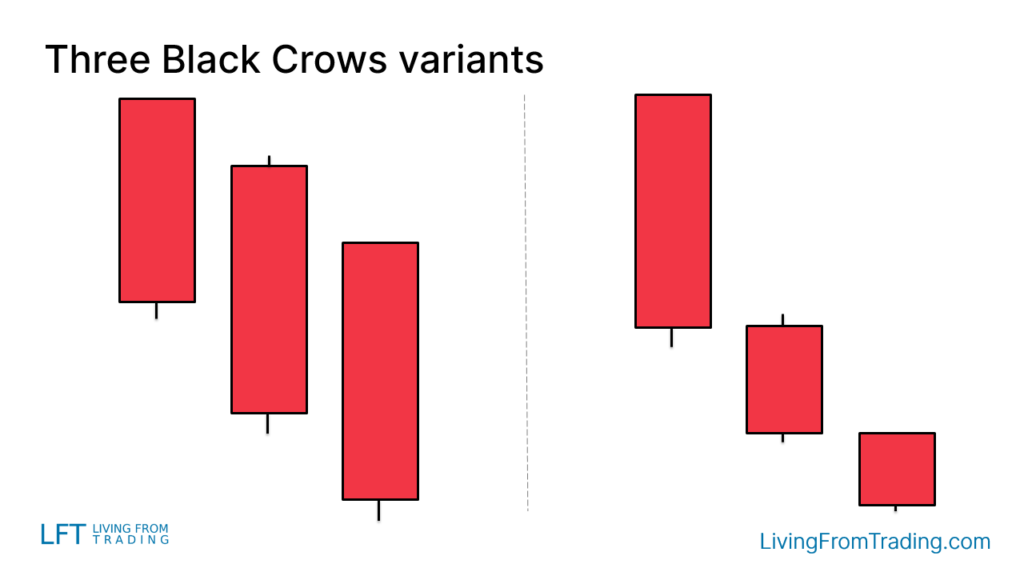

Variants of the “Three Black Crows” Candlestick Pattern

In practice, the Three Black Crows pattern may appear with some variations:

- Large Gaps Between Candles: There may be significant gaps between the close of one candle and the open of the next.

- Decreasing Candle Size: The size of each successive candle may decrease, indicating a gradual weakening of market momentum.

How to Trade

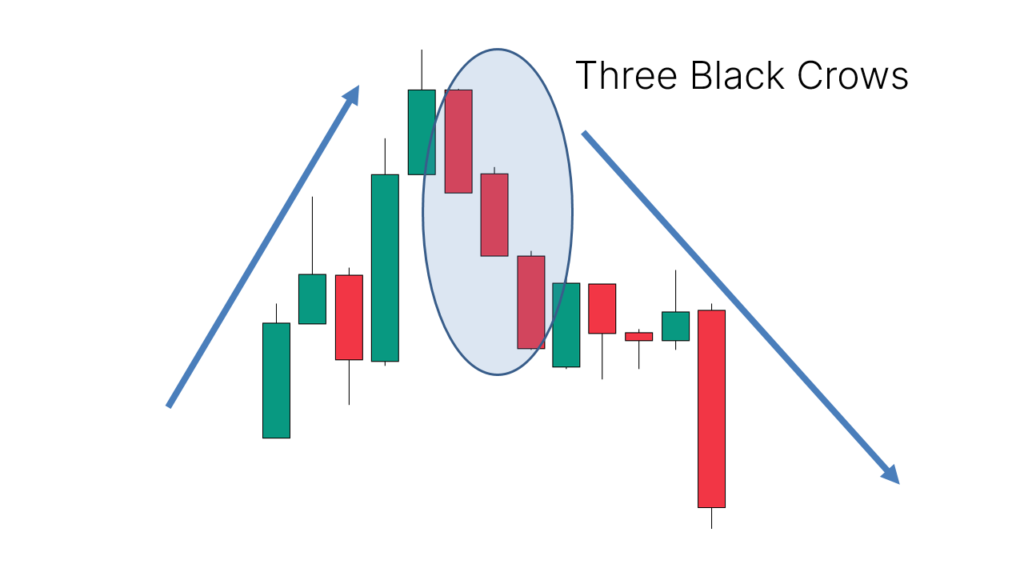

To trade the Three Black Crows pattern, it's not enough to just find a series of candles with the same shape. The effectiveness of the pattern depends on its location. A valid signal occurs when the pattern forms after an uptrend, and a bearish reversal is anticipated.

Trade Entry: Enter a short position when the low of the last candle in the pattern is broken. A stop loss should be set to manage risk, typically placed on the opposite side of the pattern.

Trading Strategy

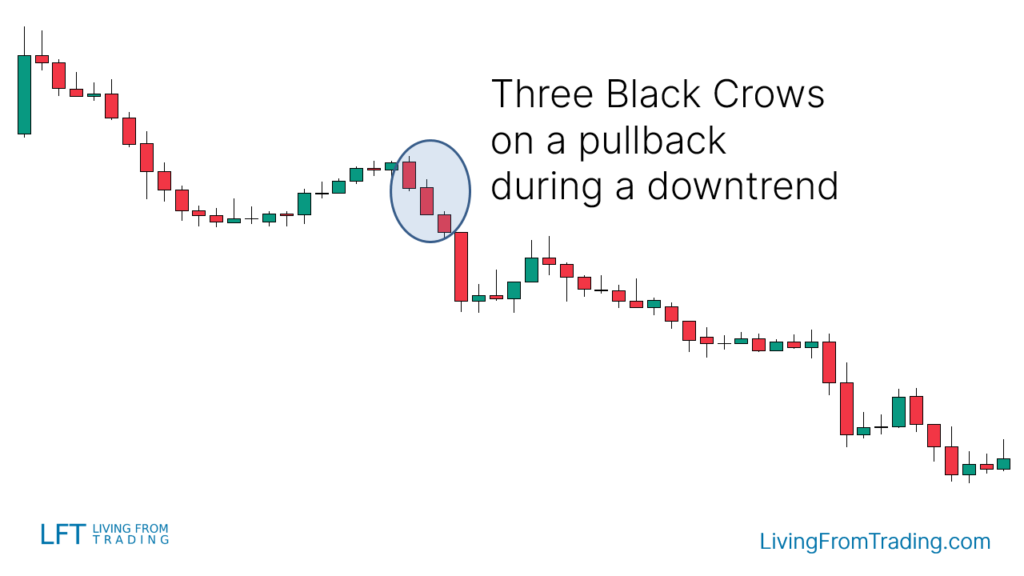

Strategy 1: Pullbacks on Naked Charts

Overview: As a bearish reversal pattern, Three Black Crows is effective during a downtrend.

Implementation Steps:

- Observe if the price is in a downtrend and wait for a pullback.

- Watch for the appearance of Three Black Crows during the pullback.

- Consider entering a short position at the end of the pullback.

- Set a stop loss above the pattern and establish a target price below.

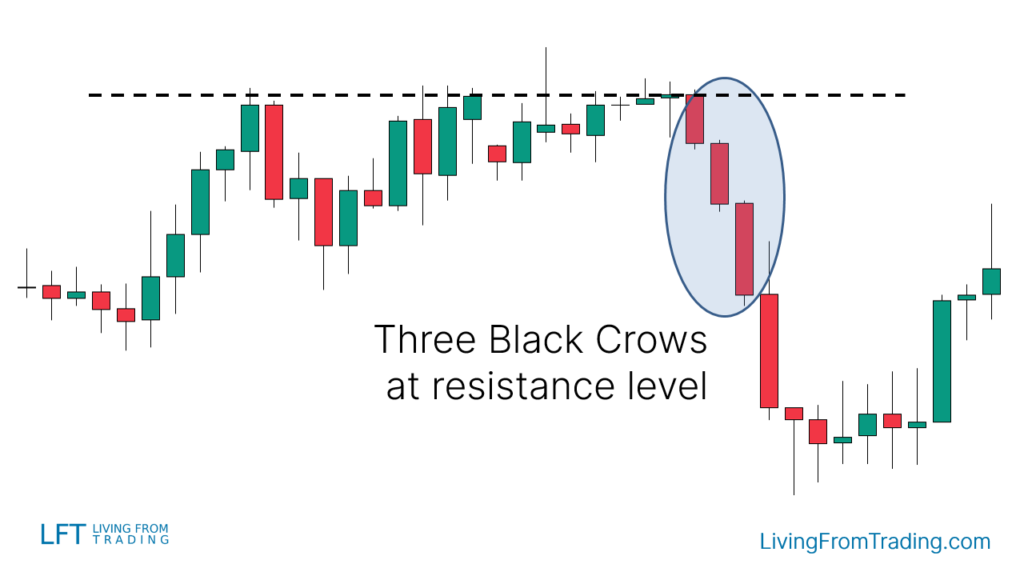

Strategy 2: Trading with Resistance Levels

Overview: Resistance levels are key areas for identifying price reversals.

Implementation Steps:

- Mark key resistance levels on your chart.

- Wait for the price to rise to these resistance levels.

- Check for the formation of Three Black Crows at these levels.

- Short when the price breaks below the low of the last candle in the pattern.

- Set stop loss above the resistance level and determine target price below.

Strategy 3: Trading with Moving Averages

Overview: Moving averages help in identifying trend reversals.

Implementation Steps:

- Identify a downtrend where the price is below a moving average.

- Wait for the price to rise and touch the moving average.

- Look for Three Black Crows forming at the moving average.

- Short when the price breaks below the low of the last candle.

- Set stop loss above the moving average and set target price below.

Strategy 4: Trading with RSI Divergence

Overview: RSI divergences can confirm market trends.

Implementation Steps:

- Identify an uptrend and mark the highs in the price.

- Compare these price highs with the RSI indicator.

- Look for a situation where the RSI makes lower highs while the price makes higher highs (bearish divergence).

- When Three Black Crows forms at a higher high price, aligned with an RSI lower high, consider entering a short position.

- Set stop loss above the pattern and establish target price below.

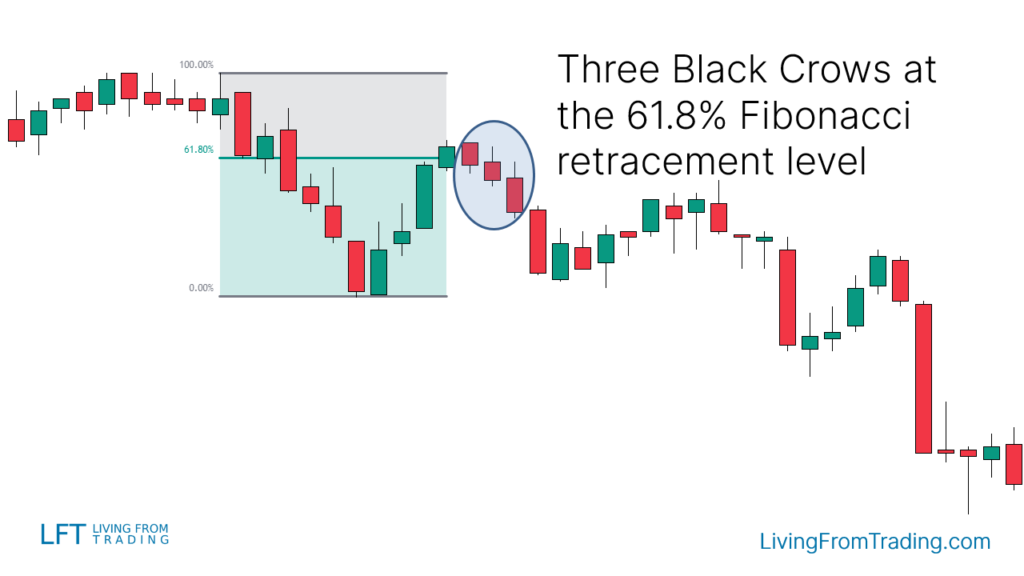

Strategy 5: Trading with Fibonacci Retracement

Overview: Fibonacci retracement levels identify potential reversal points.

Implementation Steps:

- Identify a downtrend or the beginning of one.

- Wait for a price movement upwards.

- Draw Fibonacci levels from the high to the low of the move.

- When the price hits a Fibonacci level and forms Three Black Crows, short the position.

- Set stop losses above the Fibonacci level and target further declines.

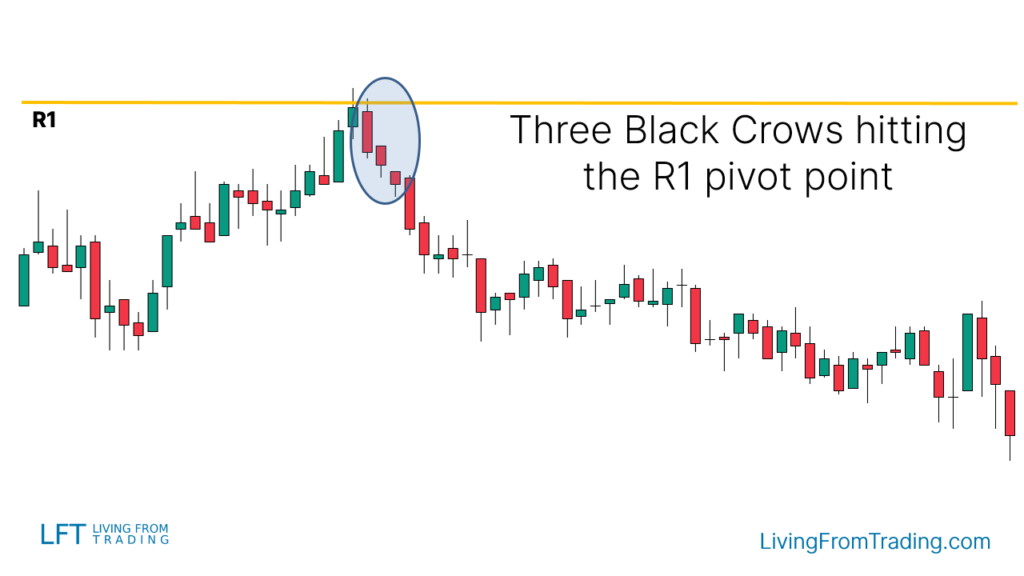

Strategy 6: Trading with Pivot Points

Overview: Pivot Points are automatic support and resistance levels.

Implementation Steps:

- Activate Pivot Points on your chart.

- Determine which Pivot Points are above the current price, as these act as resistance.

- Wait for a price move up to a Pivot Point level.

- If Three Black Crows appear at that level, short the position.

- Set stop losses above the Pivot Point and target lower price levels.

Conclusion

The Three Black Crows is a powerful bearish reversal pattern that signals a potential shift from an uptrend to a downtrend. By employing various trading strategies and technical indicators, traders can improve the accuracy of their trades and achieve better trading results.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.