Recently, in the Snowflake Build 2024 keynote speech, Wu Enda, former head of Google's brain and former director of the Stanford Artificial Intelligence Laboratory, made predictions about the rise of agents and the future development of the AI revolution.

Wu Enda compares AI to new electricity.He said this is because AI, like electricity, is a general technology. If someone asks what the purpose of electricity is, it is difficult to answer because electricity is almost omnipotent.Now, new AI technology, like electricity back then, is creating an unprecedented opportunity for us to build new applications that were previously impossible.

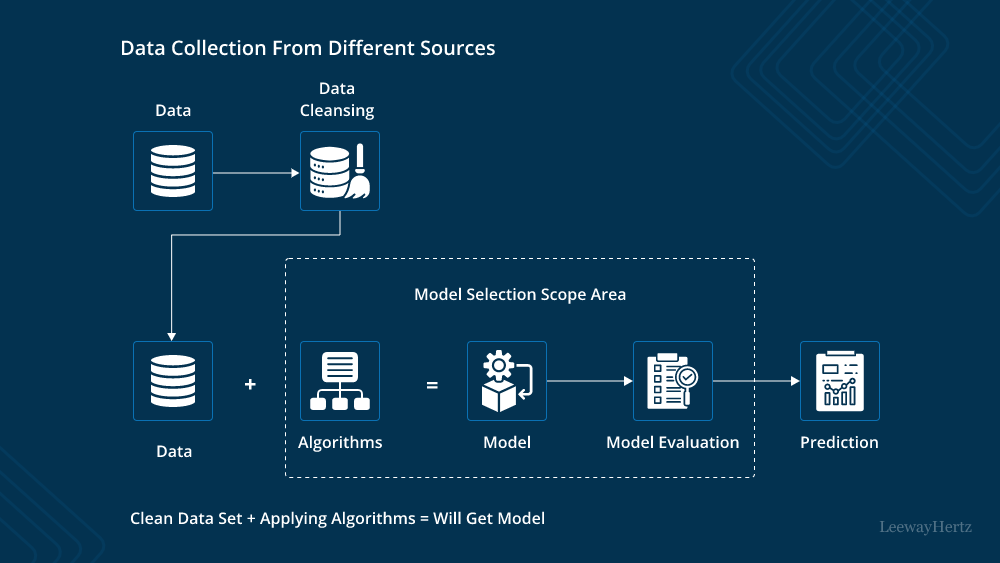

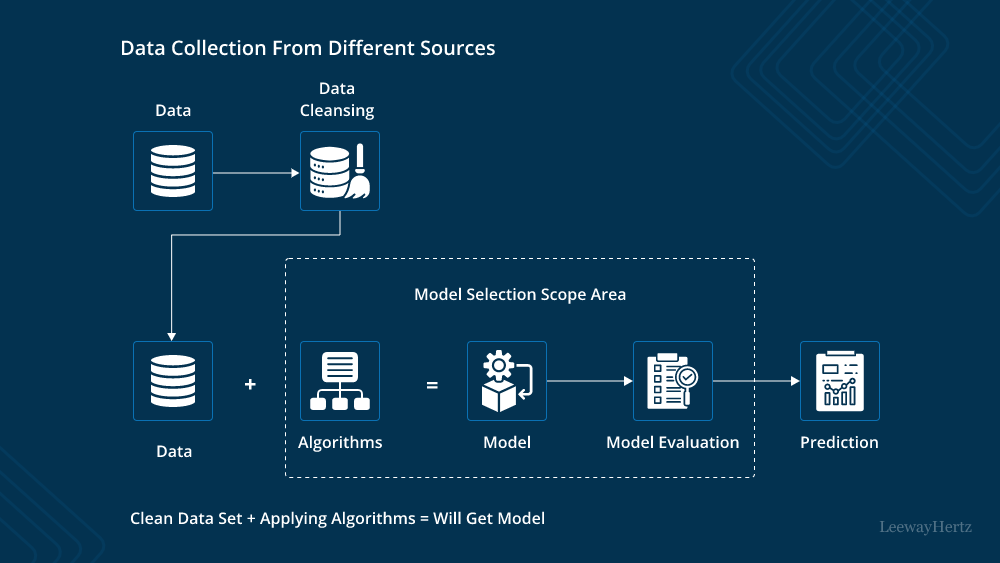

If anyone does not understand AI yet, Wu Enda divides AI into three layers: the lowest layer is semiconductors, the middle layer is cloud computing and development tools, and the upper layer is many basic models and model training processes.In addition to these three layers, the more important thing is actually the application layer. Only when the realization of the application layer generates more value and revenue can we feed back the sustainable development of the underlying technology.

Unfortunately, the current focus of many media is only on the technical level, especially the development of AI generation and big language models. However, what can really enable AI to break through the growth bottleneck is more capabilities, GPUs or other types of hardware.

For example, Wu Enda said that he often talks with many people with ideas. These people already have commercial prototypes that can bring significant ROI to AI, but they do not have enough GPUs, or the token cost is slightly higher, so that the project cannot be realized.

Wu Enda believes that this problem will definitely be solved because the economic motivation to solve supply chain problems through GPUs or other types of hardware is very strong: more GPUs will be manufactured and more processing processes will be deployed, opening new doors for the promotion and implementation of AI projects.

Wu Enda said that in the past 10 to 15 years, a small number of people have said that AI is hitting a wall. Such statements have been repeatedly proven to be wrong. AI is still far from reaching a bottleneck period.As a general technology, AI has made great progress and will even make breakthroughs in the near future. The tasks we can accomplish with AI are growing rapidly.

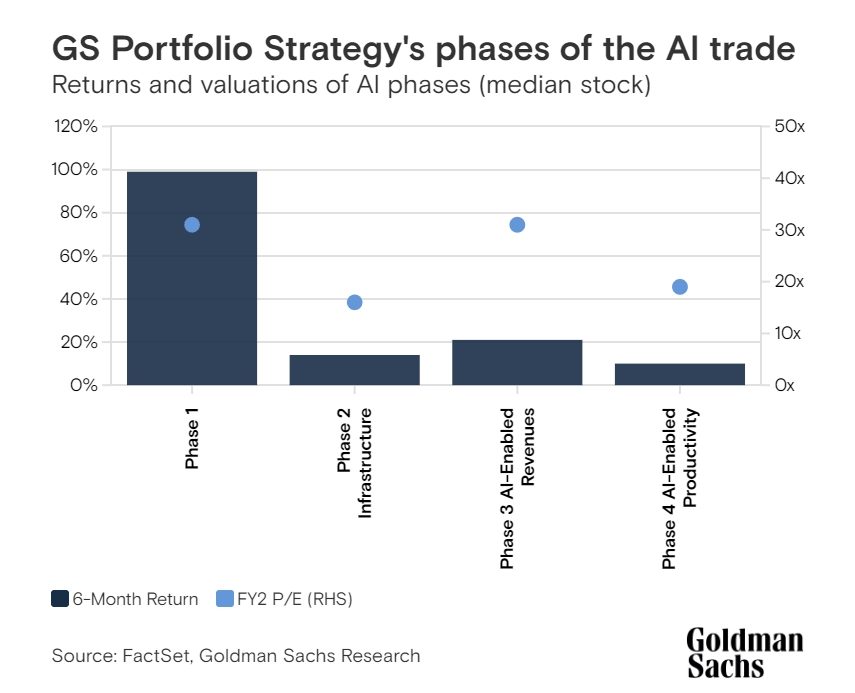

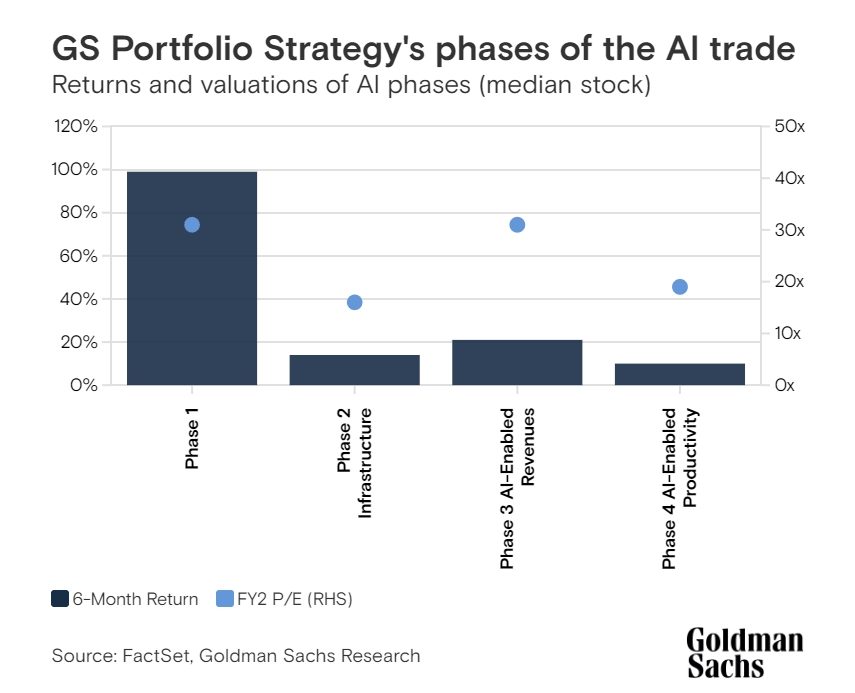

Wu Enda's views coincide with Goldman Sachs 'latest research report.

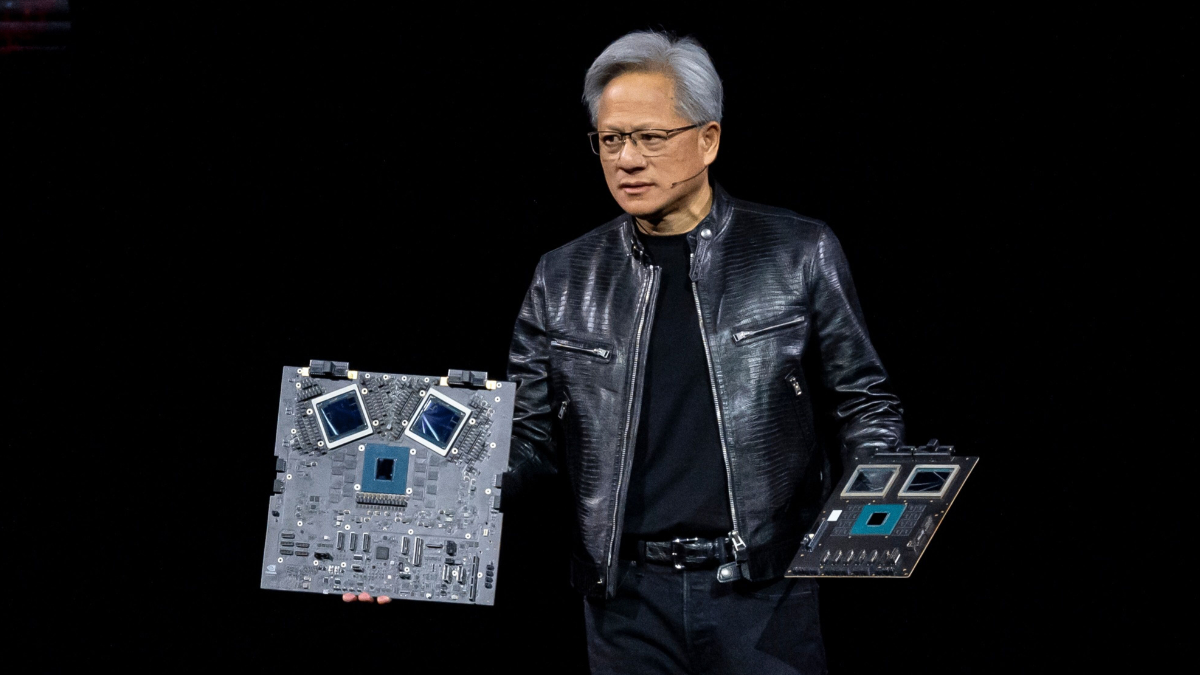

In Goldman Sachs 'perspective, the dividends of AI are divided into four stages: the first stage: the most clear AI beneficiaries benefit stage, represented by Nvidia; the second stage: the benefit stage for companies focusing on AI infrastructure; the third stage: Focus on the benefit stage for companies that have the potential to realize AI monetization by generating incremental revenue; the fourth stage: the benefit stage for companies that benefit the greatest potential profit increase in extensive AI adoption and productivity improvements.

Goldman Sachs said that the current investment hotspots in the market are still concentrated in the second phase, and the AI infrastructure has not yet been completed.For example, the world's top Internet giants, such as Amazon, Google, Meta, Microsoft, Oracle, etc., have all announced large-scale AI infrastructure plans this year and next.

Goldman Sachs expects their capital expenditures to reach $215 billion in 2024 and $250 billion in 2025, respectively, and a large portion of this will be AI-related.

Even Nvidia, the chief AI leader, said at the latest earnings call that AI is only at the "early stage" and its future applications will be more extensive and advanced.Nvidia's long-term vision is that within the next decade, companies will have thousands of "digital employees" to perform complex tasks-such as programmers, circuit designers, marketing project managers, legal assistants, etc.

Faced with this wave of dividends, everyone wants to participate.However, there is still a threshold for ordinary people to participate in artificial intelligence investment, because the stock price of artificial intelligence concepts is relatively high.

Take Nvidia as an example. Buying a share of Nvidia costs US$140; Oracle and Google share prices are both above US$150; Microsoft's share price is around US$400; and Meta's share price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, which can achieve the above-mentioned "package and buy effect", but there is no such high buying threshold.

Generally speaking, the capital threshold of ETFs is between individual stocks and over-the-counter funds. Buying a lot (100 shares) may only cost more than 100 yuan, and the lower one is even less than 100 yuan, which is much lower than the threshold of individual stocks.

Moreover, ETFs have a rich selection of individual stocks.For investors unfamiliar with individual stock analysis, ETFs provide a simple way to invest without having to delve into each company.

There is also no risk of trading or delisting in ETFs.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

With low thresholds, transparent transactions, rich options, no thunder, and support on-site trading, ETFs are the best choice for ordinary investors or novice investors to participate in the artificial intelligence market.