Red Sea Crisis Increases Oil Supply Risk Uber and Tesla Reach Partnership

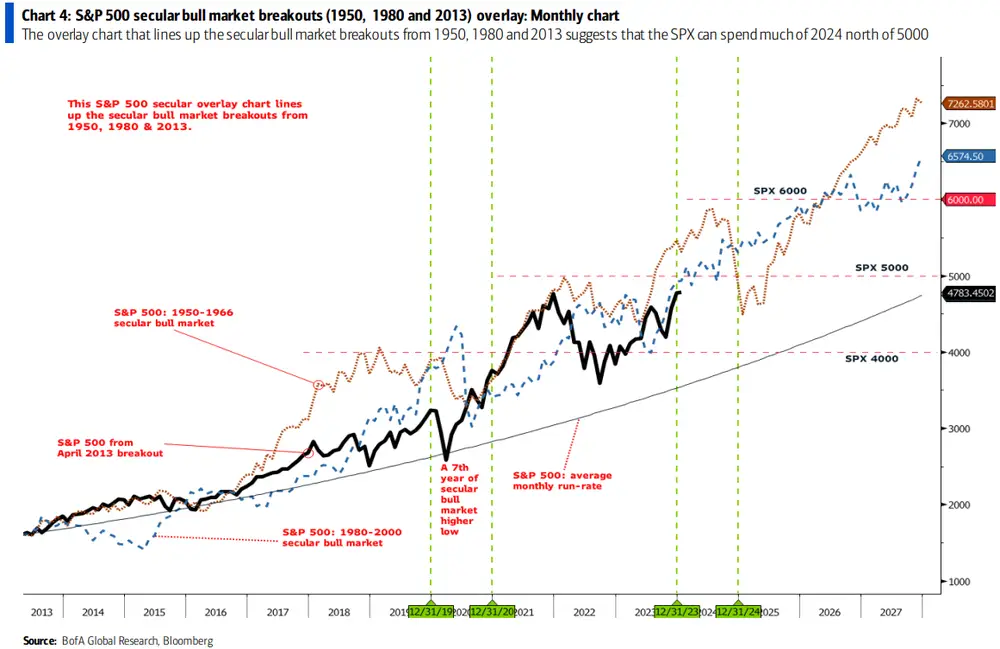

Stephen Suttmeier, a technical analyst at Bank of America, noted that after observing the two long-term bull markets in U.S. stocks, 1950-1966 and 1980-2000, he believes that the current bull market in U.S. stocks may continue until 2033。

U.S. stocks traded yesterday.

Dow Jones Industrial Average -0.62% to 37,361.12, S & P 500 Index - 0.37% to 4,765.98, technology-led Nasdaq -0.19% to 14,944.35。In terms of industry trends, IT is the strongest, up + 0.39%, energy industry weakest, down -2.36%。

After-hours U.S. stock news.

"01" Fed Director Says Rate Cut Slower Than Market Expectations

Fed Governor Christopher Waller said on Tuesday that a rate cut is indeed possible this year, but he believes it should be slower than the market expects.。Waller pointed out that as long as inflation does not rebound, I believe the Fed will be able to lower interest rates this year, but compared to the past interest rate cut cycle, when mostly passive, and the rate cut is very fast, this time the Fed should be able to carefully and methodically cut interest rates, there is no reason to act as quickly as in the past, the Fed can slowly ease monetary policy。

→ Goldman Sachs says Waller's comments increase the likelihood of a late rate cut, or that the Fed may prefer to cut rates once a quarter

"02" The Red Sea crisis is a major risk to oil supplies.

Chevron (CVX) CEO says Red Sea crisis situation is very serious and seems to be getting worse。The CEO noted that the Red Sea crisis poses a serious risk to oil shipments and that prices could change rapidly if tensions lead to serious disruptions in Middle East supplies, and he was surprised that crude oil prices in West Texas are still below $73 a barrel because the risk is "very real."。Chevron said the company is working closely with the U.S. Navy and continues to transport oil through the Red Sea routes, but sources close to the situation said British oil giant Shell (BP) has stopped the Red Sea routes.。

"03" super micro surge to close to historical highs

Barclays Bank raised its price target for Ultra Micro (AMD) from $120 to $200 on Tuesday, implying a potential increase of about + 26%, inspiring Ultra Micro to surge + 8 on Tuesday..31%, currently only about 2% below the all-time high of November 2021。Analyst Tom O'Malley pointed out that the current market for ultra-micro high-end server chip MI300 demand is strong, is expected to ultra-micro this year's AI chip sales are expected to reach $4 billion。In addition, well-known investor Jim Breyer also said that he will add ultra micro to the ranks of the "Big Seven."。

"04" Boeing fell sharply on Tuesday to break the New Year's line

Boeing (BA) fell nearly -8% on Tuesday after the Chicago airport collision, breaking its 200-day moving average, and according to Reuters, Ryanair CEO said Boeing may not get 737 MAX 10 certification until 2025。In response to the 737 Max 9 hatch loss earlier this month, Boeing on Tuesday appointed a retired admiral as special counsel who will independently lead a review of Boeing's quality management system, which has plummeted nearly -20% since the grounding.。

"05" Uber and Tesla cooperate to promote the adoption of electric vehicles

Uber (UBER) said on Tuesday that it is working with Tesla (TSLA) to promote the adoption of electric vehicles by U.S. drivers and is committed to achieving zero emissions in U.S. and Canadian cities by 2030.。Uber revealed that the cost of ownership and the convenience of charging are the two major obstacles to drivers adopting electric vehicles, so the company is working with Tesla to solve these two problems, in addition to the existing federal tax credits, Uber will also provide up to $2,000 for driving Model 3, Model Y exclusive purchase incentives, in addition to Uber also shared with Tesla the driver's charging needs location。

"06" This round of bull market is expected to go to 2033?

Stephen Suttmeier, a technical analyst at Bank of America, noted that after observing the two long-term bull markets in U.S. stocks, 1950-1966 and 1980-2000, he believes that the current bull market in U.S. stocks may continue until 2033。According to him, the current long-term bulls officially began in April 2013, and after looking at the movements of the previous two long-term bull markets together, Suttmeier believes that the S & P 500 may be above 5,000 for most of 2024 and expects the current rally to end between 2029 and 2033。

《 More 》

* OpenAI CEO Sam Altman said that General Artificial Intelligence (AGI) may be coming, but the changes to the world may be much smaller than we think, and people's worries that AI will one day disrupt the world are superfluous

* Berkshire at the helm of Buffett (BRK.B) announced on Tuesday that it has acquired the remaining 20% stake in Pilot Travel Centers, the largest truck service station operator in the United States, from the Haslam family, after which Pilot Travel Centers will become a wholly owned subsidiary of Berkshire.

* Amazon (AMZN) is testing a generative AI tool that can answer shoppers' questions about products

* Streaming media leader Netflix (NFLX) has reached a pilot partnership with French supermarket giant Carrefour, with the goal of gaining more customers with low-cost subscription plans through a bundled service that includes a Netflix ad subscription plan, a 10% discount on Carrefour-branded products, and a free shipping offer for orders over 60 euros

* Spirit Airlines plummeted on Tuesday as a court blocked the $3.8 billion sale of budget airline Spirit Airlines (SAVE) to JetBlue (JBLU) -47.1%, JetBlue up + 4.9%

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.