On November 18, the media reported that after the Trump administration took office, it would significantly relax the regulations on fully autonomous vehicles (FSD), which would benefit Tesla, which is leading the race on the cliff.Transition advisers to the new Trump administration say the U.S. Congress may bypass the Department of Transportation and directly introduce bills to pave the way for large-scale autonomous driving technology.

People familiar with the matter also revealed that the Trump team is looking for suitable candidates to lead the U.S. Department of Transportation to develop a policy framework to regulate autonomous vehicles.

Why is approval of fully autonomous driving so important to Tesla?

First, Musk had bet on this technology long ago and sought to make autonomous driving and artificial intelligence the core business of Tesla's transformation in the future.Musk plans to mass produce Tesla driverless robot taxis that do not require driver control starting in 2026 as a new growth point for the company's business.

Second, under the supervision of the Biden administration, Tesla's long-developed Cybercab project has no place to be implemented.Companies that want to deploy autonomous vehicles on a large scale face significant obstacles under current federal regulations.Currently, the National Highway Traffic Safety Administration only allows exempted manufacturers to deploy 2,500 autonomous vehicles per year, while car companies have an appetite of up to 100,000.

Now, after Trump came to power, Tesla's long-established fully autonomous driving technology is finally possible.In the latest quarterly report for 2024, FSD technology contributed $326 million in revenue to Tesla.At the same time, Tesla continues to upgrade FSD through OTA, and the selling price continues to grow, from US$2,500 in 2015 to US$15,000 in 2022, and the pricing has increased by US$12,500 in seven years.It is foreseeable that if FSD is fully rolled out on a large scale, this contribution will only increase and not decrease.

So, as a master of artificial intelligence technology, what contribution will FSD technology make to this sector?

To understand this problem, we must first understand the core of FSD-the autonomous driving chip.

From the perspective of chip algorithms, the FSD sensing module adopts HydraNets architecture to integrate multiple visual recognition tasks into a single network, and realizes perception of the surrounding environment of the vehicle through BEV (Bird's Eye View)+ Transformer technology.

From the perspective of chip computing power, Tesla has built the Dojo supercomputer system to process the massive amount of data needed for autonomous driving and reduce reliance on NVIDIA GPUs.

From the perspective of the chip itself, Tesla has gone through many iterations.From HW1.0 to HW3.0, Tesla gradually shifted from cooperation to comprehensive self-research on hardware platforms; starting from HW4.0, Tesla has used FSD2.0 chips, which has greatly increased its computing power by five times.The number of neuroaccelerators has increased significantly, the FSD frequency has increased significantly, and the chip has been used to this day.Currently, the market expects that the next generation of AI5 chips will be put into production in the second half of 2025.

It can be said that Tesla has embarked on its own path of self-research, whether it is for autonomous driving technology or for the more macro artificial intelligence sector.

Generally speaking, ordinary autonomous driving relies on lidar and high-definition maps, but for Tesla, the company adopts a purely visual solution, using cameras, sensors and deep learning algorithms to achieve autonomous driving, opening up a different path.Also, Tesla FSD is an end-to-end autonomous driving system, meaning it can output driving decisions directly from input sensor data without the need for traditional intermediate steps.

For traditional solutions, the quality of the autonomous driving experience depends heavily on the number of lidar, and once the hardware equipment is determined, it cannot be changed; but for Tesla, FSD can continuously learn and optimize the algorithm through massive driving data, which means that Tesla can continuously upgrade FSD functions through OTA to ensure that users can still experience the optimal autonomous driving experience after purchasing a car.

The entire artificial intelligence sector will benefit from the full implementation of Tesla's FSD.

First, advances in Tesla's FSD technology, especially in FSD v12.5.2 and v13 versions, have significantly improved the reliability and performance of autonomous driving, including increased distances traveled without human intervention, which will push the entire industry towards higher levels of autonomous driving capabilities.Higher capabilities mean higher pricing, and the profitability of artificial intelligence platforms will be greatly improved.

Secondly, Tesla has built an industry-leading closed-loop data system through its huge fleet accumulation and simulation, providing a steady stream of high-quality data for its intelligent driving system.The construction of this kind of data closed-loop will become the key to improving the performance of intelligent driving systems in the future, and it is also one of the important competitiveness of future car companies.Once this technical route is replaced, the demand for artificial intelligence chips will boost again.

Finally, Tesla said that as early as the first quarter of 2025, the company plans to expand FSD technology to Europe and China, which will also help artificial intelligence chips further extend to the global market and enjoy global dividends.

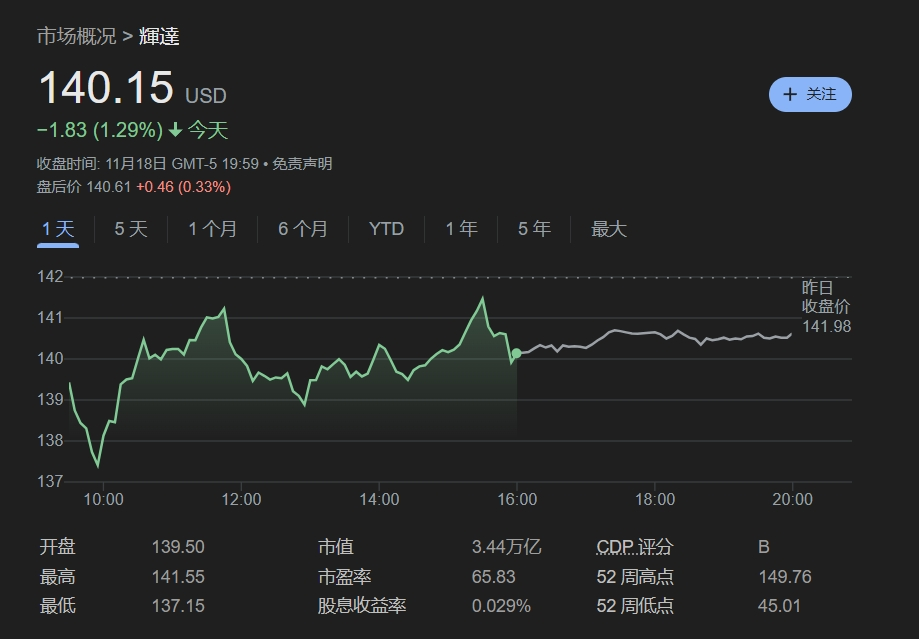

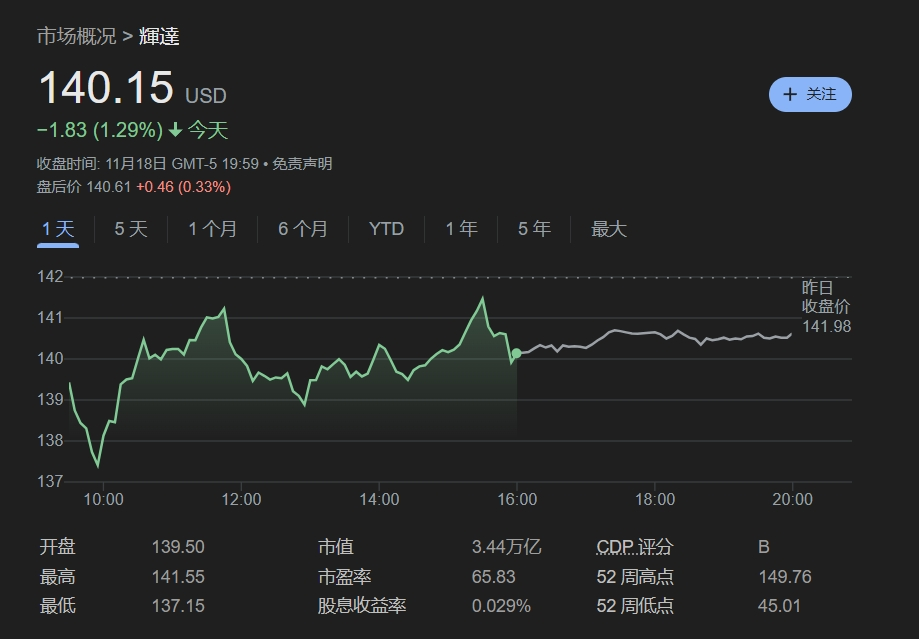

Faced with this wave of dividends, everyone wants to participate.However, there is still a threshold for ordinary people to participate in artificial intelligence investment, because the stock price of artificial intelligence concepts is relatively high.

Take Nvidia as an example. Buying a share of Nvidia costs US$140; Oracle and Google share prices are both above US$150; Microsoft's share price is around US$400; and Meta's share price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, which can achieve the above-mentioned "package and buy effect", but there is no such high buying threshold.

Generally speaking, the capital threshold of ETFs is between individual stocks and over-the-counter funds. Buying a lot (100 shares) may only cost more than 100 yuan, and the lower one is even less than 100 yuan, which is much lower than the threshold of individual stocks.

Moreover, ETFs have a rich selection of individual stocks.For investors unfamiliar with individual stock analysis, ETFs provide a simple way to invest without having to delve into each company.

There is also no risk of trading or delisting in ETFs.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

With low thresholds, transparent transactions, rich options, no thunder, and support on-site trading, ETFs are the best choice for ordinary investors or novice investors to participate in the artificial intelligence market.