2023Q4 Earnings Below Market Expectations Tesla Warns Production Growth Will Slow This Year

Throughout the year, Tesla is part of the increase in revenue and profit reduction。The company's revenue reached $96.8 billion in 2023, up 19% year-over-year, but earnings per share were 4% higher than in 2022..The all-time high of $07 is down 23% to just 3.$12。

On Wednesday (January 24) after the U.S. stock market, Tesla announced its full-year earnings for the fourth quarter of 2023.。

Tesla shares dive as results miss expectations

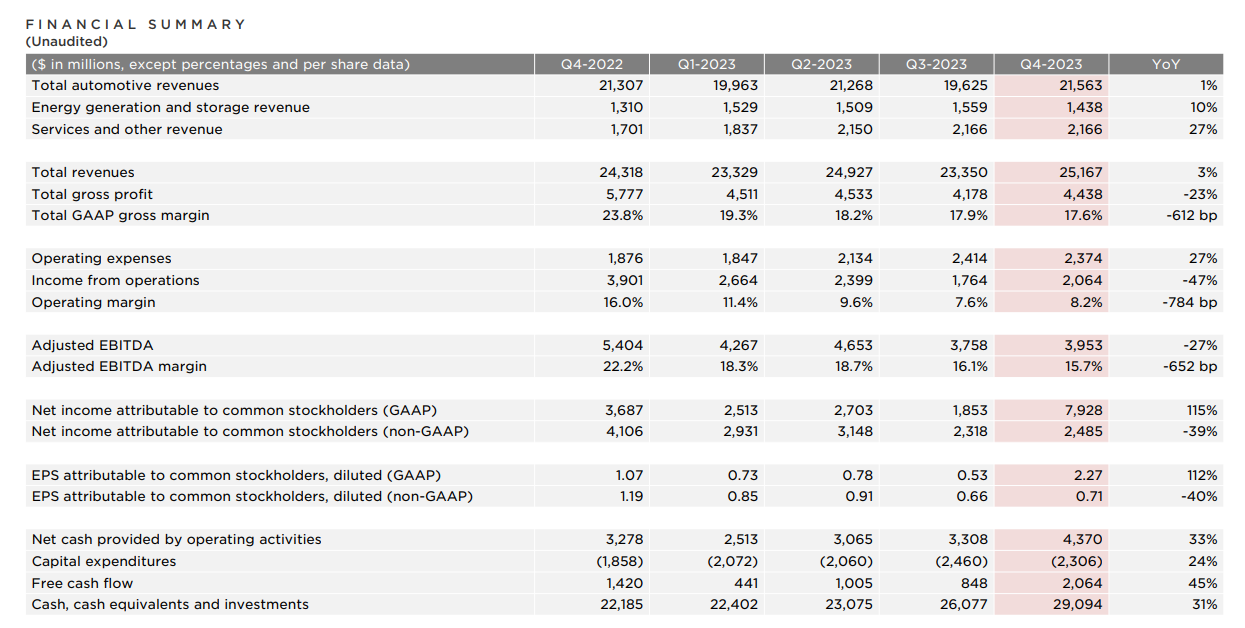

Financial data show that in the fourth quarter, Tesla achieved revenue of 251.$6.7 billion, below market expectations of 256.$200 million, up 3% year-over-year, Tesla's slowest pace of growth in more than three years。

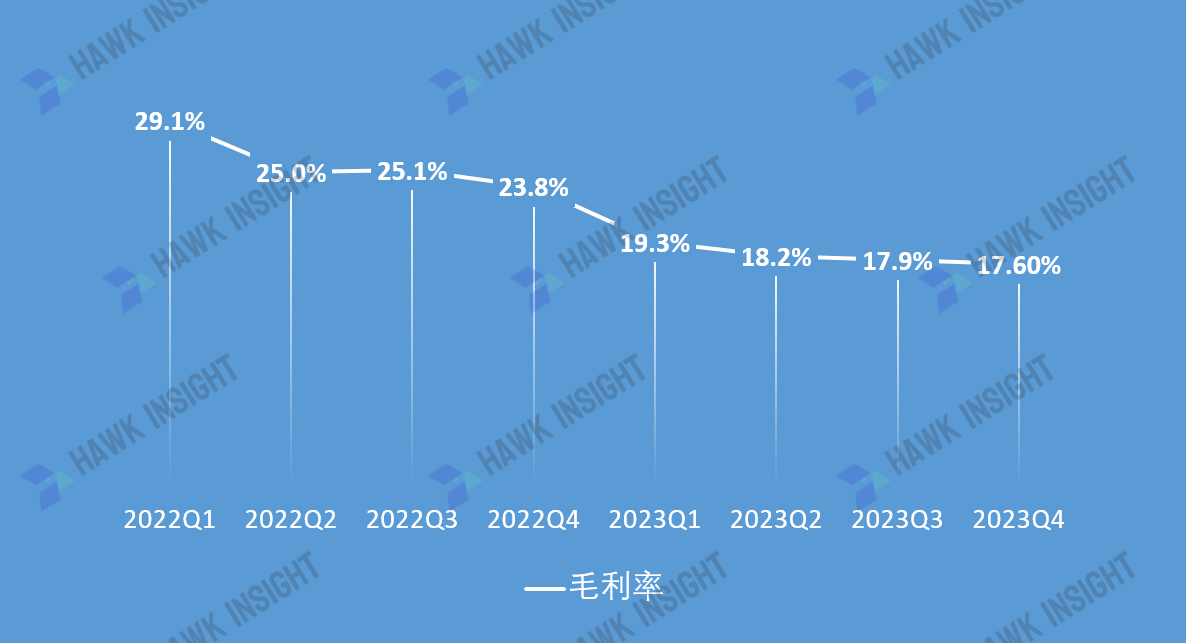

In terms of earnings, Tesla reported adjusted earnings per share of 0.71 dollars, the market expected 0.73 美元。Adjusted net profit was 24.$8.5 billion, against Wall Street expectations of 26.100 million dollars。The market's most concerned gross margin fell further in the fourth quarter to 17..6%, below Wall Street expectations of 18.1%, the lowest level since 2019。Tesla's gross margin last quarter was 17.9%。

Throughout the year, Tesla is part of the increase in revenue and profit reduction。The company's revenue reached $96.8 billion in 2023, up 19% year-over-year, but earnings per share were 4% higher than in 2022..The all-time high of $07 is down 23% to just 3.$12。

By business, Tesla's automotive revenue was 215 in the fourth quarter..$6.3 billion, the source of most of the company's revenue, but up only 1% year-over-year。In contrast, the growth of the other two businesses is much brighter.。Revenue from energy and storage business grew 10% year-over-year in the fourth quarter to 14.$3.8 billion, while services and other revenue increased 27% year-over-year to 21.$6.6 billion。

According to Tesla's disclosure, while its energy storage deployments fell in the fourth quarter from the previous quarter, total installations in 2023 more than doubled from 2022, and profits in its energy and storage businesses almost quadrupled.。In 2023, Tesla expects to install about 14.7 GWh of battery storage。

Tesla shares plunged nearly 6% after earnings due to weaker-than-expected results。Tesla has fallen 16 percent so far this year..4%。Last week, Tesla shares fell 3%, the fifth consecutive week of decline。

Sales up, profits down

Earlier this month, Tesla reported its fourth-quarter 2023 deliveries of 484,507 vehicles, beating market expectations of 483,173 vehicles and setting an all-time record for Tesla's quarterly deliveries.。

With the release of the earnings report, Tesla's gross profit margin this year has also "settled."。As expected, Tesla's gross margin dropped further to 17.6, down 612 basis points YoY。The average gross margin for the four quarters was 18.25%, much lower than in 2022..75% quarterly average gross margin。

The decline in Tesla's gross margin was the result of multiple price cuts in 2023.。Earlier this year, Tesla CEO Elon Musk (Elon Musk) (proposed a "price reduction for sales" strategy, and then Tesla has repeatedly lowered the price of its Model 3 sedan and Model Y mid-size SUV in major global markets such as the United States and China.。This price reduction strategy did work, with Tesla selling 1.81 million vehicles last year, up 38% year-over-year and exceeding the company's target of 1.8 million vehicles.。But Musk's approach has been controversial.。

Long-time Tesla shareholder Ross Gerber expressed concerns about Tesla's direction and its dynamic pricing model in an interview this week.。"When they produce more cars, they have to lower the price to sell, because in essence, they are not creating any new demand。Most buyers who want an electric car have already bought an electric car。Gerber said, "So I don't know where Tesla's sense of profitability will go."。They will sell more cars, but I don't know how they can make more money with their current strategy。"

In addition, it is worth noting that Tesla has not announced its delivery targets for this year, and Chief Financial Officer Vaibhav Taneja has not given profit margin guidance.。As Tesla continues its price-cutting strategy into 2024, analysts believe auto gross margins will be a key issue for Tesla this year。

Musk said bluntly on the conference call that he doesn't know where the company's gross margin will go in 2024。Musk said: "If (U.S. benchmark) interest rates fall quickly, I think (Tesla's) profit margins will be good, but if interest rates don't fall quickly, profit margins won't be as good.。"

Currently, analysts predict that Tesla's 2024 earnings per share will increase from 3 at the end of last year..81 dollars further down to 3.63美元。Last week, Gary Black, managing partner of Future Fund, posted on X that due to Tesla's price cuts in January, he lowered the company's 2024 earnings forecast from 3 per share..$90 down to 3 per share.75美元。

Competition intensifies, Tesla will bet on the next generation of cars?

On the earnings call, Musk praised Chinese car companies.。He said Chinese car companies are "the most competitive" and "will have significant success outside of China, depending on what kind of tariffs or trade barriers are established."。He added: "If trade barriers are not set up, they will almost destroy most of the other car companies in the world."。they are very good。"

In the last quarter of 2023, Chinese car company BYD achieved its anti-Tesla overtaking, topping the world's pure electricity sales crown。This achievement of BYD was achieved when its internationalization pace was not as good as Tesla's.。At present, BYD is still in the early stages of "going to sea" and has not yet entered the auto market in many countries, including the United States, the world's second largest auto market.。In addition to BYD, there are many new forces in China are also rubbing shoulders, Tesla is facing the pressure is not small。

However, unlike other automakers that launch new models from time to time, Tesla currently sells only two models worldwide, the Model 3 and the Model Y.。There have been many rumors that Tesla will launch new models with lower prices to cope with the increasingly fierce competition, but the official has not responded。

The results come after news that Tesla plans to start producing a new electric car codenamed "Redwood" in mid-2025.。In the earnings call, Tesla confirmed the news。

Tesla said: "Our team is launching the next generation of vehicles at the Texas Super Plant, so the company's vehicle production growth rate in 2024 may be significantly lower than the growth rate in 2023."。The company added that it is currently in the midst of "two major growth waves," namely the global expansion of the Model 3 and Model Y car platforms.。But the company also stressed: "We believe that the next wave of growth will be driven by the global expansion of the next generation of cars."。"

Musk said: "We have made a lot of progress on the next generation of low-cost vehicles.。He mentioned that Tesla currently plans to start production sometime in the second half of 2025.。Other than that, he did not disclose more information, "This was an earnings call, not a product announcement.。In addition, he warned that he had reservations about anything he said.。

It is not clear when the next generation of cars will be delivered.。Musk promises to cut costs through "revolutionary" manufacturing, but that could take a long time to happen。

"There's a lot to look forward to in 2024.。Musk said on a conference call.。He added that Tesla's focus is to ensure that its next-generation vehicles, energy storage, fully autonomous driving and other projects "execute as well as possible."。

Don't give up?Musk again says he wants to increase stake

During the earnings call, Musk also responded to his comments last week.。He says he needs to gain greater control of Tesla if it is to achieve its broad AI ambitions。

Last week, Musk said on his social platform X that he would be reluctant to make Tesla a leader in artificial intelligence and robotics if he did not gain at least 25% voting control of the company.。"If twice as many shareholders vote against me than support me, I can be overturned."。"

During the call, Musk again expressed his concerns, saying that given his current holdings, he was concerned that his future influence was "too small" for some major shareholders to take away control of him or make the wrong decision.。"I could be voted out by some random shareholder advisory firm.。"

Musk also cited Institutional Shareholder Services (ISS) and Glass Lewis, two major shareholder proxy advisory firms, as examples.。Musk said: "A lot of activists have infiltrated shareholder rights organizations.。He added that he "does not seek additional economic benefits; I just want to be an effective manager of powerful technology."。"

Musk once held a large stake in Tesla, but later sold a large amount of Tesla stock in order to raise enough money to buy Twitter (now X)。As a result, his stake in Tesla has been diluted from about 22% to about 13%.。

Musk wants to take 25% of the vote, twice the amount he now has voting control。In order to achieve this goal, Musk said it is open to new super-voting stocks, rather than through the acquisition of $30 billion worth of Tesla shares to achieve this purpose。However, the creation of any super-voting stock in Tesla would require a shareholder vote, and no major Tesla shareholders have spoken out in support of Musk's idea so far.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.