NIO's Q1 gross profit margin remains in single digits, and the second brand "ONVO" is preparing to compete with Tesla

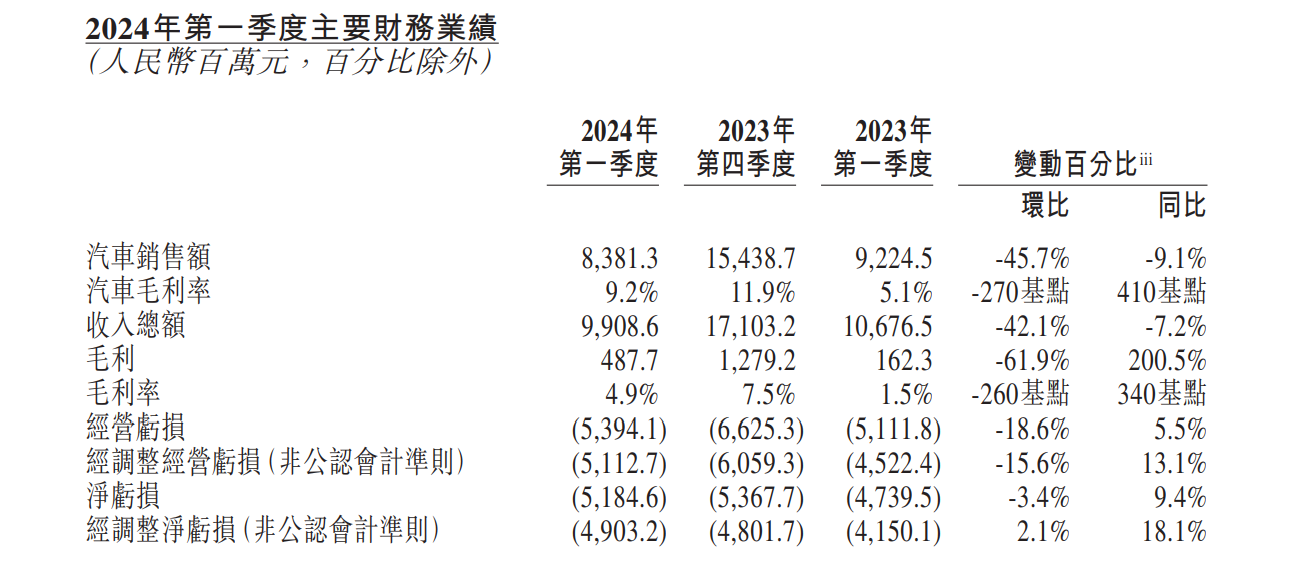

Data shows that NIO's total revenue in the first quarter was 9.91 billion yuan, a year-on-year decrease of 7.2% and a month on month decrease of 42.1%. The gross profit margin of automobiles was 9.2%, compared to 5.1% in the same period last year and 11.9% in the previous quarter.

On June 6th, electric vehicle manufacturer NIO Motors released its financial report for the first quarter of 2024.

Gross margin remains in single digits

Data shows that NIO's total revenue in the first quarter was 9.91 billion yuan, a year-on-year decrease of 7.2% and a month on month decrease of 42.1%. Among them, automobile sales amounted to 8.38 billion yuan, a year-on-year decrease of 9.1% and a significant decrease of 45.7% compared to the previous period.

In that quarter, NIO's loss situation did not improve and both increased compared to the previous quarter.

After deducting equity incentive expenses, NIO's adjusted net loss (non GAAP) for the first quarter was 4.9 billion yuan, an increase of 18.1% year-on-year and 2.1% month on month.

In terms of gross profit, there has been an improvement compared to the previous quarter, but it is relatively poor. In the first quarter, the gross profit recorded 490 million yuan, a year-on-year increase of 200.5%, but a month on month decrease of 61.9%.

In terms of gross profit margin, which the market is most concerned about for automobile manufacturers, it recorded 4.9% in the first quarter, compared to 1.5% in the same period last year and 7.5% in the previous quarter. The gross profit margin of automobiles in the first quarter was 9.2%, compared to 5.1% in the same period last year and 11.9% in the previous quarter.

Regarding the poor gross profit margin, Qu Yu, the Vice President of Finance at NIO, explained during a conference call that the main reasons include a decrease in average selling prices and low profit models being the main focus of sales.

Qu Yu stated that starting from March this year, NIO will gradually upgrade its NT2.0 platform models to the 2024 version. During the transition period of model iteration, NIO launched a series of promotional activities for the old models, which also led to a decrease in the average sales price in the first quarter. In addition, in the first quarter, NIO sold more low profit models, such as NIO ET5 and ET5T. These factors have all led to a decline in gross profit margin.

Meanwhile, Qu Yu also stated that in May this year, NIO's delivery volume exceeded 20,000 units. With the recovery of sales, the company will continue to optimize its product portfolio and negotiate with supplier partners in the coming months to improve cost efficiency.

"We expect NIO's overall vehicle profit margin to gradually recover to double digits in the second quarter and continue to improve in the third and fourth quarters. However, considering the intensifying market competition environment, we will also be more flexible in our sales strategy to ensure the stability of our brand's market position." Qu Yu said.

Li Bin, founder and chairman of NIO, also mentioned that for the NIO brand, the company's core business goal in China is still "a scale of 30000 vehicles, a 20% gross profit margin" and achieving profitability. "At present, we still maintain this business goal. The so-called" scale of 30,000 vehicles, 20% gross profit margin "refers to a monthly scale of 30,000 vehicles, and the average gross profit margin under NIO's NT3.0 platform reaches 20%."

In terms of other financial indicators, NIO's performance in the first quarter was inconsistent.

NIO achieved significant results in cost reduction this quarter. The sales cost in the first quarter was 9.421 billion yuan, a year-on-year decrease of 10.4% and a month on month decrease of 40.5%. Sales, general and administrative expenses amounted to RMB 2.997 billion, a year-on-year increase of 22.5% and a month on month decrease of 24.6%.

In terms of research and development expenses, NIO's research and development expenses in the first quarter were 2.864 billion yuan, a year-on-year decrease of 6.9% and a month on month decrease of 27.9%.

As of March 31, 2024, the company's cash and cash equivalents, restricted cash, short-term investments, and long-term fixed deposits amounted to RMB 45.3 billion.

In terms of delivery data, NIO delivered 30,053 vehicles in the first quarter, including 17,809 high-end intelligent electric SUVs and 12,244 high-end intelligent electric sedans, a year-on-year decrease of 3.2% and a month on month decrease of 39.9%.

It is worth noting that NIO's guidance for the second quarter is quite good.

NIO's delivery guidance for the second quarter was 54,000 to 56,000 units, a year-on-year increase of 129.6% to 138.1%. The revenue guidance was 16.59 billion to 17.14 billion yuan, a year-on-year increase of 89.1% to 95.3%.

Previously, NIO announced that its delivery volumes for April and May were 15,620 and 20,544 vehicles, respectively. That is to say, NIO only needs to sell 17,836 vehicles in June to reach the lower limit of delivery guidelines.

Second brand competing with Tesla - "ONVO"

NIO's second intelligent electric vehicle brand "ONVO" was officially unveiled on May 15th.

The company stated that ONVO originates from "On Voyage" and symbolizes a beautiful journey. Chinese name "Le Dao" symbolizes "the path of happiness" and expresses "every path with family is a way of happiness". From the meaning of the name, it can be seen that Le Dao is positioned in the mainstream family market.

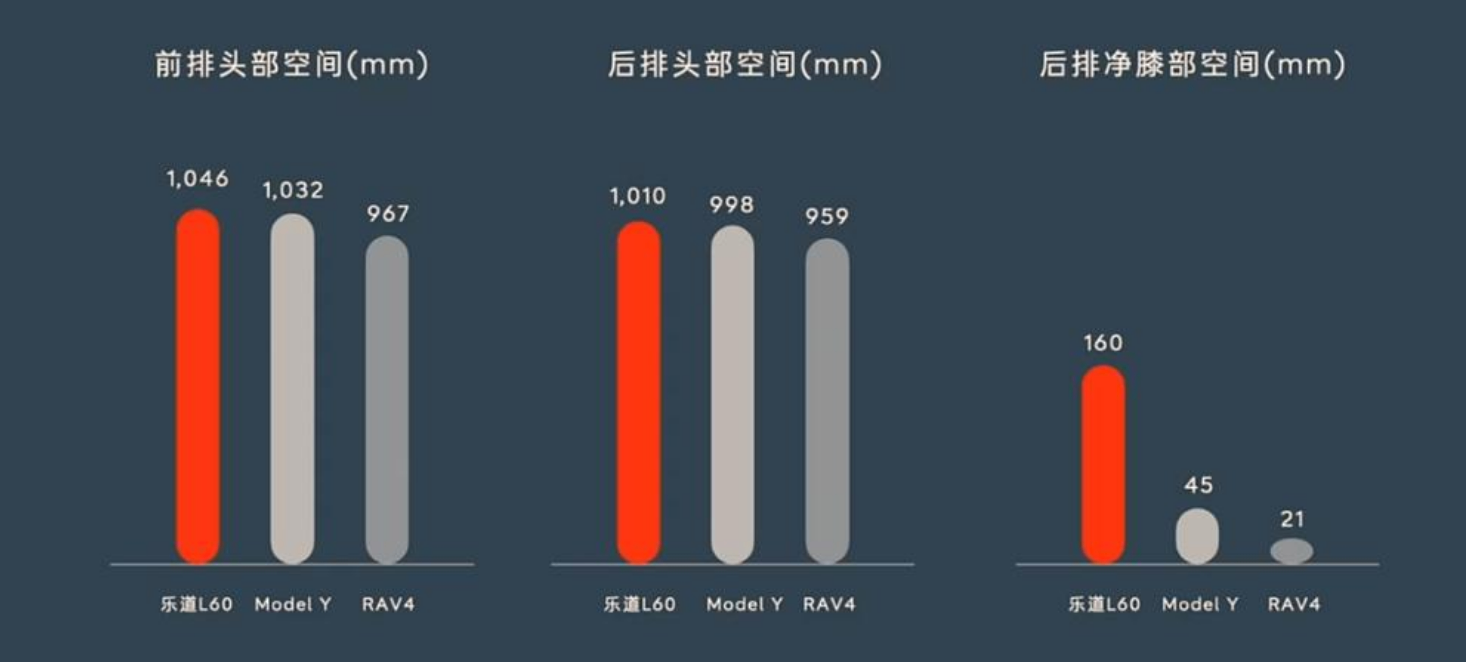

On the day of launching the ONVO brand, NIO also released ONVO's first product - the electric mid size SUV L60. At present, L60 has started booking in China with a pre-sale price starting at 219,900 yuan, which is 20,000 yuan lower than the Tesla Model Y.

When introducing the ONVO L60 product, it frequently mentions its competitor Tesla. In addition to being priced lower than Tesla's peers, the ONVO L60 also achieves lower energy consumption than Tesla.

As is well known, Tesla is renowned for its low energy consumption worldwide. The Tesla Model Y consumes 12.5 kWh of electricity per 100 kilometers, which is lower than the 12.3 kWh of the popular Xiaomi SU7 (standard version) in the automotive industry.

According to ONVO official disclosure, the energy consumption of L60 reaches 12.1 kWh per 100 kilometers. In addition, the drag coefficient of the L60 has reached 0.229, making it the lowest production SUV model in the world. As a comparison, the drag coefficient of the Model Y is 0.236.

In terms of battery life, the ONVO L60 is fully equipped with a 900V high-voltage architecture and offers three battery versions: 555km (standard range version), 730km (long range version), and 1,000+km (ultra long range version).

In addition, as a car positioned for the mainstream home market, the large space is also a major highlight of the ONVO L60. Whether it's the headroom in the front and rear rows or the legroom, the ONVO L60 is ahead of the Model Y.

It is reported that L60 exhibition cars are expected to arrive in stores in August and be launched and delivered in September. NIO stated that the Ledo brand supports battery swapping and is compatible with NIO brand battery swapping stations.

The competition for electric vehicles in the price range of 200,000 to 300,000 yuan where the Ledao brand is located is very fierce. But Li Bin emphasized during the conference call that he will not exchange particularly low gross profit for sales. "In the long run, we believe that the Ledo brand will maintain a gross profit margin of over 15%." Li Bin said, "From a breakeven perspective, if the Ledo brand can achieve monthly sales of 20,000 to 30,000 vehicles, it can achieve breakeven."

Regarding the upcoming product line layout of Ledo, Li Bin stated during the performance conference that the second model of the Ledo brand will be launched next year, which will be a mid to large-sized SUV suitable for larger families. However, overall, the Ledo brand will not have too many products.

Li Bin revealed, "For each product, we hope that its sales can reach a relatively high market share in the segmented market, because it is located in the 200,000 baseline family car market, which is about 4 million vehicles. We believe that the Ledo brand still has a very large market space in this. However, we will not promote too many products, and we need to ensure its competitive advantage for each product."

Li Bin also revealed the progress of the third brand Firefly. He stated that the overall progress of Firefly's research and development is relatively smooth, and the first model of the Firefly brand will be officially delivered in the first half of next year. However, the release time has not yet been determined, and delivery may take place in the early part of the first half of next year.

NIO Power Receives 1.5 Billion Yuan Strategic Investment

On May 31st, NIO announced that its subsidiary NIO Power Investment (Hubei) Co., Ltd. ("NIO Power") had received a strategic investment of RMB 1.5 billion from Wuhan Guangchuang Emerging Technology Phase I Venture Capital Fund Partnership Enterprise (Limited Partnership) ("Wuhan Guangchuang Fund") and other institutions.

According to the agreement, Wuhan Guangchuang Fund will first invest 1 billion yuan in cash to NIO Power. After the investment is completed, Wuhan Guangchuang Fund will hold a 10% equity stake in NIO Power. In addition, Wuhan Guangchuang Fund has the right to invest up to 500 million yuan in NIO Power at the same valuation as the current transaction before the next round of financing ends.

This round of strategic investment will be used for technology research and development, manufacturing, operation and maintenance in the fields of charging, power exchange, energy storage, battery service, energy Internet, as well as the layout and development of NIO Power charging and power exchange infrastructure, and support the investment in vehicle network interactive innovation business.

Li Bin stated that after this round of financing, NIO Power still maintains a roughly 90% stake in NIO Power. And it is stated that other investors are also welcome to invest in NIO Power in the future.

Li Bin also expressed that he is very optimistic about the long-term operational sustainability of NIO Power. He said, "Of course, it is still in the investment stage and needs to establish a network. We need to first establish a nationwide network. There are indeed some advanced investments, but overall, its profitability is very clear."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.