FTMO-Reviews And Analysis

Get a funded account to trade Forex, Indices, Crypto, or Stocks from FTMO prop firm.Full review and how to pass the challenge.

FTMO is a proprietary trading firm established in 2015 and headquartered in Prague, Czech Republic. FTMO is dedicated to providing traders with funding to support their trading activities in various markets, including forex, indices, metals, commodities, stocks, and cryptocurrencies. As a well-regarded firm, FTMO offers a range of attractive services and conditions for traders.

Key Features

- Trading Instruments: FTMO allows traders to trade a diverse array of financial products, including Forex, indices, metals, commodities, stocks, and cryptocurrencies.

- Maximum Account Balance: FTMO offers a maximum funding balance of up to $2,000,000.

- Profit Split: Traders can earn up to 90% of the profit split.

- Challenge Fees: The cost to participate in the account challenge starts from €155.

- Trading Platforms: FTMO supports various popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and Dxtrade.

Pros and Cons

Pros

- Reputation: FTMO has a strong reputation in the industry due to its long-standing operation and solid business practices.

- Challenge Fee Refund: The challenge fee is refunded if traders pass the evaluation and become FTMO traders.

- High Profit Split: Traders can receive up to 90% of the profits they generate.

- Quick Evaluation: Traders can complete the evaluation in as little as 4 days.

- Free Trial: FTMO offers a free trial that allows traders to test their system before committing to the formal challenge.

Cons

- Two-Step Evaluation: The two-step evaluation process can increase psychological pressure, requiring traders to perform well in both stages.

- Account Restrictions: There are strict limits on holding positions overnight or trading during news events for non-Swing account types.

Trading Assets

FTMO is focused on forex and other CFD trading. The main asset categories supported by FTMO accounts include:

- Forex: All major currency pairs, minor pairs, and some exotic currency pairs.

- Indices: Cash CFDs including important indices like DAX (Germany 30), Nasdaq (NASDAQ Composite), Dow Jones (DJIA), S&P 500, FTSE 100.

- Commodities: Energy products such as Natural Gas, Crude Oil, Brent Oil; metals like Silver, Gold, Palladium; agricultural commodities like Cocoa, Coffee, Soybean.

- Stocks: Currently supports trading of 23 US stocks.

- Cryptocurrencies: Major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Cardano (ADA), Polkadot (DOT), Dogecoin (DOGE).

Account Sizes

FTMO offers various account size options to cater to different traders' needs. Available account currencies include USD, GBP, EUR, etc.

- Small Account ($10,000): Challenge fee is €155.

- Medium Account ($200,000): Challenge fee is €1,080.

- Maximum Account Size: Up to $2,000,000.

The challenge fee is a one-time payment and is refunded upon passing the challenge and making the first payout.

Leverage Settings

FTMO provides different leverage settings based on the account type:

-

Standard Account:

- Forex Pairs: 1:100

- Metals: 1:50

- Indices: 1:50

- Commodities: 1:50

- Cryptocurrencies: 1:3.3

- Stocks: 1:10

-

Swing Trading Account:

- Forex Pairs: 1:30

- Metals: 1:15

- Indices: 1:15

- Commodities: 1:15

- Cryptocurrencies: 1:1

- Stocks: 1:3

FTMO Challenge Rules

The FTMO challenge process is divided into four steps to assess a trader's skills and discipline, ultimately providing successful traders with real trading opportunities. Here are the detailed rules and requirements for each step:

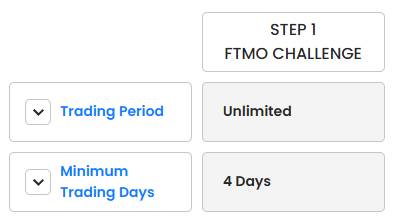

Step 1: Challenge

The FTMO Challenge is the first step in the evaluation process, aimed at assessing traders' basic trading skills and discipline. Here are the fundamental rules for the challenge:

- Trading Period: No time limit; traders can trade at their own pace.

- Minimum Trading Days: At least 4 trading days.

- Maximum Daily Loss: 5% of the account balance.

- Maximum Loss: 10% of the account balance.

- Profit Target: 10% of the account balance.

Traders must open at least one position on four different trading days to meet the minimum trading days requirement. The previous time limits for completing the challenge have been removed to reduce unnecessary trading pressure.

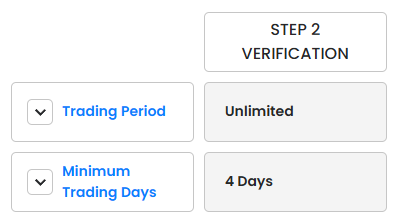

Step 2: Verification

Verification is the second step in the FTMO evaluation process, with more relaxed requirements compared to the first step. The rules for the verification stage are as follows:

- Trading Period: No time limit; traders can arrange their time as needed.

- Minimum Trading Days: At least 4 trading days are required.

- Maximum Daily Loss: 5% of the account balance.

- Maximum Loss: 10% of the account balance.

- Profit Target: 5% of the account balance.

Similar to the first step, there is no maximum trading period in the second step, and the profit target is reduced to 5% of the account balance. No fee is required for this stage.

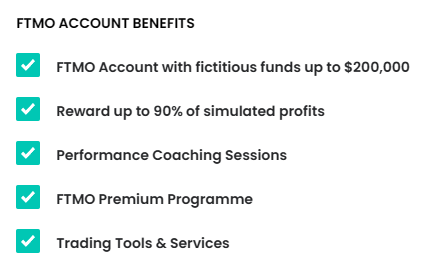

Step 3: FTMO Account

After completing the first two steps, traders move to Step 3, becoming official FTMO traders. The main features of this stage include:

- Account Usage: Upon successfully passing the challenge, traders will receive a funded account from FTMO for actual trading.

- Additional Support: FTMO will provide performance coaching sessions, access to the FTMO Premium Program, and trading tools and services.

- Fee Refund: The challenge fee will be fully refunded after the first payout is received.

Step 4: Quantlane Trader

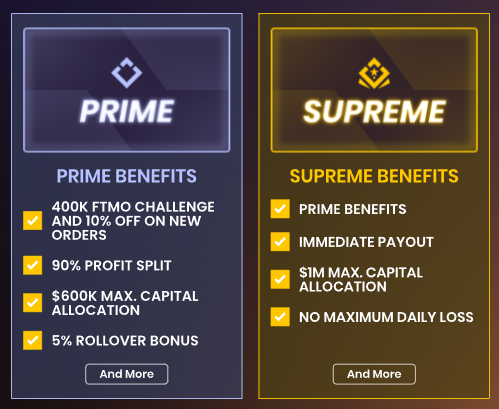

Becoming a Quantlane Trader is the ultimate goal for those aiming to be professional traders. To reach this stage, traders must complete the first two steps of the challenge and meet the conditions of the FTMO Premium Program. The features of this stage include:

- Real Trading Environment: Traders will have the opportunity to trade in a real market environment with institutional-level trading conditions.

- Contract Benefits: A fixed salary contract will be signed, with performance and mindset coaching support.

- Institutional Trading Conditions: Includes trading spreads, liquidity, risk management, and trading framework.

- Customized Platform: Provides a customized trading platform and tools.

EA Usage Rules

- EA Exclusivity: FTMO allows the use of Expert Advisors (EAs) but requires that the EAs can be replicated on a live account. Traders cannot use EAs already used by other FTMO traders, so it is recommended to use custom or self-developed EAs.

- Order and Position Limits: There are specific limits for orders and positions when using EAs. FTMO allows a maximum of 200 orders at a time and 2000 open positions per day. Exceeding these limits may cause issues with the execution of trading strategies.

Free Challenge and Trial

- Free Challenge: FTMO previously offered free repeats of the challenge, but this has been discontinued. If traders face difficulties, it is recommended to learn how to calculate the maximum safe lot size to avoid breaching the drawdown rule.

- Free Trial: The free trial is a simplified version of the challenge and does not provide access to a funded account. It is suitable for traders who want to test the FTMO trading environment before committing to the formal challenge. Success in the free trial generally increases the chances of passing the official challenge.

Platform Support

FTMO supports several mainstream trading platforms, which traders can choose from based on their preferences:

- MetaTrader 4

- MetaTrader 5

- cTrader

- DXtrade

These platforms are widely used in forex trading, and many traders are already familiar with their interfaces and functionalities.

Trading Hours and Rules

-

Position Rules: During the challenge, there are no strict requirements on holding positions overnight or over the weekend. However, traders with funded accounts (except Swing trading accounts) must adhere to the following rules:

- Positions must be closed before the market closes for the weekend.

- Positions must be closed if the overnight break period exceeds 2 hours. For example, all stock trades need to be closed before market close times.

- For cryptocurrencies, which usually trade over the weekend, existing positions may not need to be closed.

-

News Trading: During the FTMO challenge, there are no restrictions on trading during news releases. However, for funded accounts (except Swing trading accounts), the following news trading rules apply:

- Positions in assets affected by significant news releases must be closed two minutes before and after the news release. Symbols not affected by the news can be traded normally.

FTMO, as a renowned proprietary trading firm, offers diverse trading options and funding support. With flexible account sizes, reasonable leverage settings, and profit splits up to 90%, it is a compelling option for traders. After successfully passing FTMO's evaluation, traders can receive funding, utilize various mainstream trading platforms, and benefit from growth opportunities provided by advanced programs.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.