Funded Trading Plus: Reviews And Analysis

Funded Trading Plus is an extension of Trade Room Plus, designed to support successful traders with limited capital.

Funded Trading Plus is a forex capital firm based in London, UK, established in 2021 as an extension of Trade Room Plus. It aims to support successful traders with limited capital by enabling them to trade larger accounts, thus eliminating inequality among traders and providing opportunities to earn substantial returns.

Product Features

- Trading Instruments: Forex, indices, metals, commodities, cryptocurrencies.

- Maximum Account Balance: Up to $2,500,000.

- Profit Split: Up to 100%.

- Cost: Starting from $119.

- Trading Platforms: cTrader, TradingView, MatchTrader, DXtrade.

Pros and Cons

Pros

- No time limit on challenges; traders can progress at their own pace.

- Multiple program options including instant funding, 1-step, or 2-step challenges.

- Instant funding allows withdrawals from day one.

- Up to 100% profit split, a rare offering in the industry.

- Fastest settlement within 1 day after trading completion.

Cons

- Lack of free trials to test the platform.

- Instant funding accounts cannot hold trades over weekends.

- Moderate leverage, suitable for intraday trading or with appropriate risk management.

Trading Products

- Indices: Includes major indices such as Dax, Dow Jones, Nasdaq, and S&P 500.

- Commodities: Includes crude oil, gold, silver, and platinum.

- Cryptocurrencies: Supports various cryptocurrencies like BTC, ETH, LTC, DOGE, and ADA.

Account Types and Scale

Funded Trading Plus offers traders account funding ranging from $5,000 to $200,000, which can be gradually increased based on trading performance, up to a maximum of $2,500,000.

- Experienced Trader Program (Phase 1): Initial account funding ranges from $12,500 to $200,000.

- Advanced Program (Two Phases): Requires passing through two evaluation phases with the same initial account funding, with slight differences in evaluation criteria.

- Advanced Program: Similar to the Advanced Program, it also requires passing through two evaluation phases with the same initial account size, but with different evaluation criteria.

- Master Program (Instant Funding): Provides instant funding support, with initial account funding ranging from $5,000 to $100,000.

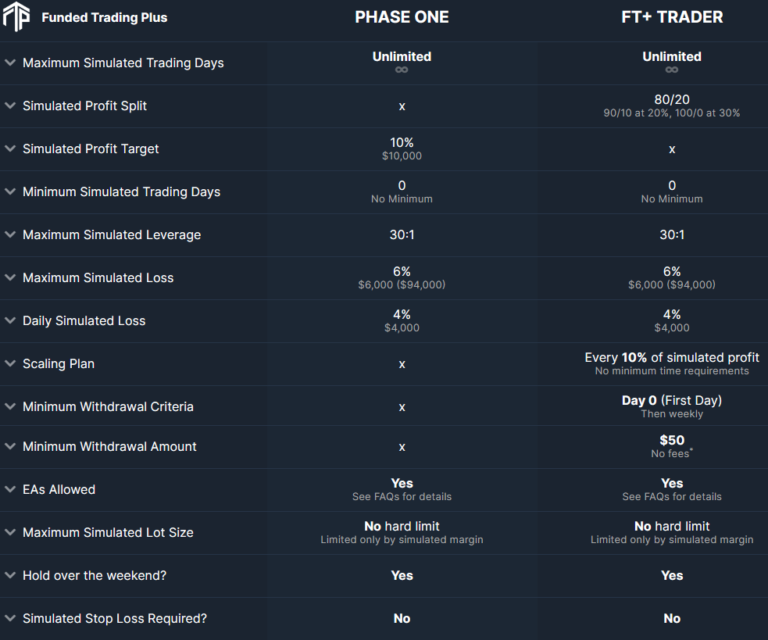

The Experienced Trader Program

During this phase, traders need to pass a single evaluation phase to obtain funding and an active account. Evaluation requirements include:

- Minimum trading days: No minimum requirement.

- Challenge duration: No maximum limit, trade as needed.

- Maximum relative drawdown: 6%

- Maximum daily drawdown: 4%

- Profit target: 10%

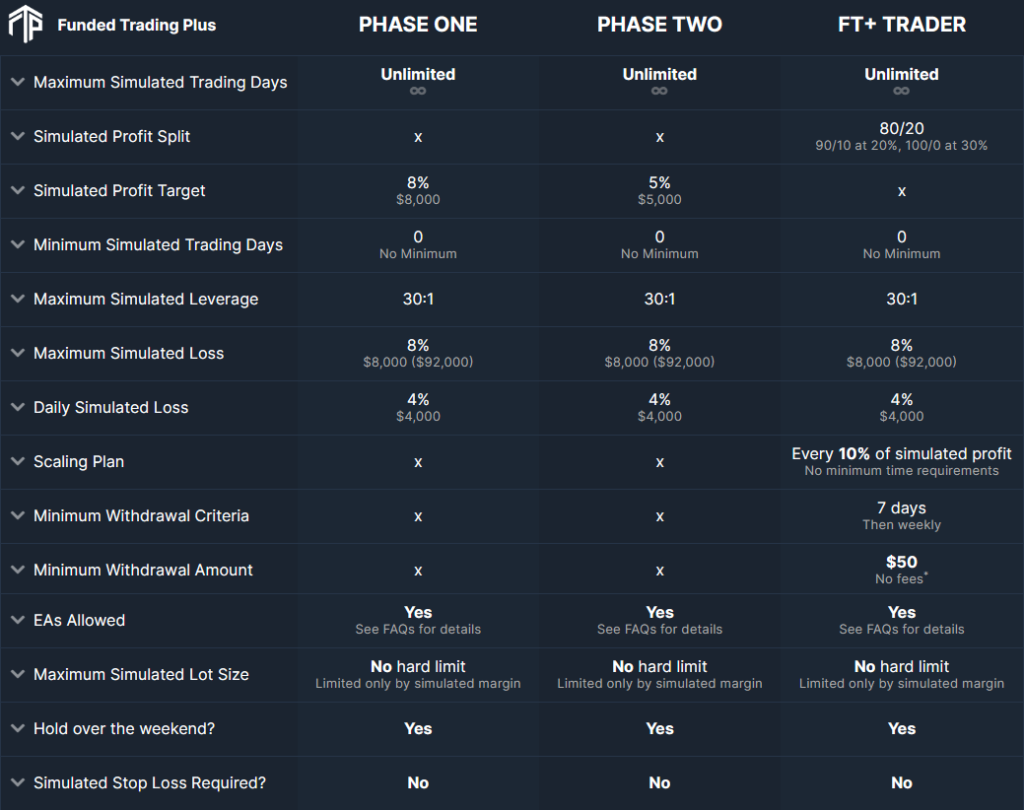

The Premium Trader Program

The Premium Trader Programconsists of two evaluation phases where traders must achieve minimum profits without exceeding daily and overall drawdown limits.

Phase 1

- Minimum trading days: No minimum requirement.

- Challenge duration: No maximum limit, trade as needed.

- Maximum relative drawdown: 8%

- Maximum daily drawdown: 4%

- Profit target: 8%

Phase 2

- Minimum trading days: No minimum requirement.

- Challenge duration: No maximum limit, trade as needed.

- Maximum relative drawdown: 8%

- Maximum daily drawdown: 4%

- Profit target: 5%

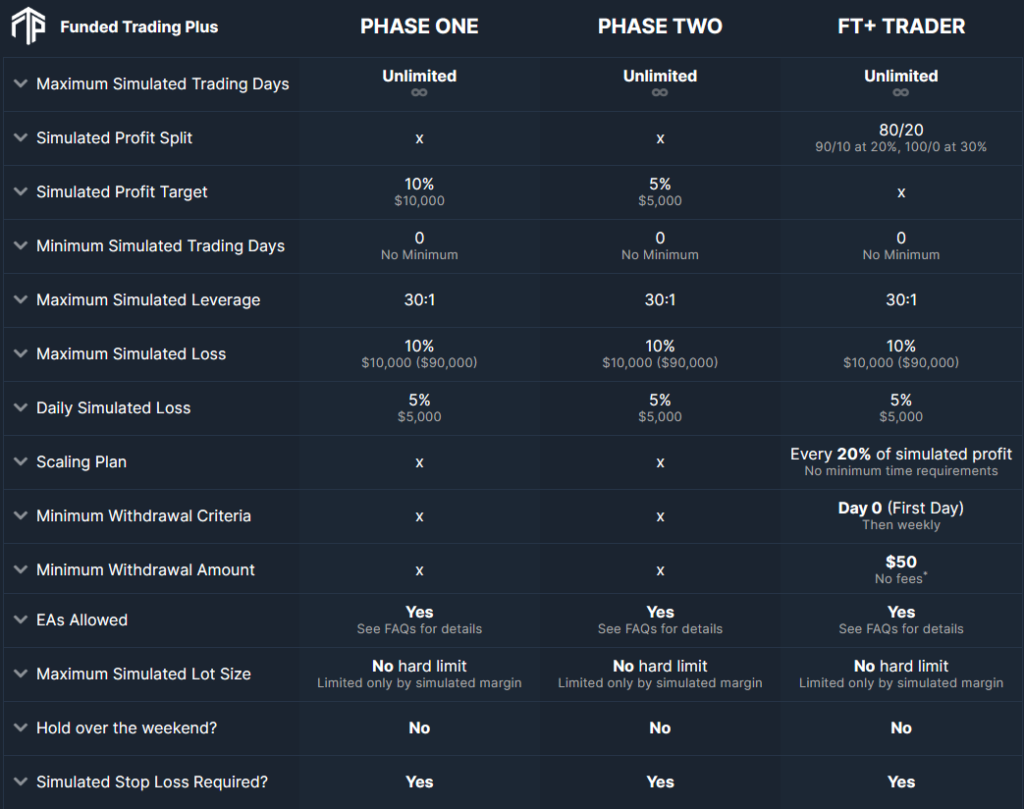

The Advanced Trader Program

The Advanced Trader Programis similarly divided into two evaluation phases, with evaluation criteria including daily and overall drawdown limits, and achieving minimum profit targets.

Phase 1

- Minimum trading days: No minimum requirement.

- Challenge duration: No maximum limit, trade as needed.

- Maximum relative drawdown: 10%

- Maximum daily drawdown: 5%

- Profit target: 10%

Phase 2

- Minimum trading days: No minimum requirement.

- Challenge duration: No maximum limit, trade as needed.

- Maximum relative drawdown: 10%

- Maximum daily drawdown: 5%

- Profit target: 5%

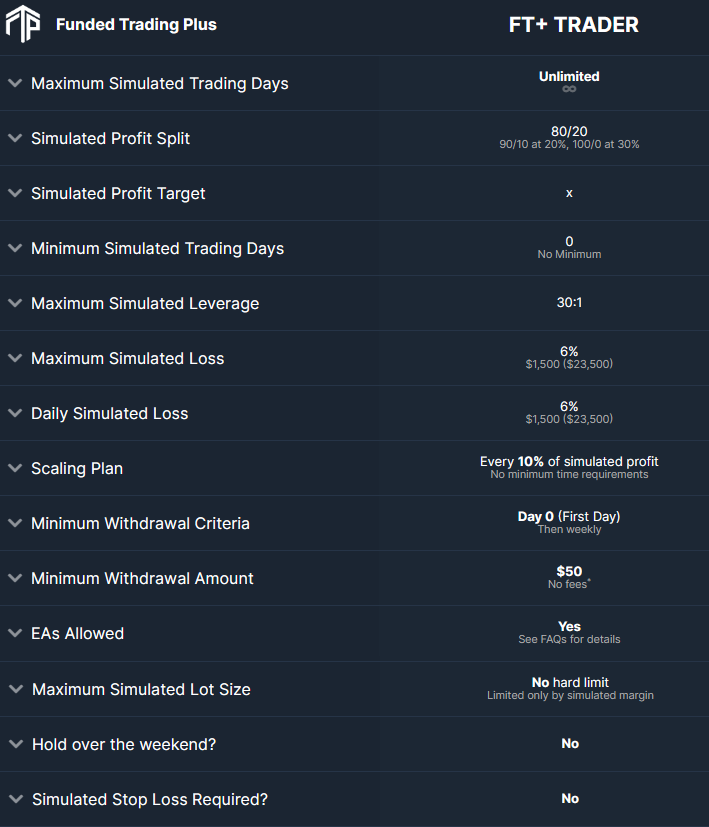

The Master Trader Program (instant funding)

The Master Program offers instant funding support where traders only need to maintain their account below the maximum drawdown limit.

- Minimum trading days: No minimum requirement.

- Challenge duration: No maximum limit, trade as needed.

- Maximum relative drawdown: 6%

- Maximum daily drawdown: 6%

- Profit target: No target, profits can be withdrawn from the first day.

These programs offered by Funded Trading Plus provide options for funded trading partnerships, aiming to support different types of traders in achieving profit targets under strict evaluation and management.

FT+ allows the use of Expert Advisors (EAs) across all programs but prohibits abusive strategies such as arbitrage or grid trading. The platform offers a discount code LFT10 for purchases, providing at least a 10% discount.

Leverage and Profit Sharing

Funded Trading Plus provides different leverage ratios depending on the asset class:

- Forex: Up to 1:30.

- Indices and commodities: Up to 1:20 or 1:30.

- Cryptocurrencies: Up to 1:2.

Profit sharing starts from 80% and can increase gradually based on trading performance, up to 90% or even 100%.

Promotions and Platform Support

Using the discount code LFT10 allows purchasers to enjoy a discount. FT+ supports popular trading platforms such as cTrader, TradingView, and allows overnight trading positions.

Funded Trading Plus, through its diverse funding account options and flexible evaluation processes, provides a platform for traders globally to achieve their trading goals, making it an excellent choice for those seeking capital support and aiming to enhance their trading capabilities.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.