Demand Wanes: Global Hedge Funds Are Selling Off Crude Oil Assets

The market's position on crude oil in early April has changed from moderately bullish to strongly bearish.

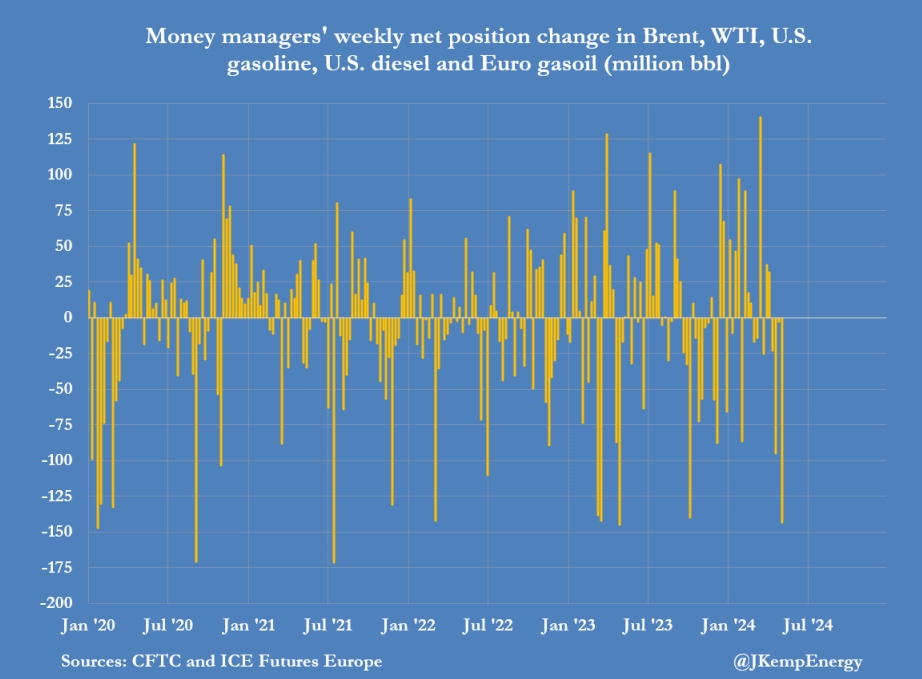

On May 14th, due to recent geopolitical tensions cooling down and consumer recovery not meeting expectations, investors are selling off crude oil futures and options at the fastest pace in a year last week.

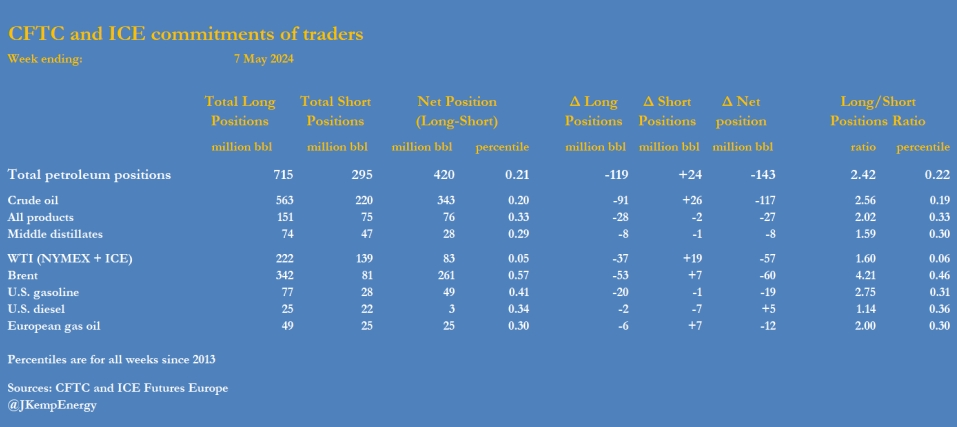

The latest data shows that in the seven days ending on May 7th, global hedge funds and other fund managers sold contracts for six of the most important petroleum-related derivatives, equivalent to 143 million barrels. If we extend the time frame to April 9th, since then, global fund managers have sold a total of 265 million barrels of crude oil derivatives, and the total position of crude oil has plummeted from 685 million barrels four weeks ago to the current 420 million barrels.

According to reports submitted by the European ICE Futures Exchange and the U.S. Commodity Futures Trading Commission, the market's position on crude oil at the beginning of April has shifted from a moderate bullish to a strong bearish sentiment.

If we look only at the most recent week, the wave of selling off various crude oil futures contracts continues. Among them, Brent crude oil futures positions decreased by 60 million barrels; NYMEX and ICE's WTI crude oil futures positions decreased by 57 million barrels; U.S. gasoline contracts decreased by 19 million barrels; European natural gasoline decreased by 12 million barrels. Only the U.S. diesel contract saw a positive increase.

Among the many contracts, the market's position on WTI crude oil is exceptionally bearish, with a net position of only 83 million barrels, and the ratio of longs to shorts is only 1.60:1. In contrast, the position on Brent crude oil is slightly more neutral, with a net position of 261 million barrels, and the ratio of longs to shorts reaches 4.21:1. Analysts say the reason for the difference is that the continued growth in WTI crude oil production ensures that its inventory can remain near long-term levels, with ample supply in the regional market; while Brent oil is still affected by the risk of conflicts in the Middle East, and North Sea oil prices have been less affected by the surplus of U.S. production.

Market analysis suggests that so far this year, the expected cyclical depletion of crude oil inventories has not occurred; the market supply is still abundant, and there is no clear sign of oil prices rising in the short term. The market's bullish sentiment on U.S. gasoline has also gradually disappeared, with data showing that hedge funds have sold a total of 36 million barrels of gasoline in the past four weeks, reducing net positions from 85 million barrels four weeks ago to 49 million barrels.

Looking ahead, crude oil investors are watching the U.S. Consumer Price Index data to be released on Wednesday for clues on when the Federal Reserve might consider cutting interest rates. Wednesday's inflation report may provide guidance for the Fed's policy outlook at its June 11-12 meeting, where officials will update their economic and interest rate forecasts. Ian Lyngen, head of U.S. rate strategy at BMO Capital Markets in New York, said: "If the data is stronger than expected, it will be difficult for the Fed to signal 'we will cut interest rates by 50 basis points' without an increase in unemployment."

At the same time, the market is also paying attention to the wildfires in remote areas of western Canada, which could disrupt the country's oil supply and heat up oil prices. Although there are currently no reports of operational disruptions, Alex Hodes, an analyst at energy brokerage StoneX, said that Canada's 3.3 million barrels per day of crude oil production capacity is "likely to be affected."

On Wednesday, the U.S. will also release the latest retail sales report, and on Thursday, the industrial production report will be released.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex in New York, said that weak CPI, retail sales, and industrial production data may put pressure on the U.S. dollar, as it will help confirm the view that interest rates have peaked.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.