U.S. stocks pre-market: Goldman Sachs expects March rate cut Apple Q4 to return to sales crown

Apple (AAPL) is appealing the Apple Watch ban order after the U.S. International Trade Commission (ITC) ruled that Apple violated Masimo's (MASI) blood oxygen test patent.。

▏Front of diskUS Stock Instant News

《01》US merchant ship attacked by Houthi

The U.S. Central Command said three anti-ship ballistic missiles fired by the Houthi militant group on Monday hit a Marshall Islands-flagged U.S. freighter, though the freighter reported no casualties or serious damage。After the attack, the U.S. government warned merchant ships to avoid Red Sea routes until further notice.。The Houthi armed group, for its part, responded that in the future, in addition to continuing to attack Israeli ships, it would also include all U.S. and British ships in its attack range.。

→ The United States and Britain launched several rounds of air strikes against the Houthi militant group, but the New York Times disclosed that the air strikes did not impact the Houthi militant group's military facilities

→Even with a large number of warships escorted, but the threat of the Red Sea route will never be eliminated, more Western merchant ships to take a detour to the Cape of Good Hope, which will lead to soaring international shipping costs, the world's largest international shipping association Bimco warned that the current instability may continue "for some time."

《02》Goldman Sachs expects March rate cut

Goldman Sachs said the Federal Reserve (Fed) may start lowering interest rates in March, but expects a total of only five rate cuts (1 yard each) for 2024, below the market's current expectations of six to seven, and analyst Jan Hatzius noted that the U.S. economy is expected to achieve a soft landing this year as the Fed steadily reduces borrowing costs for consumers and businesses。Another Goldman Sachs report revealed that after the big rally at the end of 2023, U.S. stocks are now crowded with bulls, parts are at very optimistic levels, and the market breadth is narrow, meaning that short-term stocks may be under pressure。

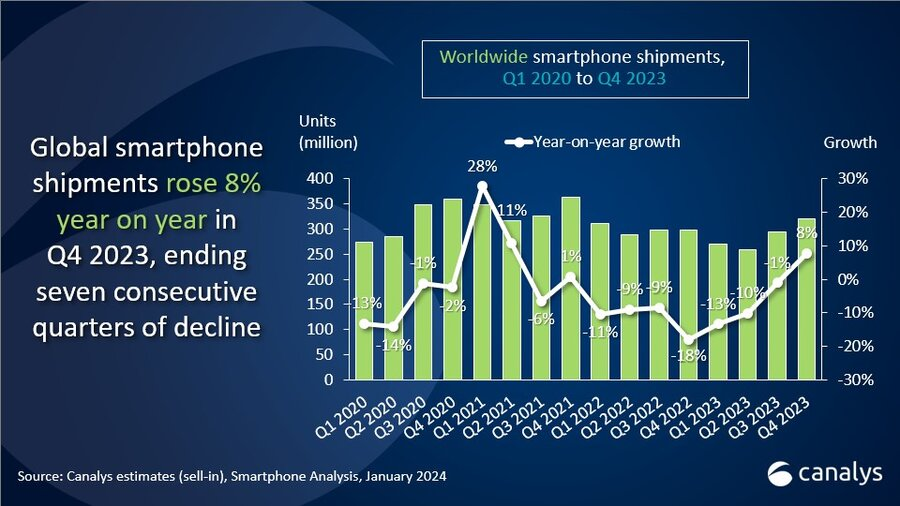

《03》Global mobile phone shipments Q4 return to growth, Apple becomes sales champion

According to research firm Canalys, global mobile phone shipments grew 8% in 2023Q4 to 3.200 million units, ending seven consecutive quarters of decline, after the launch of the new iPhone, Apple (AAPL) won the Q4 sales championship with 24% market share, while Samsung fell to second place with 17% market share.。In total, for the full year 2023, global mobile phone shipments were 1.1 billion units, down -4% from the previous year, and Apple's market share surpassed Samsung by a slight margin, becoming the annual shipment champion for the first time.。

→ Canalys pointed out that medium and low-order mobile phones are the main driving force of this recovery wave, while high-end market demand remains stable

《04》Apple plans to update Apple Watch to bypass ban

Apple (AAPL) is appealing the Apple Watch ban order after the U.S. International Trade Commission (ITC) ruled that Apple violated Masimo's (MASI) blood oxygen test patent.。Masimo revealed that Apple plans to remove the blood oxygen detection function of Series 9 and Ultra 2 through a software update to avoid the ban if the appeal fails。Regulators are rumored to have approved the change, and Apple has begun shipping the modified Apple Watch to U.S. retail outlets.。

《05》Goldman Sachs reports better-than-expected earnings thanks to asset management

Goldman Sachs (GS) Pre-Market Reports 2023Q4 Results, Revenue 113.200 million, better than expected 10.8 billion, EPS reported 5.48 dollars, beating analysts' expectations of 3.62 USD。Revenue increased by 7% over the same period in 2022, reflecting a strong 23% growth in asset and wealth management revenue, a decline of -12% in revenue for some invested banking operations and a decline in trading revenue of -2%..5% offset, net profit increased 51% from the previous year to 20.$100 million, with a significant increase in credit loss provisions from Q3。

《06》Musk wants to consolidate influence at Tesla

Tesla (TSLA) CEO Musk revealed on Monday that he wants to get more shares in Tesla, saying on the X platform that he would rather develop AI products outside of Tesla without 25% voting rights (currently about 12%)。Musk explained that his current "compensation plan" consisting of stock options is not to increase revenue, but mainly to obtain more shares to ensure that Tesla has the appropriate influence, and he also considered adopting a two-tier voting structure, but after the IPO has been unable to implement。

《07》Microsoft extends AI Copilot to consumers and small companies

Microsoft (MSFT) is opening up AI assistants to consumers and offering enterprise versions to smaller companies in an attempt to increase the number of paying customers for new services.。Microsoft has launched a $20 per month consumer version of Copilot that can use OpenAI's latest ChatGPT technology and image creation capabilities, and consumers with Office cloud subscriptions can also use Copilot to help operate various Office software。

* As the earnings season begins, Morgan Stanley notes that companies should be able to easily beat expectations after the threshold fix, as analysts have cut corporate profit expectations by 7% over the past three months

* Thanks to strong investment banking, Morgan Stanley (MS) Q4 revenue of $12.9 billion, beating expectations of 127.$500 million, but EPS is only 0 due to two one-time charges paid by Morgan Stanley.85 cents, below analyst expectations of 1.07 USD

* Uber (UBER) closes liquor delivery business Drizly to focus on core Uber Eats strategy

* Gita Gopinath, vice president of the International Monetary Fund (IMF), said market expectations for a quick rate cut were a bit premature because the fight against inflation was not over and a rate cut was more likely to occur in the second half of the year

* The Federal Aviation Administration (FAA) said there were no casualties in the collision between a Boeing (BA) 777 of Japan's All Nippon Airways and a Boeing 717 of Delta Airlines (DAL) while taxiing at the U.S. airport in Chiaga.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.