Best Gold Trading Broker (2024 Edition)

What are the best gold brokers??What platform is generally used for trading?

Gold is the oldest currency in the world and is synonymous with money.。There are several gold trading brokers that specialize in trading this precious metal, but each online broker adds gold CFDs to its asset list.。See the authors below for the highest rated gold brokers。

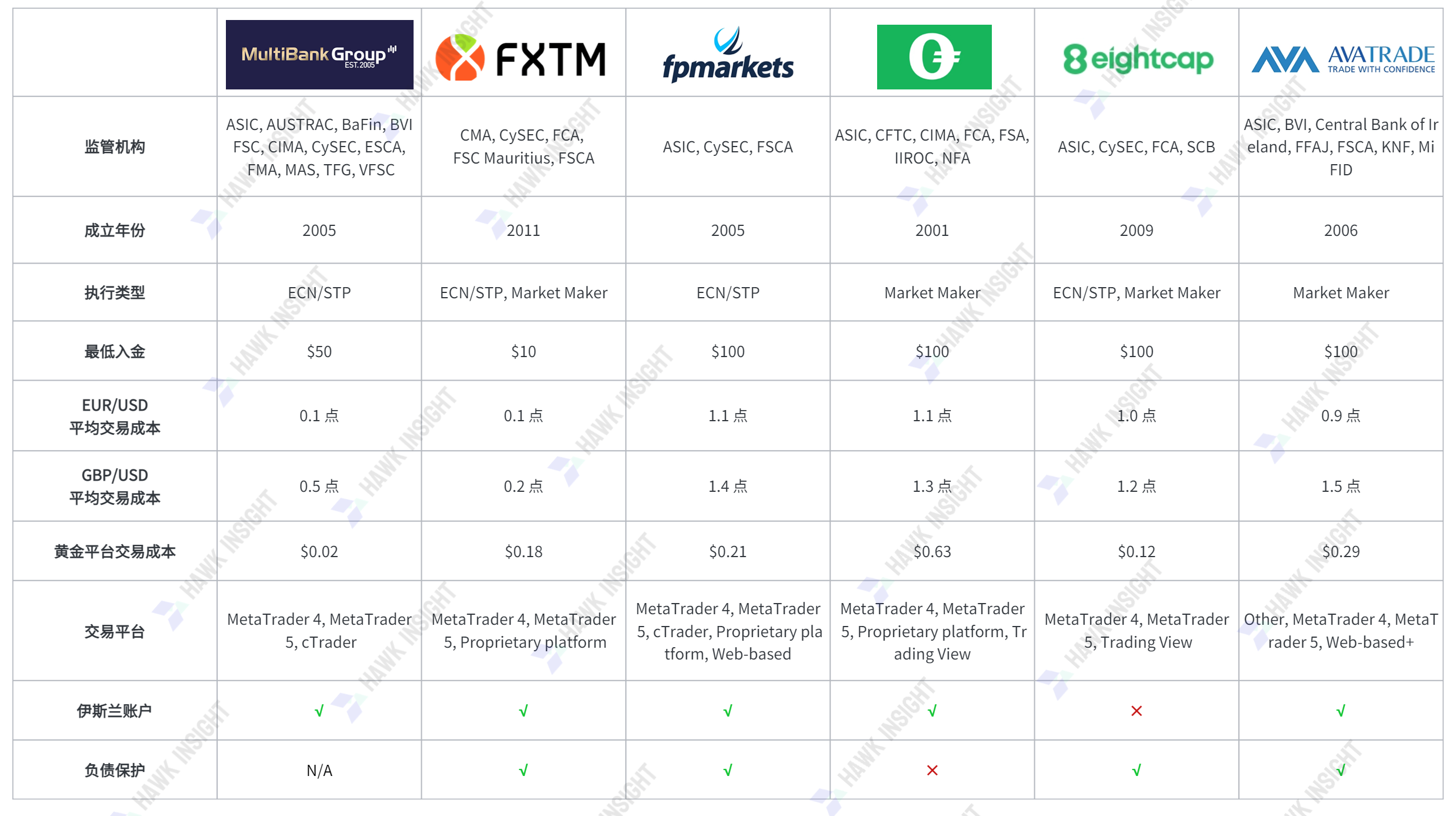

▍ Best Gold Broker Comparison

▍How to choose a gold broker

Gold, like all other assets, is primarily denominated in dollars.。It is usually inversely related to the dollar.。Since the diversification of the global economy, there has been a growing call to quote commodities in other currencies or a basket of currencies。When financial markets are volatile, many traders flock to gold as a safe-haven asset。Regardless of trading strategy or asset, gold is part of many portfolios。It offers excellent diversification and many forex traders are involved in gold trading。

Gold is a highly liquid asset that offers great trading opportunities and is an excellent long-term investment.。As global debt explodes, gold surges to record highs, a trend that is likely to continue for nearly a decade。Gold is traded in a variety of ways, making it more versatile。Institutional traders, central banks, professional traders and retail traders are active in gold trading.。The first three are engaged in physical gold trading and futures trading, while retail investors gain exposure mainly through derivatives trading such as options and CFDs, which eliminates the logistical problems associated with gold trading。

Choosing the right gold broker will ensure that traders make more profit on each trade, have a competitive portfolio of products and services, and manage their accounts with a safe, reliable and trusted broker。The authors have created a list of the best gold brokers and traders wishing to conduct research should pay attention to the following criteria to ensure that their selection will provide them with a favorable trading environment。

○ Gold trading regulation

The authors suggest this as a first step in narrowing the choice of gold brokers。Regulators require brokers to separate client deposits from corporate funds。Therefore, the broker cannot use it for any internal activities。To ensure the safety of investors' funds and the ability to extract profits quickly。The regulatory environment is changing and traders can find business-friendly, trusted brokers in many jurisdictions。EU brokers are the least competitive in the current environment, while Australia, South Africa and many offshore regulators offer the best trading environments。Britain could rejoin EU if changes are implemented after Brexit。

○ gold trading platform

Most retail traders will trade gold on the MT4 trading platform, and most online brokers offer the MT4 trading platform, which is the most versatile option。MT4 supports automated trading with built-in copy trading capabilities。However, most brokers offer below-average out-of-the-box versions, so they need to be upgraded.。The authors suggest focusing on gold brokers offering upgrades that will make MT4 a competitive trading terminal。It also shows the broker's commitment to the client, which many brokers advertise but rarely do。

○ Technology and trading tools

Superior technology ensures improved pricing and order execution。It will limit slippage and re-quotes, and the best gold brokers can offer customers higher pricing than the level shown in the order note。Gold traders who wish to deploy automated trading solutions must ensure that gold brokers offer VPS custody services, which are free to use once traders meet acceptable conditions。Manual traders should seek competitive trading tools, third-party analytics, trading platform plugins, in-house developed add-ons, and high-quality research and market commentary。Any gold broker that invests in technology and trading tools is committed to the success of its clients.。It is recommended that you do not choose a broker that provides only minimal service to maintain operations.。In today's financial markets, technological advantages will give traders greater profit potential。

○ Commissions and fees

Commissions and fees are direct transaction costs that affect the profitability of any trading strategy。It is recommended to use a gold broker for trading, because the spread between gold and other assets is small, so the profit per trade is higher。Traders must understand the full cost structure of the broker to avoid confusion and surprises。When reading the terms and conditions of transparent brokers, examples can be given so that new traders can understand。Some brokers will charge higher fees to compensate for services, and traders should ensure that they offer a competitive advantage before paying fees that are unhelpful to their trading strategy。

○ Methods of capital injection and withdrawal

All brokers offer bank wire transfers and credit / debit cards, but the authors advise traders to consider other methods。The lowest cost and fastest transaction speed for online payment processors and cryptocurrencies。There are also benefits to separating day-to-day banking activities from investment or trading activities。Customers will have more oversight of financial transactions, which will also facilitate annual tax returns。

○ Customer Support

The best gold brokers explain their portfolio of products and services on their website and operate seamlessly。Most traders never need customer support, but brokers must ensure that they are quick to help in the event of an emergency or unexpected difficulty。All brokers offer customer support during normal business hours, many brokers offer 24 / 5 support and few brokers offer 24 / 7 support。

○ Services provided

Traders can choose from a full-service broker, online broker or discount broker。Most online brokers have the best cost-service benefits。It is also recommended to ensure a low minimum deposit, which will help traders develop portfolio strategies and ensure that the maximum leverage for gold trading is high。This is still one of the most advantageous trading tools if used in the context of risk management。Traders should be cautious about bonuses, make sure they understand the terms and conditions, and evaluate whether bonuses benefit their strategy。For reputable brokers, dividends can be a huge gain for long-term traders。Active traders should consider gold brokers with volume-based rebate schemes。

▍ Gold trading account

Trading gold with the right trading account type is just as important as the choice of trading strategy and broker。Many new traders with smaller deposits are eager to trade using a standard account (sometimes called a gold account) because many brokers offer better trading conditions.。If there is insufficient funds, most of the time the result of the transaction is a loss.。This is one of the reasons why 70-85% of retail traders are not profitable.。The authors advise new traders with less than $1,000 to consider a mini-account and then move on to higher levels through their own efforts。

○ Micro account

Micro accounts are ideal for new traders with deposits of less than $1000。It is also a great tool to learn how to trade Forex。Traders using automated trading solutions usually test them in micro-accounts after intensive testing of errors in demo accounts。The loss is only 1,000 units, providing traders with a real market environment suitable for the size of their portfolio.。The minimum trading volume is usually 0.01 lots or 10 units of assets。

○ Gold account

Gold account is usually the standard account for most brokers。Recommended minimum deposit is $10,000。A mini account is a suitable option for all traders with a portfolio above $1,000 but below $10,000。Unless otherwise specified, one hand in a gold account is equal to 100,000 units and one hand in a mini account is equal to 10,000 units。Some brokers reduce the maximum leverage of gold accounts and offer more trading features。

○ VIP / Platinum account

Some brokers offer VIP or Platinum accounts。It usually requires a minimum deposit of $25,000 or more and provides the minimum leverage provided by the broker。It also offers non-transactional benefits for high-value customers, such as invitations to events, tickets to popular venues, and other benefits.。More and more brokers no longer offer multi-account levels, but offer the same trading conditions to all clients。

Gold Investment Options

Gold offers a variety of investment options, including direct and indirect investments and passive investments.。The right choice depends on personal goals, not all gold brokers offer every asset。The following options apply to gold investors, while gold traders rely more on options and CFD trading。

○ Physical gold bars & coins

Buying physical gold bars and coins is the best option for long-term investors。It stores gold ownership in a secure vault.。Investors need to pay for storage and security, which is generally acceptable。It is highly undesirable to store gold at home.。

○ ETF

ETFs are ideal for investors who want to adopt a passive investment approach。ETFs must store physical gold in proven vaults, but ETF investors are looking for gold price movements or their ability to hedge。Investors have no ownership in gold and ETF trading takes place during normal stock exchange business hours.。

○ Gold mining stocks

Investing in gold mining stocks is an indirect investment in gold and the most risky investment。While earnings potential may increase, there is no guarantee that miners will discover new gold mines or improve the operating margins of existing gold mines.。Investing in gold mining companies is more complicated than focusing on the price of gold。It is not suitable for most retail traders。

▍How to trade gold in forex trading

All forex brokers offer gold, usually quoted as XAU / USD on their trading platform。Trading mechanism is the same as currency pair trading。The spread of XAU / USD is higher than most forex currency pairs and the broker reduces overall leverage。Another fact that traders must consider is the high volatility of gold trading。Most currency pairs do not range from 100 to 200 points per day, while gold can exceed 10,000 points in extreme cases and easily exceed 2,500 points per day.。Gold is a major safe haven for senior forex traders and professionals。Traders must consider the inverse relationship with the dollar to avoid overexposure to the single currency。

▍American Gold Trading Broker

In the US, the overall choice of brokers remains limited, with only a handful of online brokers。All brokers offer gold trading through futures and options contracts。The importance of transaction costs and services plays the biggest role because American traders have fewer choices。The MT4 trading platform is less available than its international counterparts, which has cost U.S. gold traders thousands of automated trading solutions.。Gold brokers in the U.S. rely more on manual trade execution, but there are also platforms that support automated trading。Leverage is often much lower than that of international gold brokers, putting U.S. traders at another disadvantage in the competition.。U.S. Traders May Not Trade With Non-U.S. Brokers。

▍Dubai Gold Trading Broker

One of the main trading locations for gold traders is Dubai。As a financial center in the Middle East, gold trading is part of the region's history.。Today, gold trading within the Dubai Free Trade Zone accounts for 25% of global gold trading volume。A growing number of domestic and international brokers have taken advantage of Dubai's convenient business environment to obtain operating licenses.。Most comply with Sharia law for Muslim traders。There are several gold trading brokers in Dubai that specialize in physical gold trading and storage.。Online brokers provide a competitive trading environment for gold traders and fully support automated trading and copy trading。The Dubai Gold and Commodities Exchange (DGCX) offers an unrivalled gold trading platform including 1kg bullion and the only international standard for gold hedge funds。

▍FAQs

What are the best gold brokers??

The best gold brokers offer narrow spreads, high leverage and competitive trading tools。

What is the best gold trading platform??

The best gold trading platform for most retail traders is MT4。

Is it profitable to trade gold??

Trading gold is just as profitable as any other asset in the hands of a skilled trader and requires the same attributes。

○ How much does it cost to trade gold in foreign exchange?

This depends on the type of account, but a portfolio of no less than $1,000 is recommended to deal with the high volatility of gold trading。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.