Hawkinsight Gold Market Daily (1.3) Gold prices fall on first trading day of 2024 as dollar strengthens

PMI data shows US manufacturers did not perform as well at the end of the year。Output falls at fastest pace in six months as recent slump in orders intensifies。As a result, manufacturing is likely to drag down the economy in the fourth quarter。

January 3 (Wednesday) Asian morning market, spot gold slightly higher。

Market Review

On January 2 (Tuesday), due to the strength of the US dollar, the price of gold was under pressure in the first trading day of 2024, and finally closed at 2058.$60 / oz。

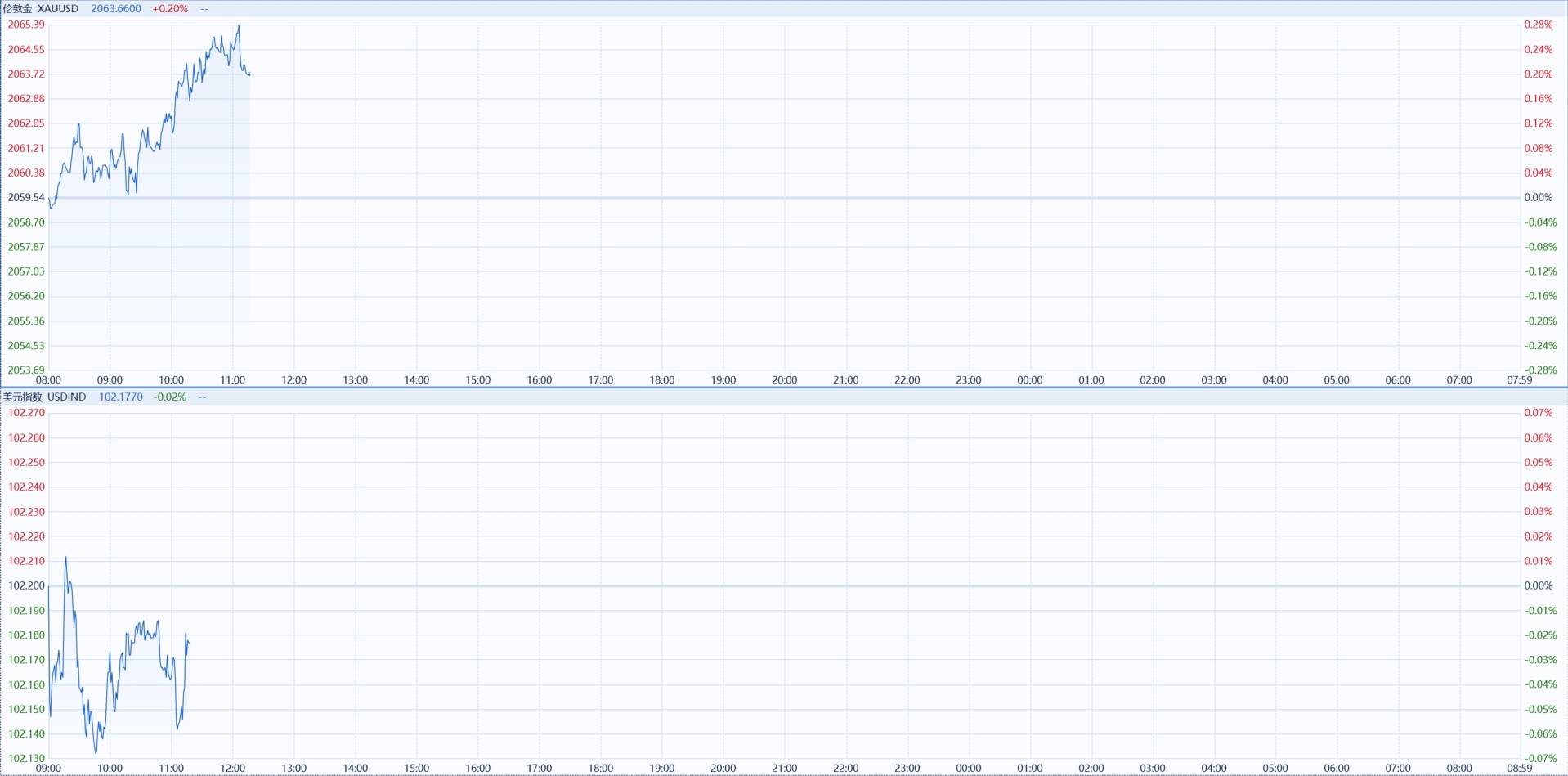

Spot gold prices up 0 today as of press time.20%, reported 2063.$66 / oz; dollar index down 0 on day.02% at 102.18。

l U.S. manufacturing data fell short of expectations: U.S. December Markit manufacturing PMI final value of 47.9, expected 48.4, previous value 48.2。Chris Williamson, chief business economist at S & P Global Market Intelligence, commented that the PMI data showed that U.S. manufacturers did not perform as well at the end of the year。Output falls at fastest pace in six months as recent slump in orders intensifies。As a result, manufacturing is likely to drag down the economy in the fourth quarter。Outside the U.S., the December manufacturing PMI data released by Britain, Germany and France were all below the boom-bust line of 50。

l Traders narrow their bets on the Fed's 2024 rate cut: Wall Street traders abruptly cut their bets on the Fed's rate cut, expecting a rate cut of less than 150 basis points this year。In addition, according to media surveys, after a big rally in 2023, Wall Street strategists believe that U.S. stock returns will fall sharply in 2024。Fourteen strategists from major companies expect the S & P 500 to reach 4,881 by the end of 2024, with full-year gains of just 2.3%。

l The market is focused on a series of economic data to be released this week: Nicky Shiels, strategist at Swiss gold and silver refining and financial group MKS Pamp, said in a trading note: "Event risk will rise in the first week of 2024.。He was referring to the release of eurozone inflation and US jobs and wages data on Friday, plus the release of the minutes of the December Fed meeting on Wednesday.。"

l CME "Fed Watch": Fed keeps rates at 5 in February.25% -5.The probability of the 50% interval being constant is 87.1%, the probability of a 25 basis point rate cut is 12.9%。The probability of keeping interest rates unchanged by March next year is 20.9%, with a cumulative probability of a 25 basis point cut of 69.3%, with a cumulative probability of a 50 basis point rate cut of 9.8%。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, spot gold is expected to fall restrictively during the day, and the technical rating RSI technical indicators run complex trends and tend to fall.。

Trading Strategy: Trading Strategy: In 2068.00 below, bearish, target price of 2051.00, then 2045.00; the alternative strategy is in 2068.00 above, bullish, target price set at 2074.00, then 2080.00。Support level: 2051.00, 2045.00; resistance level: 2074.00, 2080.00。

This week's important schedule

Tuesday, January 2

04: 00 Eurozone December Manufacturing PMI Final Value

04: 30 UK December Manufacturing PMI

09: 45 US December Markit Manufacturing PMI Final Value

10: 00 Monthly Rate of US Construction Expenditure in November

Wednesday, January 3

10: 00 US December ISM Manufacturing PMI

10: 00 US November JOLTs Job Vacancies

16: 30 US API Crude Oil Inventory for Week to December 29

20: 45 China's December Caixin Services PMI.

Thursday 4th January

04: 00 Eurozone December Services PMI Final Value

04: 30 UK November Central Bank Mortgage Permit.

04: 30 UK December Services PMI

07: 30 U.S. December Challenger Corporate Layoffs

08: 15 U.S. ADP Employment in December

08: 30 U.S. to December 30 Initial jobless claims for the week

09: 45 US December Markit Services PMI Final Value

11: 00 US to December 29 week EIA crude oil inventories

11: 00 U.S. to December 29 Week EIA Oklahoma Cushing Crude Oil Inventories

11: 00 U.S. to December 29 Week EIA Strategic Petroleum Reserve Inventory

Friday, January 5

05: 00 Eurozone December CPI Initial Annual Rate

05: 00 Eurozone December CPI Monthly Rate

05: 00 Eurozone November PPI Monthly Rate

08: 30 U.S. Unemployment Rate in December

08: 30 US non-farm payrolls after December quarter adjustment

10: 00 US December ISM Non-Manufacturing PMI

10: 00 U.S. November Factory Orders Monthly Rate

13: 00 Total number of oil rigs for the week from the United States to January 5

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.