How to deposit funds to XM trading account?

XM offers a number of ways for clients to fund their trading accounts and this article explains in detail how to fund an XM trading account using a credit or debit card.

XM offers multiple options for clients to fund their trading accounts.You can visit the XM official website and log in to the Members Area to explore the funding options available in your region.

This article will provide a detailed explanation of how to deposit funds into your XM trading account using a credit or debit card.

Deposit Steps

-

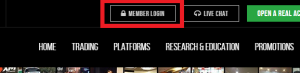

Log in to XM Members Area: Visit the XM official website and log in to your account.

-

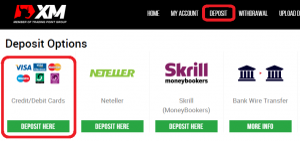

Select Deposit Method: Choose "Credit/Debit Card" as your deposit method on the Members Area interface.

-

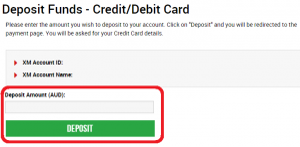

Enter Deposit Amount: Input the amount you wish to deposit.

-

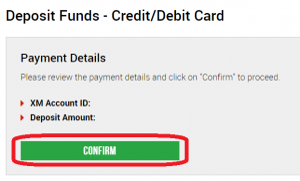

Confirm Account and Amount: Ensure the accuracy of your account and deposit amount.

-

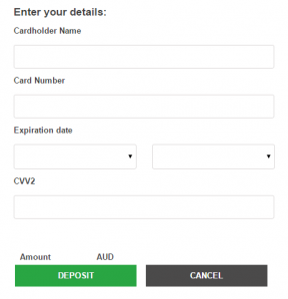

Enter Payment Details: Enter detailed information of your credit or debit card on the secure page.

-

Complete Deposit: The deposited amount will reflect instantly into your trading account.

FAQs

-

Deposit and Withdrawal Options: XM provides diverse payment options including credit cards (Visa, MasterCard), various e-payment methods (Skrill, Neteller, UnionPay), bank wire transfers, and local bank transfers. These options allow clients to choose the most convenient payment method based on their preferences and geographical location.

-

Accepted Currencies: Clients can deposit funds using multiple currencies, which will automatically convert into the base currency of their trading account. Available currencies include USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR, among others.

-

Minimum Deposit Amount: Regardless of the chosen payment method, XM maintains a uniform minimum deposit requirement of 5 USD or its equivalent in other currencies. Specific minimum amounts may vary based on the payment method and account verification status.

-

Withdrawal Processing Time: All withdrawal requests are typically processed within 24 hours on business days within XM's back-office system. Funds may take an additional 2 to 5 business days to reflect in client accounts for withdrawals via bank wire transfers or credit/debit cards, depending on bank and country transfer speeds.

-

Credit Card Withdrawal Restrictions: For security and compliance reasons, XM can only refund funds to the same credit card or debit card used for the initial deposit. Expired or stolen cards may require refunds via bank wire transfer.

-

Account Verification Requirements: To ensure trading security and compliance, clients must undergo verification before they can deposit or withdraw funds. The verification process includes submitting valid identification (such as ID card, passport, driver's license) and proof of address (utility bills, telephone/internet/TV bills, or bank statements dated within the last 6 months).

-

Handling Open Positions During Withdrawals: Clients can withdraw funds at any time provided the margin level of open positions allows. However, to avoid forced liquidation, clients must ensure that the margin level of open positions remains within XM's specified safe range.

-

Bank Wire Transfer Processing Time: Processing times for bank wire transfers depend on the country and region to which funds are being transferred. Standard bank wire transfers within the EU typically take 3 business days, while transfers to other countries may take up to 5 business days.

-

Withdrawal Arrival Time: Withdrawals to client e-wallets typically complete on the same day, whereas withdrawals via bank wire transfer or credit/debit cards may take an additional 2 to 5 business days.

-

Deposit and Withdrawal Fees: XM does not charge any additional fees for deposits and withdrawals, including e-wallet and credit/debit card deposit operations. This ensures clients do not incur extra costs during fund transactions.

-

Restrictions on Refunding Funds: Clients who deposit funds via credit/debit card must refund funds to the original card before using another withdrawal method. This policy ensures consistency and security in fund sourcing.

-

Internal Account Transfers: Clients can request internal transfers between two XM trading accounts, provided both accounts are verified and registered in the client's name. This provides clients with greater flexibility and management convenience.

-

Third-Party Fund Deposit Restrictions: To comply with financial regulatory requirements and ensure fund security, XM does not accept fund deposits or withdrawal requests from third parties (such as friends or relatives). All fund operations must return to the original fund source, ensuring transparency and security in fund flows.

-

Profit Withdrawal from Bonus Accounts: Profits earned through bonus accounts can be withdrawn at any time. However, certain specific bonus accounts may have additional conditions for profit withdrawal, and clients should be aware of these regulations to avoid unnecessary complications.

-

Account Transfer Restrictions: To ensure transparency and security in fund flows, XM does not allow account transfers between clients or involve third-party fund transfers. All fund operations must return to the original fund source, ensuring compliance and security in fund operations.

-

Withdrawals to Accounts Not in the Cardholder's Name: To comply with anti-money laundering regulations and protect client fund security, XM does not support fund withdrawals to accounts not held in the cardholder's name, including accounts under third-party names.

This concludes the detailed explanation of how to deposit funds into your XM MT4 and MT5 accounts using a credit or debit card. For more information on XM deposits and withdrawals, please visit the XM official website or contact their customer support team.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.