How TFF gets price feedback and its dilemma

Trader Funding Companies (TFFs) require a variety of resources to operate effectively, including administrative back offices, customer portal providers, trading platform access, liquidity providers, payment processors and services provided by KYC.。

Trader Funding Companies (TFFs) require a variety of resources to operate effectively, including administrative back offices, customer portal providers, trading platform access, liquidity providers, payment processors and services provided by KYC.。

Access to Price Feedback

To conduct simulated trading on any trading platform, more than one platform is needed (more than 50 platforms are used by TFF), one of the essential elements is the price feedback of the selected instrument (forex, metals, futures, etc.)。

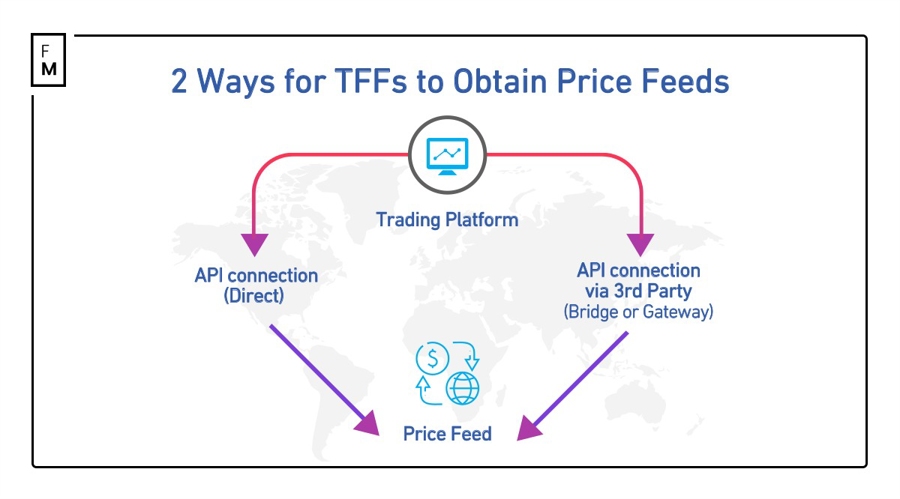

Platform providers focus primarily on technology and often do not provide price information, sometimes due to legal restrictions.。Retail Forex brokers or liquidity providers play a role here, as they all have access to price information (whether executable or not)。From a technical point of view, the following are the two most important situations in which TFF obtains price information.

- Trading Platform → API Connection (Direct) → Price Feedback

- Trading platform → Connect API via third party (bridge or gateway) → Price feedback

If TFF works directly with the trading platform supplier, it must enter into separate agreements with the bridging supplier (if required by the platform) and the price feedback supplier。

On the other hand, if TFF rents a trading platform from a retail broker or third-party advisor, price feedback and bridging are usually provided by them。If retail brokers also get lead agreements, they usually charge less, or even no, compared to third-party advisors。Consultants I've seen charge up to $50,000 for basic TFF setup。

Price feedback costs range from free (although there are still some dubious ways to get free price feedback) to over $20,000 per year。

The role of liquidity providers

Similar to retail forex brokers that claim to process customer orders straight-through, it is legally impossible to verify whether TFF is operating a proprietary trading desk behind the scenes。Here's Why Institutional Forex Practitioners May Be Skeptical About 'Prop Trading' Claims on TFF's Website。

Let's assume that a TFF operates a proprietary trading platform as stated on its website and provides simulated trading that simulates real trading (although even complex simulation settings cannot be perfectly replicated)。In addition, assume that the trader passes the challenge, is ready to manage real money, and gains the trust of TFF funds (I very much doubt that a month of positive results will lead to an investment of 100,000)。

How winning traders are tied to the real market?

Some TFFs claim to offer real trading accounts to successful traders (some do), while others suggest that traders continue to use demo accounts, with TFFs copying their trades onto actual prop trading accounts。

However, for TFFs to connect to liquidity providers for prop trading, a more complex technical setup is required。In addition to this, given the leverage and funding provided, TFF requires significant cash reserves。At this point, haven't seen a formal prop fund trade with leverage of 1: 100。

All of the above (complex technical setups, liquidity regulations) pose a significant challenge to TFF, making it almost impossible to achieve the requirement to forward financed trader trades to liquidity providers。

It is more feasible to transfer real-time trading to retail brokers or hedge traffic.。

Choosing a cost-effective model

TFF's business model relies on collecting fees from failed assessments to cover the costs of a very small number of profitable traders.。This in itself is not good or bad, but the core of the business model.。

In summary, TFF typically works with retail forex brokers (formal or informal) to obtain trading platforms, price feedback and occasional hedging, as well as separate lead sharing and marketing agreements.。This setup is indeed cost-effective for TFF, but fewer retail brokers are willing to take risks today, choosing instead to start their own TFF。

Liquidity providers typically participate in two situations: newer, less experienced TFFs need to hedge rare winning customers or non-net inflows; larger, mature TFFs have enough customers and data to run their own proprietary trading。However, in my experience, only a few TFFs fully understand how to leverage the real-time and historical data they access。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.