Bitcoin Drops 0.64%, Price Falls Below $84K as $1.8B in Bitcoin Options Expire Bitcoin Drops 0.64%, Price Falls Below $84K as $1.8B in Bitcoin Options Expire

Key momentsBitcoin’s price slumped to $83,974 on Friday.The expiration of Bitcoin options, totaling over $1.8 billion, contributed to the market instability.Investor apprehension was intensified by on

Key moments

- Bitcoin’s price slumped to $83,974 on Friday.

- The expiration of Bitcoin options, totaling over $1.8 billion, contributed to the market instability.

- Investor apprehension was intensified by ongoing uncertainty regarding U.S. interest rates and the potential consequences of increased trade tariffs.

Bitcoin Price Under Pressure Amid Options Expiry and Economic Uncertainty

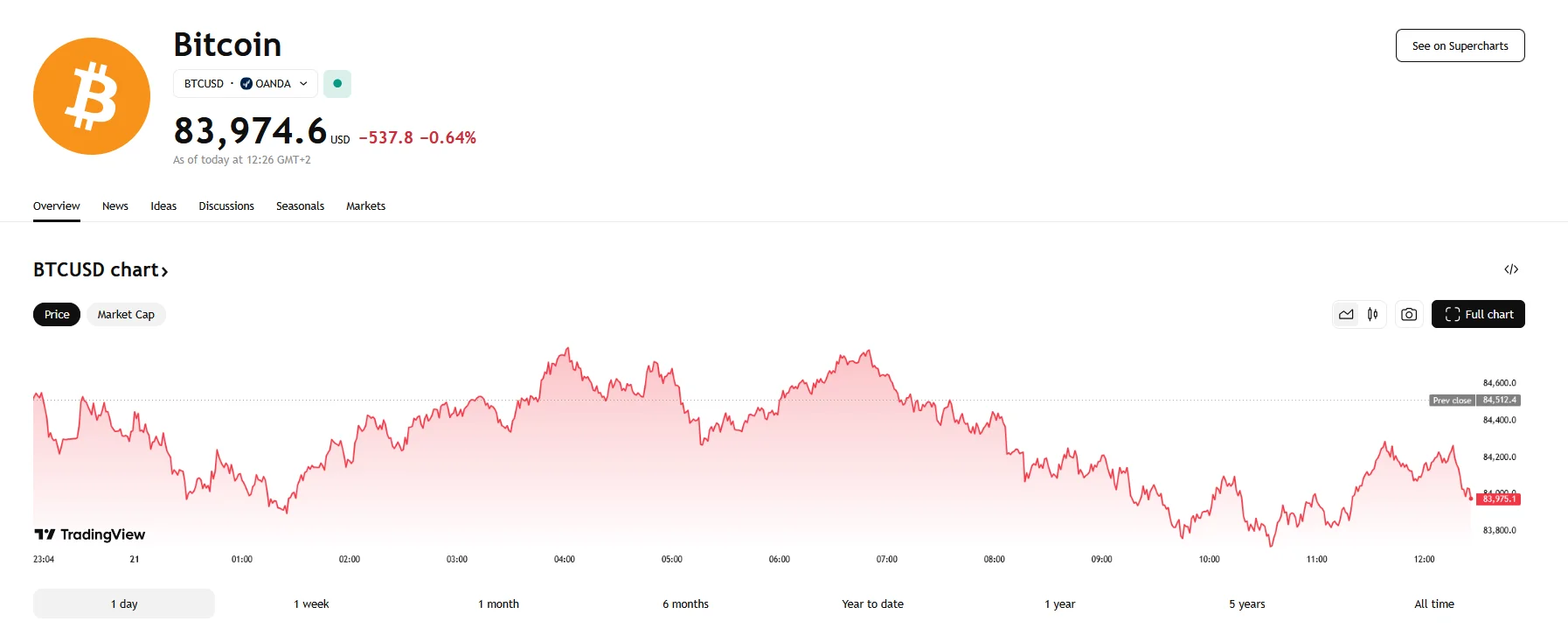

Bitcoin’s price fell on Friday, reaching $83,974 as the cryptocurrency market grappled with a confluence of economic and market-specific factors. The price decreased by 0.64%, and at press time, Bitcoin’s market capitalization stands at around $1.66 trillion.

A significant event contributing to the day’s volatility is the expiration of over $1.8 billion in Bitcoin options. This large-scale expiry, involving thousands of contracts, introduced a period of potential price swings as traders adjusted their positions. While the put-to-call ratio suggested a generally bullish market sentiment, the sheer volume of expiring options created an environment ripe for short-term price fluctuations.

The prevailing market sentiment was further influenced by the lingering uncertainty surrounding U.S. interest rates and the potential impact of heightened trade tariffs. The Federal Reserve’s recent decision to maintain current interest rates, coupled with signals of economic uncertainty, dampened investor enthusiasm. The Fed’s projections of increased inflation and slower growth, alongside concerns over the potential effects of President Trump’s tariff policies, contributed to a risk-averse environment.

Another factor to consider is Trump’s fluctuating stance on trade tariffs, particularly his threats of reciprocal tariffs against major trading partners. His persistent calls for the Fed to lower interest rates, despite the central bank’s indications of maintaining its current course, further fueled market uncertainty. The lack of economic clarity created substantial challenges for cryptocurrencies like Bitcoin.

Analysts highlighted a divided market sentiment, with some anticipating a post-FOMC price decline due to the lack of interest rate cuts, and others predicting a temporary surge before renewed volatility. Gracy Chen, CEO of Bitget Exchange, expressed confidence that Bitcoin’s price will remain stable above the $73,000 to $78,000 threshold. She also predicted a surge towards $200,000. This optimism was attributed to the U.S. strategic Bitcoin reserve, specifically its potential to bolster trust from major financial institutions. However, traders and investors were advised to remain vigilant due to the potential for short-term volatility.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.