Ignition Bars: Are You Using This Powerful Pattern to Make Money?

This little known way to detect the beginning or end of a trend can potentially make you a lot of money.Learn how to detect and trade ignition bars.

What is an Ignition Bar?

An Ignition Bar is a crucial price chart pattern that signifies the start of a new trend. The term “Ignition” refers to its role in marking the beginning of a trend. Whether it's a bullish or bearish trend, the Ignition Bar effectively identifies turning points in the market, helping traders capture early opportunities. Mastering this pattern can significantly enhance your trading profitability.

How to Identify an Ignition Bar?

-

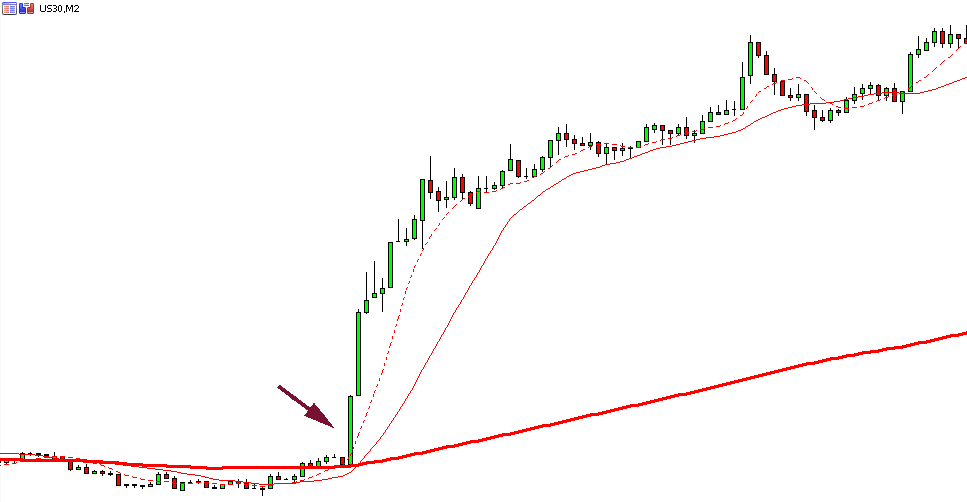

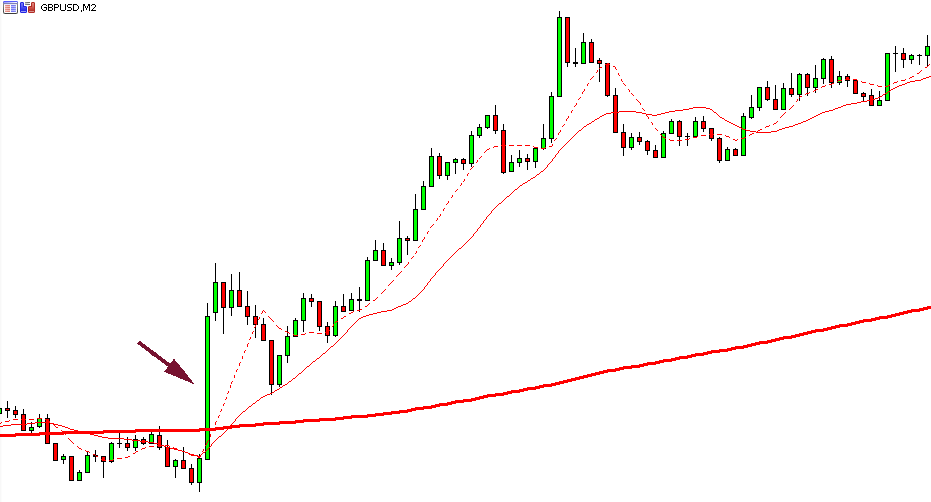

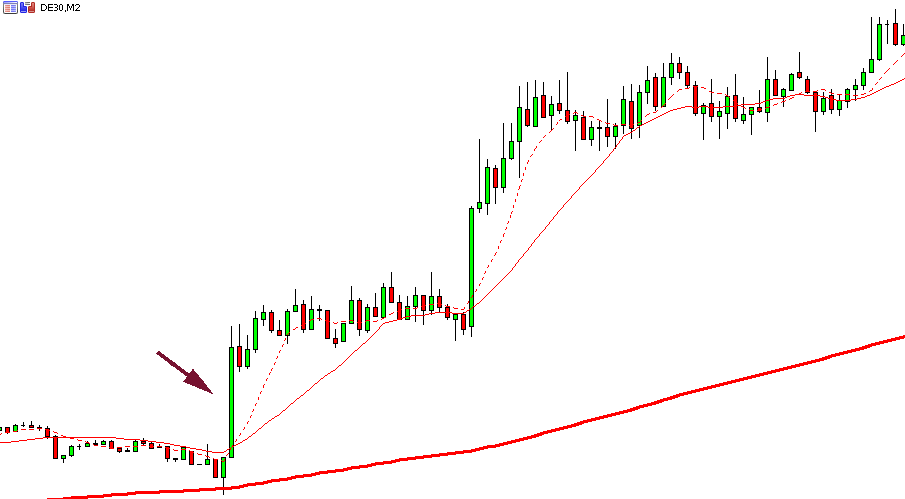

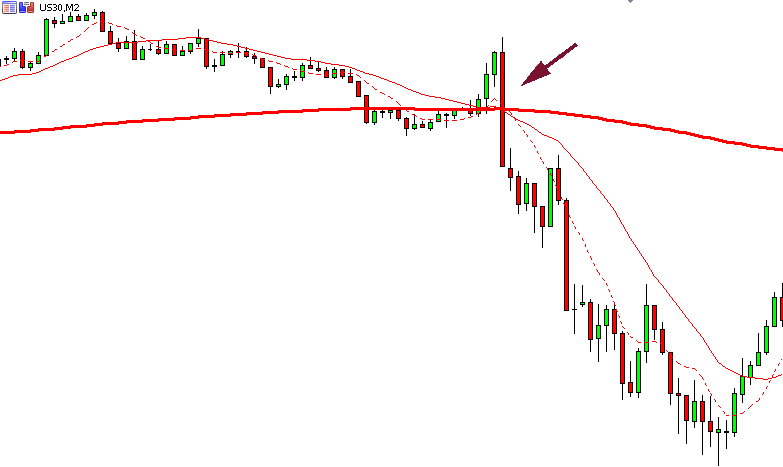

Shape Characteristics:A key feature of an Ignition Bar is its large body. Compared to previous candles, an Ignition Bar has a noticeably larger body, indicating strong market momentum. This bar is usually solid, especially on the closing side, with minimal or no wicks. For example, a typical bullish Ignition Bar can be visually distinguished from other candles due to its substantial size.

-

Location and Context:The effectiveness of an Ignition Bar depends on its location. It typically forms in two key market scenarios:

- Breakout from a Consolidation Phase: When the market has been consolidating within a range, an Ignition Bar signals a potential breakout and the start of a new trend.

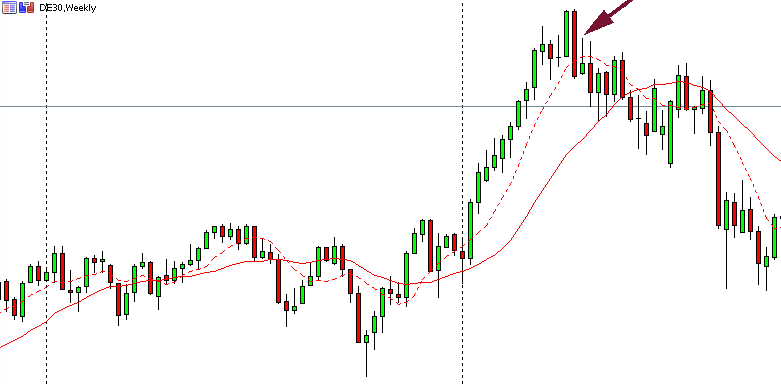

- End of an Opposing Trend: When an existing trend is ending, an Ignition Bar often indicates a reversal and the beginning of a new trend in the opposite direction. In this case, the Ignition Bar marks the end of the previous trend and the start of a new one.

For instance, an Ignition Bar emerging from a prolonged consolidation phase usually indicates that the market is about to break out of the range, initiating a new trend.

- Breakout from a Consolidation Phase: When the market has been consolidating within a range, an Ignition Bar signals a potential breakout and the start of a new trend.

Timing of Ignition Bars

Ignition Bars are often associated with high volatility events:

- Important News Releases: Major economic data, central bank announcements, and other significant news events can lead to substantial market volatility. During these times, Ignition Bars frequently appear, providing excellent trading opportunities. For example, an Ignition Bar formed during CAD news release can lead market movements.

- Market Openings: Ignition Bars also commonly appear at market opening times. For instance, the DAX index during the London open or the Dow Jones index during the New York open often show notable Ignition Bars, which can signal strong intraday trading opportunities.

Time Frames for Ignition Bars

Ignition Bars can appear in any time frame. The choice of time frame depends on the trader’s strategy and style:

- Day Traders: Can look for Ignition Bars in shorter time frames such as M2, M5, or M15.

- Swing Traders: Can search for Ignition Bars in H1, H4, Daily, Weekly, or Monthly time frames to capture longer-term trends.

How to Trade Ignition Bars Effectively

-

Trend Following: When encountering an Ignition Bar, prioritize trading in the direction indicated by the bar. Avoid counter-trend trades and focus on following the main trend.

-

Multi-Time Frame Strategy: Identify Ignition Bars in higher time frames and then execute trades based on these signals in lower time frames. This approach helps in leveraging trend signals from higher time frames and fine-tuning trades in shorter time frames.

-

Combine with Other Indicators: While the Ignition Bar itself is a powerful signal, combining it with other technical indicators (such as volume, RSI, etc.) for confirmation can enhance trading accuracy.

-

Risk Management: Set appropriate stop-loss and take-profit levels to manage risk effectively when trading Ignition Bars.

By applying these methods, traders can use Ignition Bars to identify key trends and optimize their trading strategies, leading to improved profitability. This pattern is valuable across various market conditions and trading styles, making it an indispensable tool for traders.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.