International oil prices fall to nearly 5-month lows, the market still faces three downward pressures

Looking ahead, international oil prices still face greater downward pressure。

On December 6, international oil prices rebounded, now Brent oil rose 0.32%, reported 77.$25 a barrel; WTI up 0.35% at 72.$44 / barrel。

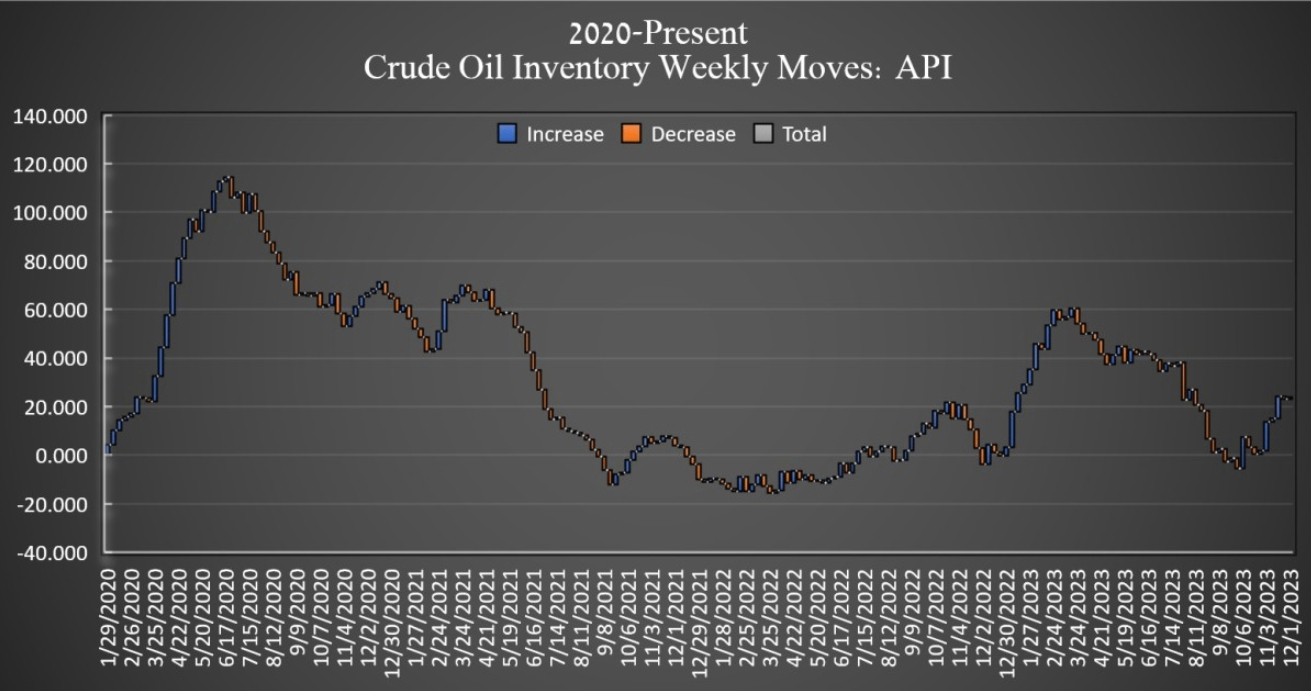

API crude oil inventories rose instead of falling Oil prices dived slightly

Yesterday, international oil prices fell for the fourth consecutive session due to concerns about the lack of OPEC + production cuts and sluggish demand, hitting a five-month low during the session.。Among them, Brent crude oil futures closed at 77.$20 a barrel, down 0.$83 a barrel, down 1.06%; WTI crude oil closed down 0.$72 a barrel, down 1.0%, closed at 72.$32 / barrel。It was the lowest closing price for both international crude benchmarks since July 6, and for WTI crude, it was the first time the variety had fallen for four consecutive days since May.。

On Tuesday, the United States released API crude oil inventories for the week to December 1.。Data show that inventories do not fall but increase, expected to decrease 226.70,000 barrels, an increase of 59.40,000 barrels, a decrease of 81.70,000 barrels, putting pressure on oil prices。According to the report, the overall accumulation of crude oil products, especially the significant increase in Cushing inventories, reinforced the real concerns about supply pressures in the crude oil market.。In addition, there is news that Saudi Arabia has also lowered the official price of crude oil exported to Asia, also reflecting the pressure on the oil market in terms of sluggish demand.。Oil prices dive slightly after API data。

At a time when oil prices are under pressure, the United States has also come to "take advantage of the fire" and announced a high-profile replenishment of crude oil inventories.。This week, Deputy Energy Secretary David Turk said the United States would buy back as many oil reserves as possible.。The market expects the United States to replenish its oil reserves of about 4 million barrels in February next year, and the replenishment plan is not scheduled for next summer.。

Future international oil prices will face three major concerns

Looking ahead, international oil prices still face greater downward pressure。

First, the market remains skeptical about OPEC + 's production cuts, and how to rebuild investor confidence in it will be a major challenge for OPEC + in the future。Currently, a number of countries, including Iraq and Kazakhstan, claim that production data fell in November, but the expected improvement in market expectations from this production cut is very limited.。Russia has also declared that OPEC + will be ready to deepen oil production cuts in the first quarter of 2024, but still can't stop oil prices from falling.。Fiona Cincotta, financial market analyst at StoneX, said: "The voluntary part of the agreement leaves the market questioning whether the supply reduction is actually going to work.。"

Second, according to the latest U.S. employment data, the U.S. economy is already showing clear signs of slowing down, which is hitting the already sluggish oil market demand regeneration。According to the US October JOLTS job openings released yesterday, the figure has fallen to its lowest level since early 2021.。The Fed's Beige Book, released this month, also said that economic activity in many parts of the U.S. has shown signs of slowing down。Notably, the slowing labor market and receding inflation have also stoked optimism, with markets betting that the Fed will end its cycle of rate hikes in December and that lower rates in the future could reduce the cost for consumers to borrow to buy goods and services, thereby increasing demand for oil.。

Third, this week's financial market turmoil, all kinds of assets generally downward, market sentiment is more pessimistic, but also further increased investors bearish oil prices after the market expectations.。Greg Michalowski, currency analyst and director of client education at ForexLive, a well-known foreign exchange information website, said that the highest price of U.S. oil reached $75 yesterday.。The lowest price is 72.66美元。The lowest price in November was 72.22 USD。If it falls below that price, the bearish bias will increase。

He also said that last week, WTI crude oil prices soared to 79.56美元。This brings the price above 50% of the full-year 2023 trading range, or 79.30美元。However, the momentum quickly waned, with WTI crude not only falling below the 50% retracement level, but also falling below 78.$05 200-day moving average。The subsequent downward trend also fell below the full-year 2023 trading range of 61.8% retracement 75.$59 - This level is now the upside target (and risk level) for sellers looking for more downside momentum。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.