Japan May "core-core" inflation weak July rate hike basically hopeless

But at least for now, the Bank of Japan has not found evidence that it can raise interest rates with an iron heart.

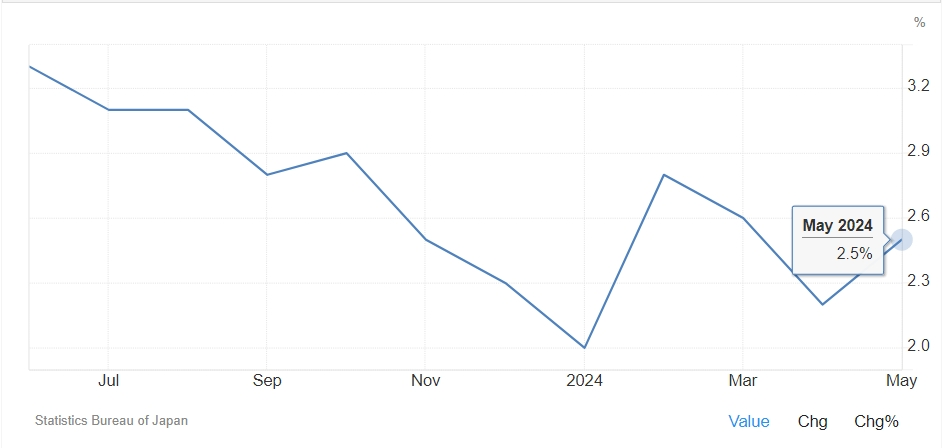

On June 21, according to Japanese authorities, Japan's overall CPI in May rose by 2.8% year-on-year due to the impact of energy taxes, higher than the previous value of 2.5%. The core CPI, excluding fresh food, increased by 2.5% year-on-year, up from 2.2% previously, with market expectations at 2.6%.

When both energy and fresh food are excluded, the “core-core” inflation closely watched by the Bank of Japan was only 2.1%, roughly in line with the 2% inflation target.

The data shows that due to the Japanese government's increase in renewable energy-related taxes, energy items significantly impacted Japan's CPI rise in May. Energy prices in Japan rose by 7.2% in May, with electricity prices surging by 14.7%.

Food prices in May rose by 3.2%, although this was slower than the previous value of 3.5%, the increase in food prices still outpaced the wage growth of Japanese households, which could pressure household consumption levels.

Service prices in Japan rose by 1.6% in May, slightly down from 1.7% in April.

Analysts say that although core inflation has reached or exceeded the Bank of Japan's 2% inflation target for the 26th consecutive month, the surge in energy prices in May cannot be ignored. Additionally, the Bank of Japan has consistently argued that the significant wage increases agreed upon during this spring's wage negotiations will eventually boost service sector inflation, but there is little evidence of this happening so far. The Bank of Japan's rate hike may not be imminent.

As a result, after the data was released, the yen fell to its lowest level against the dollar in nearly 34 years during the early Asian trading session. So far, the yen has recorded its longest losing streak since March, increasing the risk of intervention by the Bank of Japan. Public data shows that over the past two months, the Japanese Ministry of Finance has spent approximately $62.7 billion to intervene in the yen's value, easing the depreciation pressure on the yen.

Currently, although the Bank of Japan ended its negative interest rate and YCC policy in March 2024, the bond-buying process has not stopped. This massive bond-buying by the Bank of Japan can effectively raise bond prices, thereby lowering long-term interest rates and achieving quantitative easing. On one hand, this large-scale stimulus policy helps heat the economy, keeping Japan's inflation rate stable above the 2% target. On the other hand, this level of "flooding" also affects the yen's value, leading to a depreciation of the exchange rate.

Therefore, to stabilize the currency value, the Bank of Japan stated at the latest monetary policy meeting that it would decide on the detailed plan to reduce bond purchases at the next meeting, with a significant scale expected. Japanese Finance Minister Shunichi Suzuki said that future policymakers would continue to monitor exchange rate trends, but interventions should be limited. Bank of Japan Governor Kazuo Ueda's view is more "aggressive," stating that as long as the data supports it, a rate hike in July is "certainly" possible.

Many economists expect the Bank of Japan to raise rates to 0.25% this year, but it is uncertain whether this will happen in July or later this year. The Bank of Japan has hinted that it will raise rates to a "neutral level" this year, which will neither overheat nor cool the economy. Analysts believe this neutral rate could be between 1-2%.

But at least for now, the Bank of Japan has yet to find the evidence to firmly support a rate hike.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.