日元兑美元、欧元、英镑等货币的市场情绪分析

当前,交易员仍对日元兑一系列其他货币持空头态度。

最新市场情绪分析

- 美元/日元(USD/JPY)-前景喜忧参半

- 欧元/日元(EUR/JPY)-牛市相反的偏向

- 英镑/日元(GBP/JPY)-牛市相反的偏向

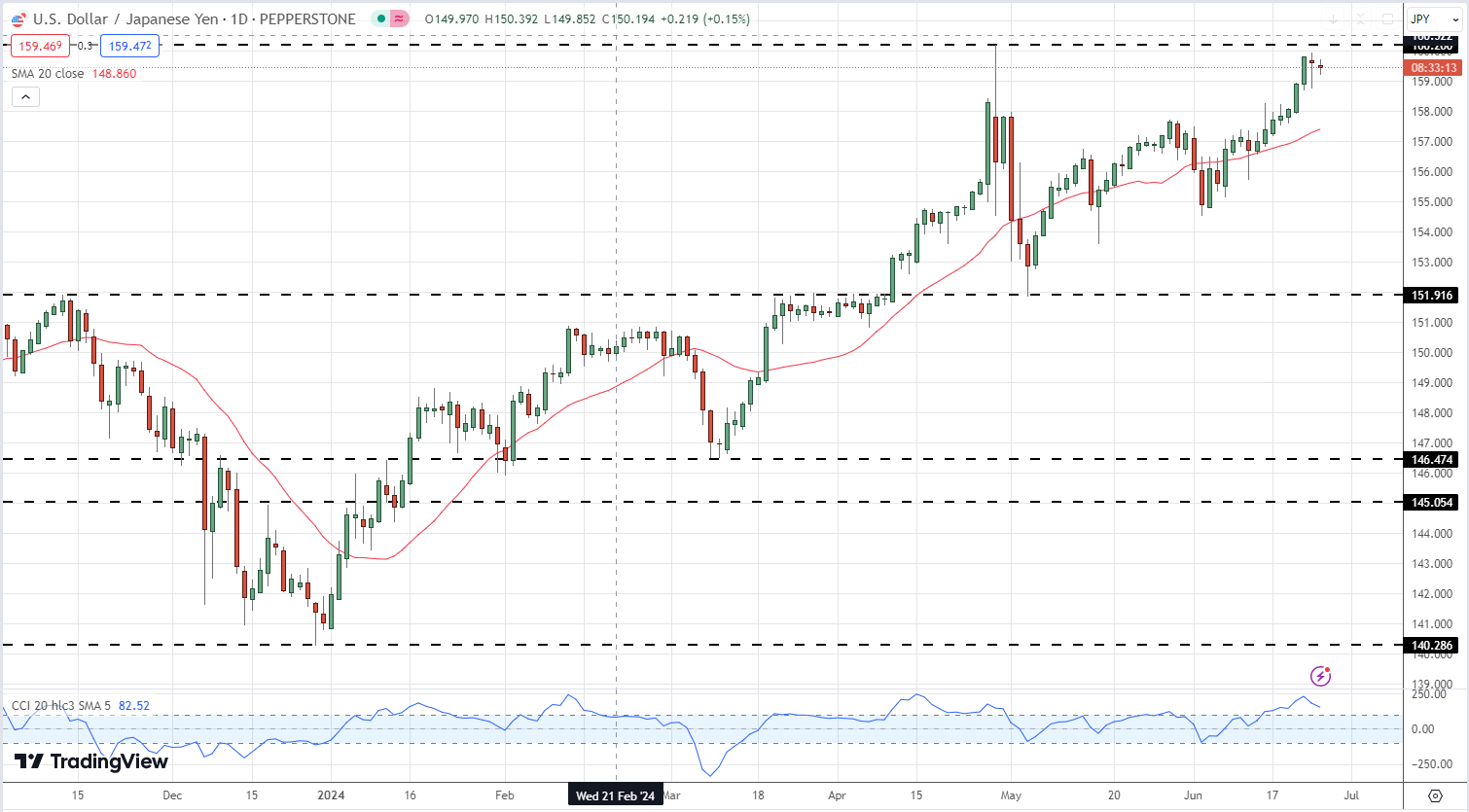

美元/日元

最新交易员数据显示,美元/日元市场分化明显,只有16.98%的交易员保持净多头头寸。这就形成了4.89比1的显著的长短比。自昨日以来,净多头交易者增加了1.36%,但本周减少了10.94%。净空头交易者每日增长0.51%,每周增长22.33%。

反向分析表明,美元/日元汇率将持续上涨。然而,当前定位的动态性质使情况复杂化,导致美元/日元交易前景喜忧参半。

美元/日元日线价格图

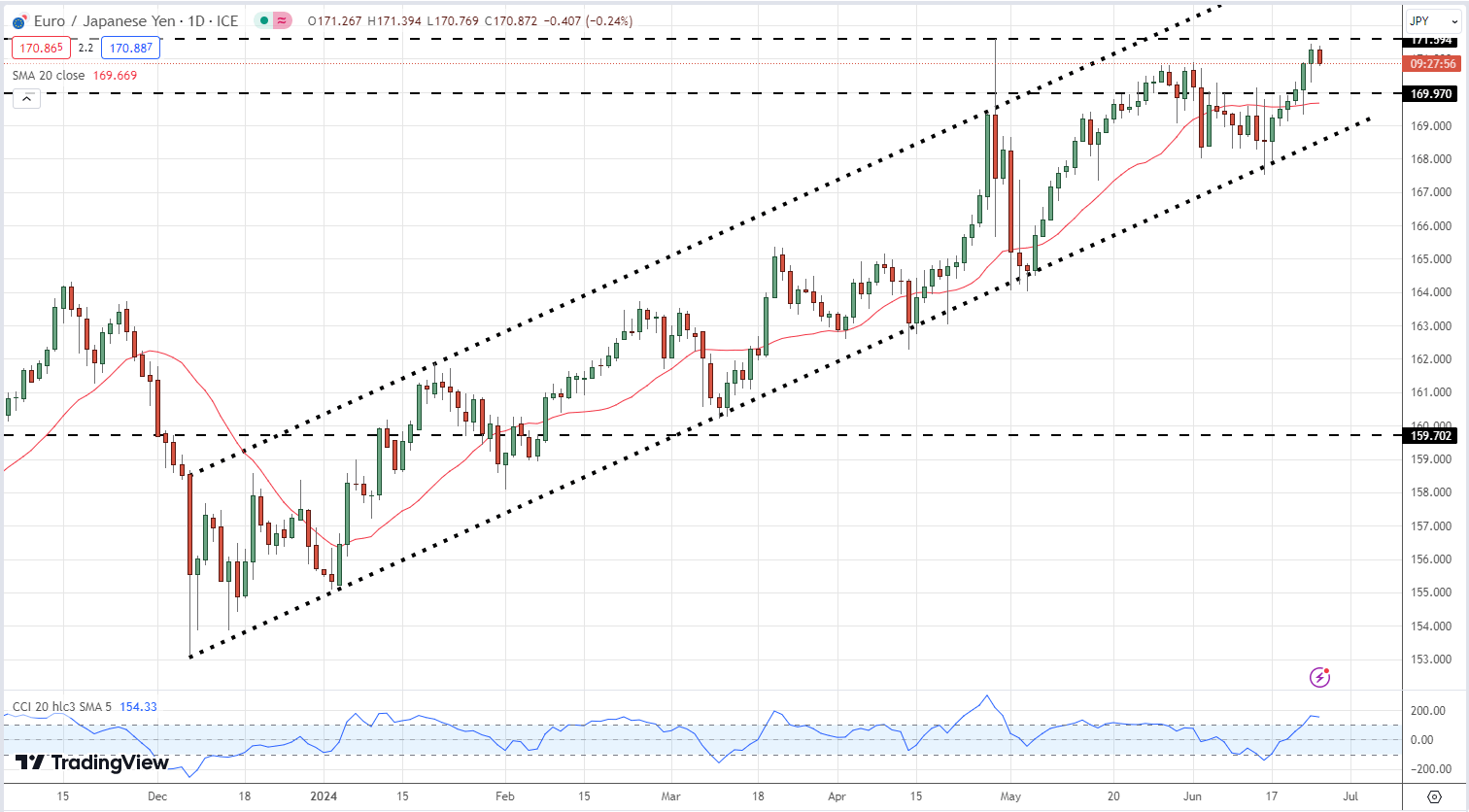

欧元/日元

最新数据显示,欧元/日元零售交易员头寸发生明显变化。只有16.49%的交易员持有净多头头寸,因此空头与多头的比例为5.07比1。自昨日以来,净多头交易者减少了13.75%,本周减少了31.34%。与此同时,净空头交易者每日增长8.20%,每周增长19.90%。

我们对大众情绪的反向看法指向欧元/日元价格的潜在上涨。不断加强的净空头头寸强化了我们对欧元/日元的乐观展望,表明存在强烈的反向交易倾向。

欧元/日元日线价格图

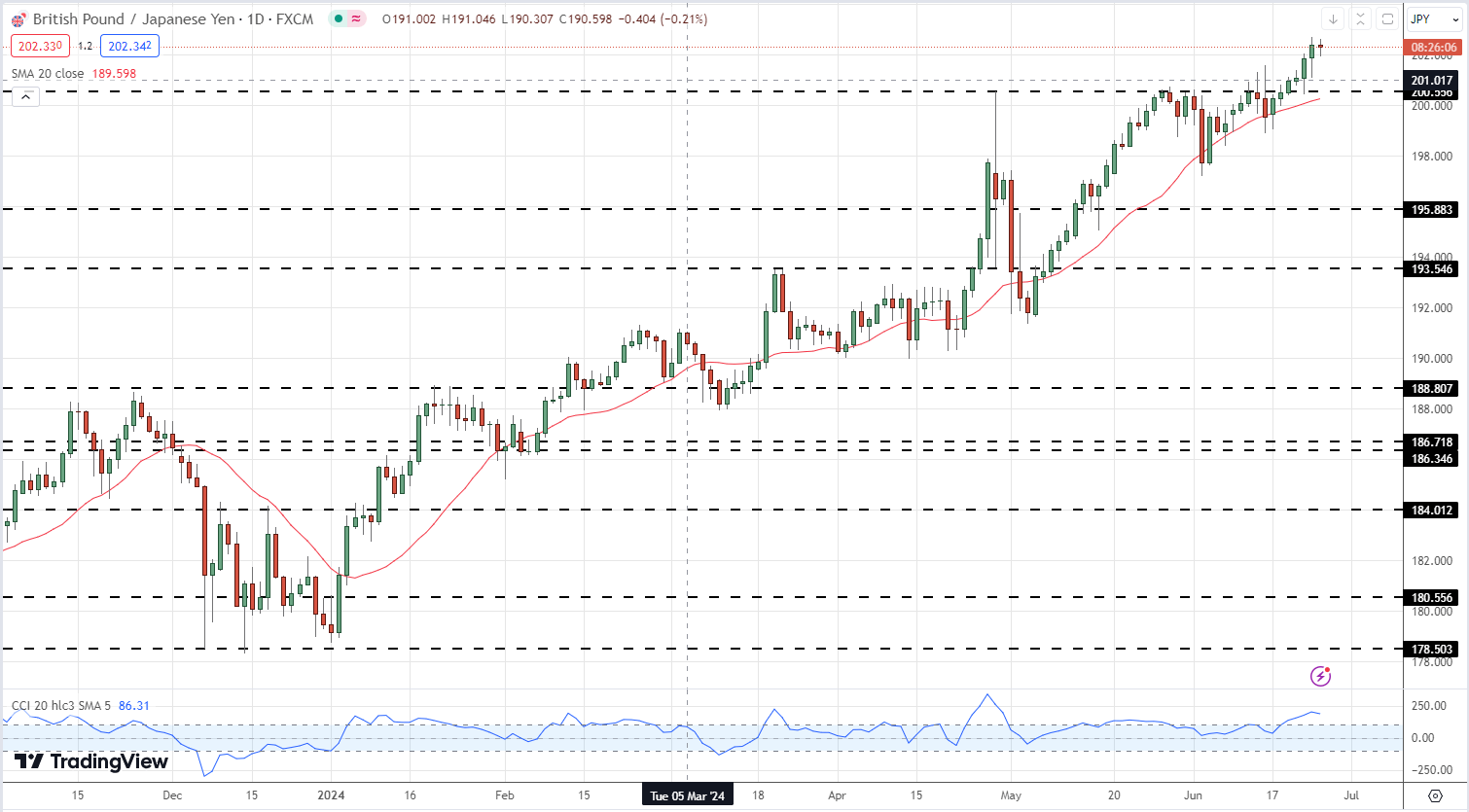

英镑/日元

零售交易员数据显示,22.28%的交易员净做多,做空与做多的比例为3.49比1。净做多的交易员数量比昨天减少3.95%,比上周减少10.99%,而净做空的交易员数量则比昨天增加2.60%,比上周增加15.82%。

交易员净做空的事实表明英镑/日元价格可能会继续上涨。交易员比昨天和上周进一步净做空,当前情绪和近期变化的结合使我们对英镑/日元的反向交易偏好更加乐观。

英镑/日元日线价格图

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.