Meituan announces: Shen Nanpeng resigns as non-executive director

Meituan mentioned in the announcement that after the annual shareholders meeting, due to other work arrangements, Shen Nanpeng resigned as a non-executive director.

On June 14th, Meituan released a statement regarding the voting results of the annual shareholders meeting and the resignation of non-executive directors. According to the announcement, after the annual shareholders' meeting, due to other work arrangements, Shen Nanpeng resigned as a non-executive director.

In the announcement, the board of directors of Meituan expressed gratitude to Shen Nanpeng for his valuable contributions to the company during his tenure.

Public information shows that Shen Nanpeng is the founder and partner of Sequoia Capital China Fund, as well as the founder of Ctrip Travel and Home Inn.

In June last year, the globally renowned venture capital fund Sequoia Capital stated that due to its leading market positions in various regions, Sequoia chose to fully embrace localization strategies and divide its global business into three parts: Sequoia USA/Europe, Sequoia China(HongShan China), and Sequoia India/Southeast Asia. After the split, Shen Nanpeng continued to serve as the person in charge of HongShan China.

In the past decade or so,Sequoia China has seized on China's Internet and invested in hundreds of Internet technology enterprises. Behind Meituan, ByteDance, Pinduoduo and other famous enterprises, Shen Nanpeng's investment traces are left.

In 2006, HongShan China was still Sequoia Capital at that time, serving as its sole investor in the A-round financing of Dazhong Dianping. In 2010, Sequoia Capital became the A-round investor of Meituan, also the only investor. In the subsequent rounds of investment by Meituan, the presence of Sequoia China can also be seen.

In 2015, Meituan and Dazhong Dianping announced a joint statement, officially announcing a strategic partnership to jointly establish a new company.

Later, Shen Nanpeng held approximately 570 million B-class shares of Meituan through Sequoia Capital China Funds and Sequoia Capital Global Growth Funds, and began serving as a non-executive director of Meituan in October 2015.

In 2018, Meituan landed on the Hong Kong Stock Exchange. At that time, Sequoia China's shareholding in Meituan reached 12.05%. When Meituan went public, Sequoia Capital's shareholding ratio was 12.05%. However, in recent years, Sequoia Capital has significantly reduced its shareholding ratio by repeatedly selling Meituan shares or distributing shares to LPs.

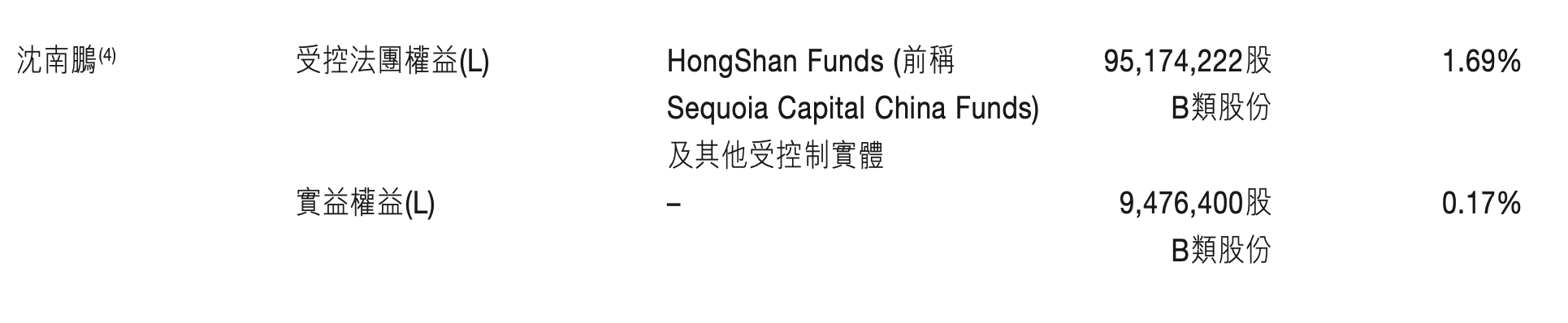

According to supplementary information from the Hong Kong Stock Exchange, the reduction of shares is related to the fund entities controlled by Shen Nanpeng, and several funds under Sequoia China led by him and Shen Nanpeng are considered to hold such equity interests.

According to Meituan's 2023 annual report, Shen Nanpeng, through HongShan Funds and other controlled entities, held 1.69% of Meituan's Class B shares and a beneficial interest of 0.17% at the end of 2023.

This time, Shen Nanpeng's resignation as a non-executive director of Meituan's board of directors can be considered as a formal farewell to Meituan. Over the past decade of companionship, Meituan has grown into a mature enterprise. Perhaps, as a well-known philosophy in Sequoia Investment states - "The best investment is the next investment," HongShan China will continue to explore startups with growth potential.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.