In the snow! Abu Dhabi has $2.2 billion in money!

On December 18, Weilai announced that it had worked with CYVN Holdings L..L.C entered into a share subscription agreement through its affiliate CYVN Investments RSC Ltd。Under the share subscription agreement, CYVN will invest a total of $2.2 billion in cash.。

Weilai has received another capital injection from the Middle East "gold owner."。

CYVN to Weilai second capital injection

On December 18, Weilai announced that it had worked with CYVN Holdings L..L.C entered into a share subscription agreement through its affiliate CYVN Investments RSC Ltd ("CYVN")。Under the share subscription agreement, CYVN will invest a total of $2.2 billion in cash at 7 per share..$50 purchase price Subscription 2.9.4 billion new Class A ordinary shares issued by the Company。

Delivery of the transaction is expected to take place in the last week of December.。

This is the second time NIO has received an investment from CYVN.。In July this year, Weilai received 7 from CYVN..$400 million strategic equity investment。In addition, CYVN purchased a number of Class A common shares of Weilai from an affiliate of Tencent, valued at 3.500 million dollars。In other words, CYVN has smashed in about $3.3 billion in real money.。

After the completion of the latest round of $2.2 billion capital injection, CYVN will hold the Weilai 4.1.9bn shares outstanding, stake down to 20.1%, CYVN will also become Weilai's largest single shareholder。

According to the NIO announcement, the Company's share capital consists of Class A common stock and Class C common stock。Holders of Class A ordinary shares may cast 1 vote per share and holders of Class C ordinary shares may cast 8 votes per share on any resolution submitted to the general meeting.。CYVN's holdings are all Class A common shares, while Weilai's Chairman and CEO Li Bin's holdings are all Class C common shares。According to last year's annual report, as of the end of 2022, Li Bin held the Weilai 10.5% of the shares, corresponding to 44.2% of voting rights。This also means that the actual controller of Wei Lai is still Li Bin.。

At the time of the closing of this transaction, CYVN will have the right to nominate two directors to the Board of Directors of NIO, provided that it continues to have actual ownership of not less than 15% of NIO's outstanding share capital.。If CYVN actually owns less than 15% but more than 5% of the outstanding share capital, it will have the right to nominate a director to the Board of Directors。

CYVN Holdings is an Abu Dhabi-based investment firm focused on advanced, intelligent mobility.。CYVN Holdings aims to create an intelligent mobility platform by investing in and partnering with industry leaders around the world。

Regarding the additional investment, Jassem Al Zaabi, Chairman and Managing Director of CYVN Holdings, said: "Our increased investment in NIO is in line with our strategy to continue to build a globally leading portfolio in the mobility sector.。This investment demonstrates our confidence in NIO's unique positioning and competitiveness in the global smart electric vehicle industry.。We are pleased to be a long-term strategic partner of NIO and support its efforts in product innovation, technological breakthroughs and international market expansion.。"

NIO said that after the latest round of investment transactions, the company and CYVN and its affiliates will continue to work together to seek strategic and technical cooperation in the international market.。

"We are deeply inspired by CYVN's vision to accelerate the global transition to a more sustainable future and are grateful to CYVN for its recognition of NIO's unique values.。With the strengthening of the balance sheet, Weilai has been fully prepared to strengthen its brand positioning, enhance sales and service capabilities, and make long-term investment in core technologies to cope with the increasingly fierce competitive landscape, while continuously improving execution efficiency and systematization capabilities.。We firmly believe that NIO will further strengthen its leading position in the transformation of the automotive industry.。"

Recently, Weilai has received nearly 4 billion US dollars of funds from outside.

It is worth noting that since the second half of this year, Weilai has obtained nearly $4 billion in funds through external capital injections and debt financing, which translates into about 28.5 billion yuan.。

Earlier, on the day it announced that it had received a $700 million capital injection from CYVN and issued $1 billion in senior debt, its shares fell about 4 percent.。Investors have questioned its frequent short-term fundraising, suspecting that NIO's liquidity is in trouble。

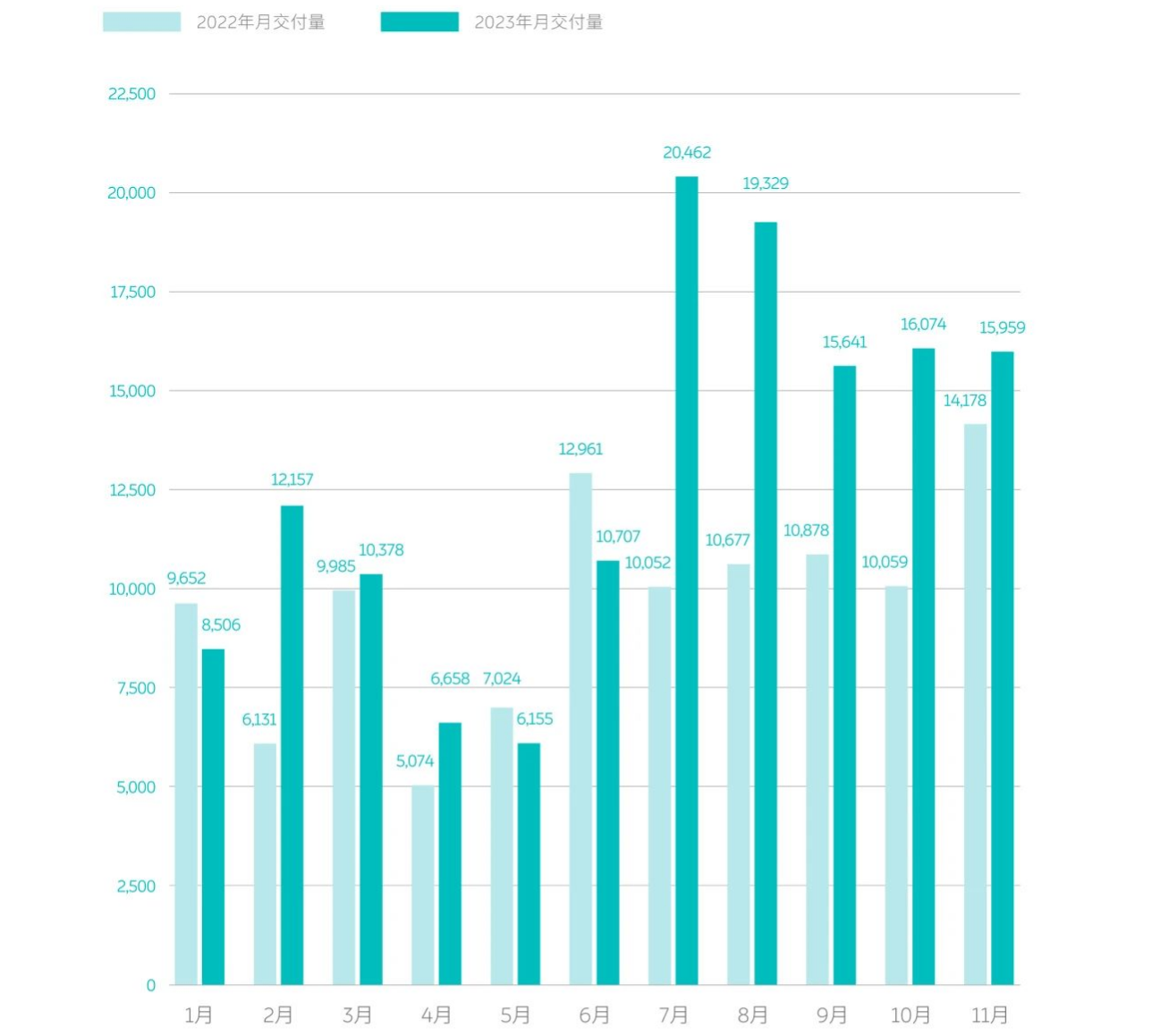

The appearance of this questioning voice is not unexpected。Since the beginning of this year, NIO's electric vehicle delivery data has been quite unstable。After sluggish sales in the first half of the year, the third quarter suddenly surged, with monthly deliveries doubling directly above the 20,000 mark in July.。But then there was a weak growth trend, with deliveries in the last three months largely between 15,000-16,000 vehicles, in sharp contrast to the apparent growth momentum of Ideal Xiaopeng and others.。

In addition, the deterioration of Weilai's financial situation in the first half of this year is also an important reason for the company to start multiple fundraising in the second half of the year.。

In the first two quarters of this year, Weilai's revenue declined.。First Quarter Revenue Down 0.2%, down 33.5%; further decline in the second quarter, revenue fell 24.9%, down 22.1%。In terms of net loss, a net loss of 47 was recorded in the first quarter..400 million yuan (RMB, the same below), further expanded to 60 in the second quarter..5.6 billion yuan。Profit margins are also lit up the "red light," the first half of this year, the two quarters, the gross profit margin of 1.5% and 1%, compared to 14.6% and 13%。In other words, one year, Weilai's gross margin fell directly from double digits to nearly zero.。This "dangerous" financial situation also pushes the company to look outside for financing.。

However, unlike the stock price that fell when it first received a capital injection from CYVN and issued senior debt, the stock price did rise when it received a second capital injection from CYVN.。On December 19, the Weilai-SW Hong Kong stock market opened up nearly 6%, and as of press time, gains narrowed to 4.96% at 64.HK $5。

The market reacted differently because Weilai's finances had already picked up considerably in the third quarter。

In the third quarter, Weilai's revenue reached 190.6.7 billion yuan, up 46.6%, up 117.4%, a record high。Net loss of 45.5.7 billion yuan, although the year-on-year expansion of 10.8%, but narrowed 24% month-on-month..8%。Group gross margins also rebounded sharply from the previous year, up 700 basis points to 8 per cent from the previous year, although from 13 per cent in the same period last year..3% still have distance。

In the third quarter, NIO's cash flow position also improved significantly。As of September 30, 2023, the Company's cash and cash equivalents, restricted cash, short-term investments and long-term term deposits amounted to $45.2 billion。That compares with 31.5 billion yuan and 37.8 billion yuan in the first two quarters of this year.。

In the event of a pickup in performance, even after receiving a new infusion of funds, the market is much less skeptical of the company's liquidity position。In addition, outsiders have speculated that the fact that Weilai received such a huge sum of money this time is likely related to its decision to build the car independently.。

Recently, Weilai and Jianghuai Automobile Group announced the "break up."。According to the agreement between the two parties, Weilai will acquire production equipment and assets from two manufacturing bases from Jianghuai Automobile Group for a total price of approximately 31.600 million yuan。The news was widely interpreted as Weilai about to say goodbye to the foundry model and build its own car.。

But at that time, the market for the large-scale acquisition of Jianghuai Automobile Group's assets or some concerns, after all, for the still loss-making Weilai, all of a sudden to take out the funds is still more difficult.。But now with the support of external funds, the financial pressure on Wei Lai's head is suddenly much less。I believe that with the support of this fund, the road to independent car building will be smoother.。Once NIO can take the road out of building its own cars, its car costs are expected to fall further by then.。

However, these are currently speculation and Weilai did not mention the use of the funds in the announcement.。"Money bag" bulging Weilai will be how to stir the new energy automotive industry, let us wait and see。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.