Naifei 2023Q4 Performance Exceeds Expectations Paying Users Growth Largest Since Epidemic

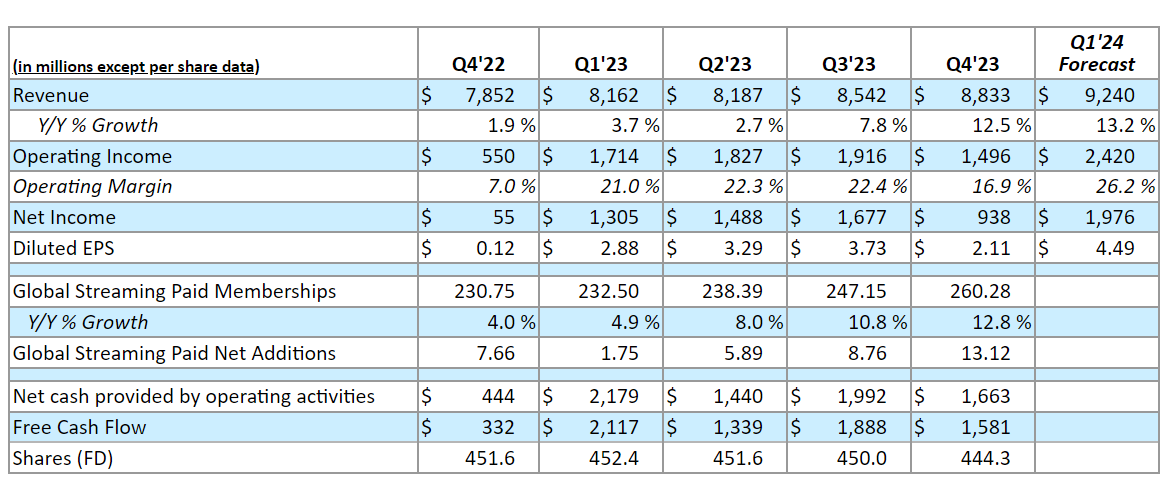

Naifei's revenue in the fourth quarter of last year was 88.$3.3 billion, up 12.5%, exceeding Wall Street expectations of 87.100 million dollars。Full-year revenue growth of 12%, up from 6% in 2022。

On January 23, local time, streaming giant Netflix (hereinafter referred to as "Netflix") announced its fourth quarter 2023 results.。

In terms of earnings metrics, Nafei's operating profit for the fourth quarter was 14.$9.6 billion, operating margin of 16.9%, with a full-year operating margin of 21% for 2023, exceeding the company's target of 20%。Net profit is 9.$3.8 billion, and its net profit for the full year 2023 reached 54.100 million dollars。Diluted EPS of 2.11, below consensus expectations of 2.$20, 0 last year.$12。

In the fourth quarter, Netflix's free cash flow was 15.$800 million, higher than market consensus of 12.600 million dollars, far more than 3 in the same period last year..$3.2 billion。Affected by last year's wave of Hollywood strikes, the company's full-year free cash flow increased to $6.9 billion in 2023, up from Netflix's previous guidance of $6.5 billion.。

Nafei shares surged more than 8% after hours in U.S. stocks, led by strong results。

In 2023, Netflix's shares rose 65% in total, compared with 26% for the S & P 500 and 45% for the Nasdaq.。

Global paid subscribers reached 2.600 million

In the earnings report, the biggest surprise to the outside world is that Naifei's user growth greatly exceeded expectations.。Driven by a number of popular movies and TV dramas, Nafei added 13.12 million new paying subscribers in the fourth quarter, well above the forecast of 8.91 million, the largest increase since the outbreak.。So far, the total number of Netflix's global streaming subscribers has reached 2.600 million, higher than the market forecast of 2.5.6 billion。

In the fourth quarter, Netflix's average revenue per member (ARM) grew 1% year-over-year, in line with the company's "essentially flat year-over-year" forecast.。Wall Street analysts expect ARM to pick up later this year as the advertising-level impact and price increase effects become apparent。

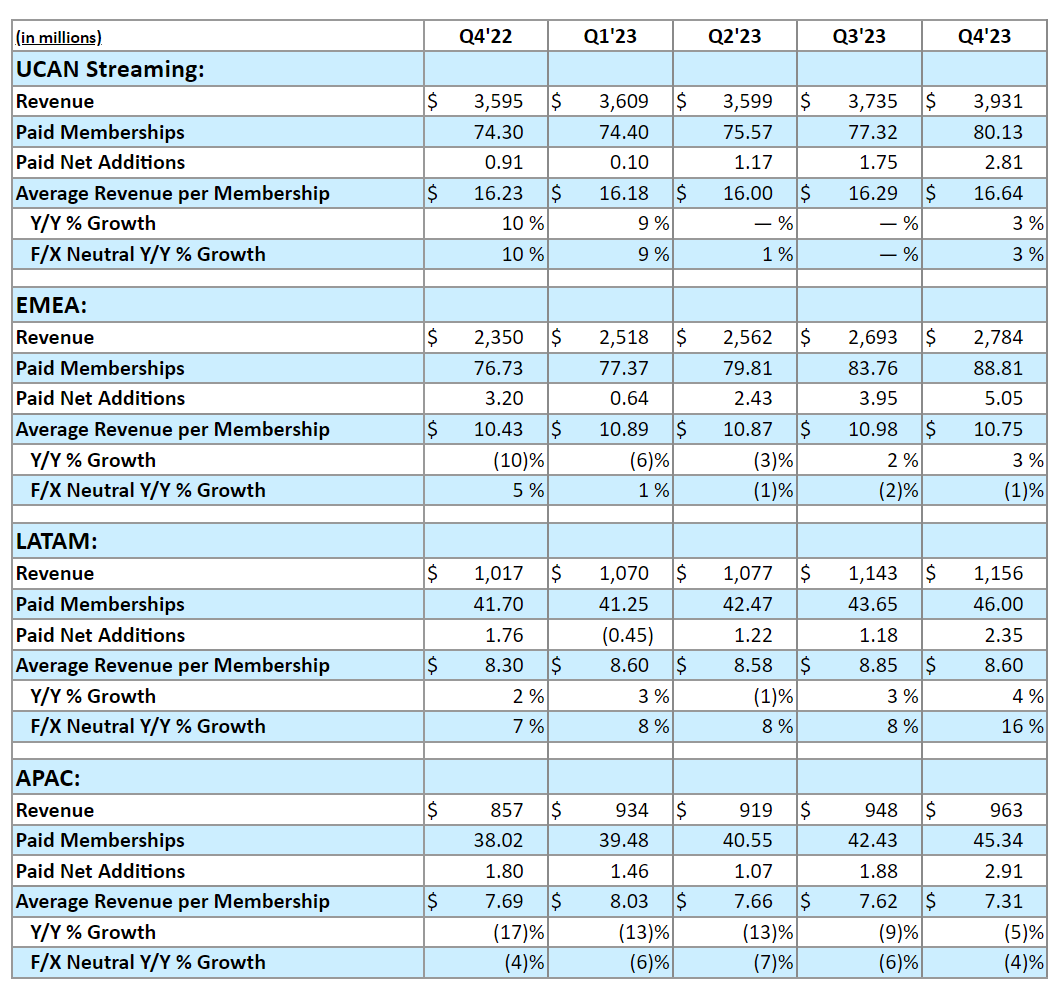

By region, the United States and Canada (UCAN) remains the base camp of Naifei。In the fourth quarter, Netflix's revenue at UCAN was 39.$3.1 billion, or 44% of total revenue.5%。Streaming media paying subscribers in UCAN region increased by 2.81 million, higher than expected net increase of 1.76 million。In the Europe, Middle East and Africa (EMEA) region, Netflix generated revenue in the fourth quarter 27.$8.4 billion, 5.05 million new users。In the Latin America (LATAM) region, Nafei's fourth-quarter revenue was 11.$5.6 billion, 2.35 million new users。In the Asia-Pacific (APAC) region, Netflix posted a net increase of 2.91 million streaming subscribers in the fourth quarter, beating analysts' expectations of an increase of 2.08 million on revenue of 9.$6.3 billion。

Netflix: Account sharing issue has been successfully resolved

On the advertising side, thanks to product improvements and the phasing out of basic plans for new and rejoining members in the advertising market, Netflix had 23 million advertising members in the fourth quarter, an increase of about 8 million over the previous quarter and a 70% increase in revenue from the previous quarter.。Netflix co-CEO Greg Peters said on the earnings call that the number is expected to continue to grow in the coming quarters.。He also said, "We still have many years of work to do before the advertising business has a significant impact on our overall business.。"

In terms of account sharing, Naifei said it believes it has successfully solved the account sharing problem。It is understood that if users want to share their accounts with others, they will need to pay an additional 7 per month on top of the regular subscription fee..99美元。Naifei believes that this "paid sharing" has been accepted by more and more users, and now there has been a large number of "paid sharing" needs in the market, which is the next business focus of Naifei.。

In terms of gaming, Netflix said that while its gaming products are still in the early stages, user engagement tripled year-on-year in 2023。Although the game is still small and "insignificant" relative to its film and television drama business, the company is "pleased" with the progress of the game business.。For example, in the fourth quarter, Netflix launched Rockstar Games' Grand Theft Auto trilogy.。In terms of installations and engagement, this has become Netflix's most successful gaming product to date。Naifei said some consumers apparently "signed up just to play these games."。"

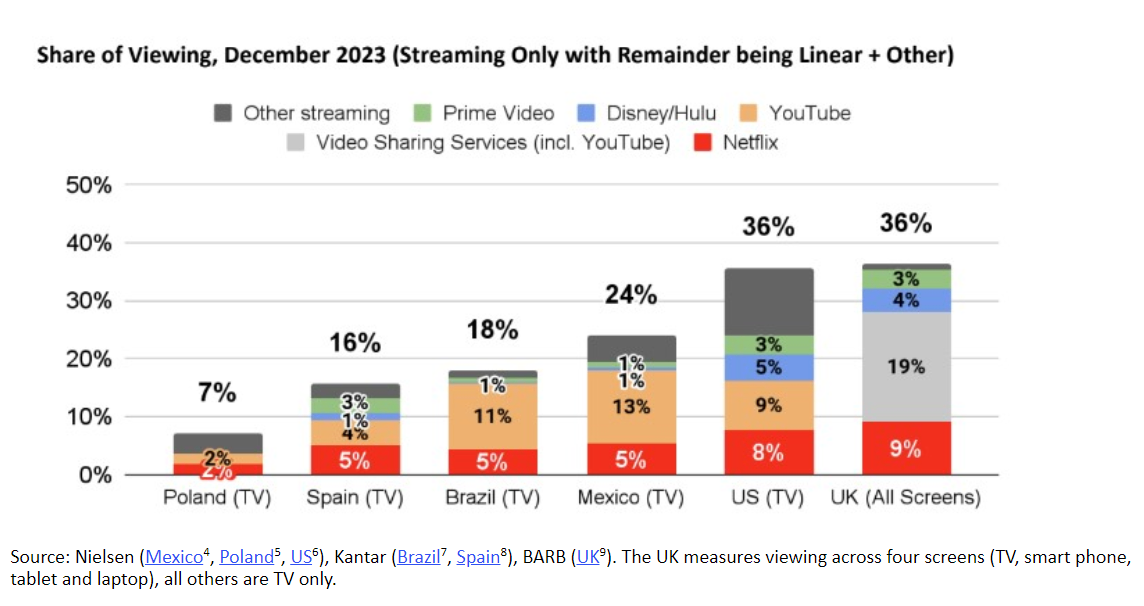

In terms of streaming viewing share, according to third-party data, in December 2023, Netflix's market share reached 9% in the UK, 8% in the US, and 5% in Mexico, Brazil and Spain.。

Continue to bet on the live field

Naifei mentioned in its earnings report that the company will continue to invest and experiment with live shows, such as the upcoming American Actors Guild Awards (SAG Awards).。And in many live tracks, Naifei will focus on sports.。

Just before the earnings release, Netflix and WWE's parent company, TKO Group Holdings, announced a partnership and signed an agreement。Under the agreement, Netflix will bring WWE's flagship show Raw (a live wrestling production) to the streaming service from January 2025.。In the United States, Canada, the United Kingdom and Latin America and other places, Naifei will enjoy the exclusive rights of "Raw," and the subsequent internal flight will take more exclusive rights to the region。

The 10-year deal, worth $5 billion, is Nafei's first foray into live sports and entertainment.。Ted Sarandos, co-CEO of Netflix, said on a conference call for fourth-quarter earnings: "Raw is a sports entertainment show, which is the best entry point for our sports business.。Sarandos, meanwhile, said the plan does not change the company's overall sports strategy.。

Raw, which airs every Monday, is a long-established WWE show that has aired more than 1,600 episodes since its premiere in 1993, making it the longest-lived professional sports TV show in North America.。

In sports, the company has also previously been involved in live sports events.。First launched on November 14 last year, the "Nafi Cup," a celebrity golf tournament featuring athletes from "Formula 1: Drive to Survive" and "Full Swing"。The Wynn Gold Club in Las Vegas also broadcast the event live.。

But Wall Street analysts and industry watchers predict Naifei could eventually be forced to dive full steam into the sports business, which they describe as a last resort for streaming amid deteriorating cable TV bundles.。

In a June report, Morgan Stanley said: "Ultimately, we expect Netflix to move into live sports broadcasting, particularly because of its growing scale in free cash flow generation and its ability to invest in the rights to major sporting events around the world.。"In addition, as its advertising capabilities expand, we believe that live sports will fit well into Netflix's content offerings."。"

Outlook for the New Year

After a good quarter, Naifei's outlook for the first quarter of 2024 is also more optimistic.。Netflix expects revenue to reach 92.$400 million, up 16% year-over-year, and the market generally expected 92.$800 million roughly flat。and expects earnings per share for the first quarter of the year to be 4.$49, higher than the consensus estimate of 4.09 USD。

Looking ahead to the new year, Netflix expects healthy double-digit revenue growth for the full year。

Netflix also mentioned that the advertising business is expected to show strong growth in 2024, but due to the small base, the business has not yet become the main driver of overall revenue growth。The company's goal is to make advertising a better source of revenue and help achieve sustained and healthy revenue growth in 2025 and beyond.。

In addition, Netflix has raised its full-year operating margin forecast for 2024 from 22% -23% to 24%.。Netflix believes the adjustment reflects stronger-than-expected fourth-quarter 2023 results, the weakness of the dollar against most other currencies since October and the company's expectations for 2024 results.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.