RBA February 2024 interest rate resolution: keeping interest rates unchanged does not rule out further rate hikes

RBA announces policy rate at 12-year high 4.35% unchanged, in line with market expectations, and suggests that a further slowdown in inflation will raise the threshold for further rate hikes, but does not rule out the possibility of further rate hikes。

On February 6, local time, the last central bank of Super Central Bank Week, the RBA, announced its first interest rate decision since the reform of the communication system.。According to the results, the RBA announced that it would keep the policy rate at a 12-year high 4.35% unchanged, in line with market expectations, and suggests that a further slowdown in inflation will raise the threshold for further rate hikes, but does not rule out the possibility of further rate hikes。This is the first interest rate decision since the RBA announced the reform of the communication system.

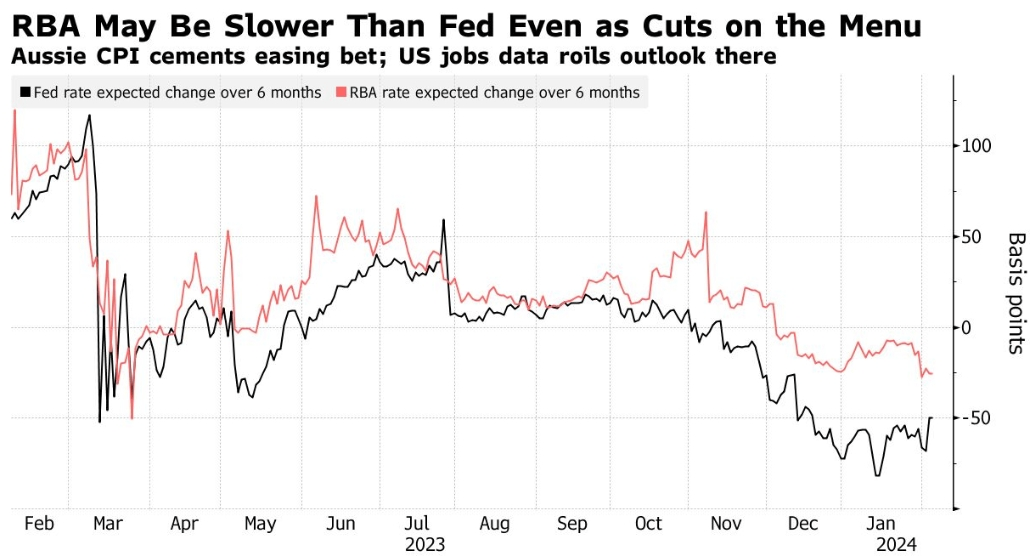

After the announcement of the resolution, the Australian dollar rose 0.5%, to 1 AUD 65.17 cents, while the yield on the policy-sensitive Australian 3-year bond rose 4 basis points to 3.72% as traders cut their bets on rate cuts。Traders also see the likelihood of a June rate cut falling to about 40 percent from about 50 percent previously, the data showed.

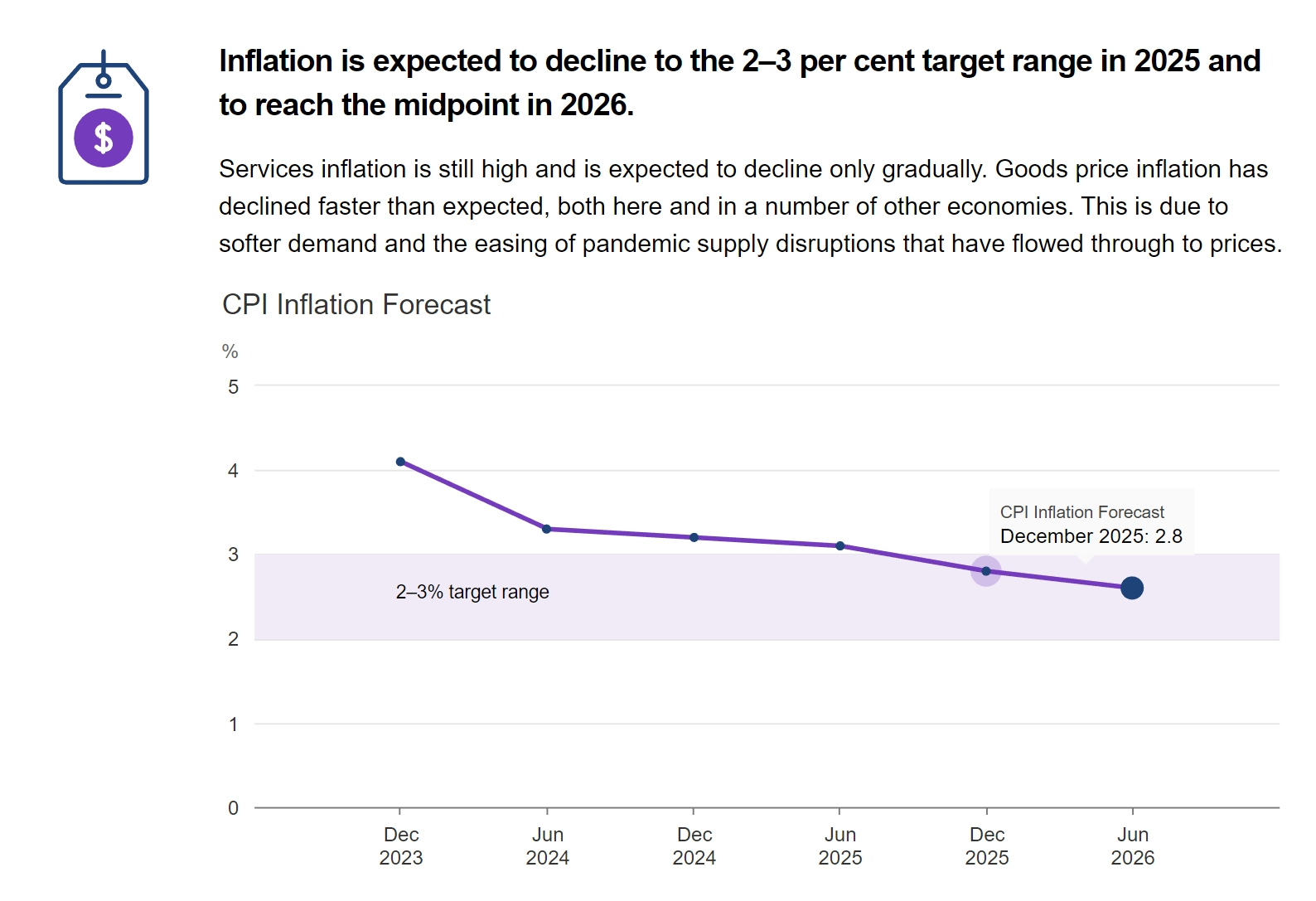

The RBA also released quarterly forecasts showing that inflation will only reach the midpoint of the 2-3% target range in 2026, a measure of 4 in the last three months of 2023..2%.

Inflation continues to slow, but remains high

In rate decision announcement, RBA says inflation continued to slow in December quarter。Despite these advances, inflation remains as high as 4.1%。Commodity price inflation below RBA's November forecast。Inflation continued to ease, reflecting earlier resolution of global supply chain disruptions and slowing domestic demand for goods.。However, service price inflation fell at a much slower pace, in line with the RBA's earlier forecast, and remains high.。This is consistent with the economy's continued excess demand and strong domestic cost pressures in terms of labor and non-labor inputs.

The RBA says higher interest rates are working to create a more sustainable balance between aggregate demand and supply in the economy.As a result, conditions in the labour market continue to ease gradually, although they remain tighter than those needed to sustain full employment and target inflation.。Wage growth picked up, but is not expected to rise significantly further and in line with the inflation target, provided productivity growth rises to near the long-term average.Inflation is still affecting people's real incomes, household consumption growth is weak, and so is residential investment.

Outlook remains highly uncertain

For the future economic outlook, the RBA believes that despite the encouraging signs, there is still uncertainty about the economic outlook and the committee remains highly concerned about inflation risks.。Inflation is expected to return to the 2-3% target range in 2025 and to the midpoint of the target range in 2026.Service price inflation is expected to gradually decline as demand slows and labor and non-labor cost growth slows.。Employment is expected to continue to grow moderately, and the unemployment rate and the broader underutilization rate are expected to rise further.

The RBA stressed that despite favourable signs of foreign commodity price inflation, service price inflation persists and the same is likely to happen in Australia。Asia's economic outlook and the impact of the conflicts in Ukraine and the Middle East remain highly uncertain。Domestically, there is uncertainty about the lag in the effectiveness of monetary policy and how companies will respond to pricing decisions and wages as economic growth slows amid excess demand and a still tight labor market.The outlook for household consumption also remains uncertain.

Getting inflation back on target is a priority

The RBA believes that returning inflation to target levels within a reasonable period of time remains the Committee's top priority.This is in line with the RBA's mission to maintain price stability and full employment.The Committee needs to be confident that inflation continues to move towards the target range.It is important that medium-term inflation expectations are consistent with the inflation target so far.

The RBA went on to say that while recent data suggest inflation is slowing, it remains high.The Committee expects it will take some time for inflation to remain within the target range.The path of interest rates that best ensures inflation returns to target within a reasonable time will depend on data and changing risk assessments, and the possibility of further rate increases cannot be ruled out.The Committee will continue to closely monitor global economic developments, domestic demand trends, inflation and labour market prospects.。The Committee remains firmly determined to return inflation to its target level and will take the necessary measures to achieve it.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.