"Cheap yen" era ushered in the end of the central bank announced the lifting of negative interest rate policy.

Analysts also said that the Bank of Japan's exit from negative interest rate policy is highly symbolic, but the actual impact on the economy is expected to be small.。

On March 19, local time, the Bank of Japan announced its interest rate resolution, announcing the lifting of its negative interest rate policy, raising interest rates for the first time in 17 years, setting the policy rate at 0% to 0%..1% interval。

In addition, the Bank of Japan also said that it will withdraw from a number of large-scale economic stimulus measures, including the removal of yield curve control (YCC), the cancellation of the purchase of ETFs, the cancellation of the purchase of real estate investment trusts (REITs) and so on.。Analysts say the Bank of Japan has begun to normalize its roughly 11-year-old policy of massive easing, ushering in a historic turning point in monetary policy。

"Spring fight" results out of the firm determination of the central bank to withdraw from negative interest rates.

The reason why the Bank of Japan dared to withdraw from the unprecedented "quantitative easing," mainly due to the "spring fight" (spring labor negotiations) statistics released last week significantly better than expected。Data show that in Japan's 2024 "spring fight," Japan's largest labor union Rengo won an annual wage increase of 5.28%, up from 3 in the previous year..8%, the biggest increase in 30 years。

At the macro level, the outcome of this spring fight is significant for the central bank, as the Bank of Japan has long believed that strong wage growth will be necessary for the bank to exit aggressive monetary policy.。

At the Bank of Japan policy meeting in January, the Bank of Japan Governor Kazuhiro Ueda also released the wind, saying that he will focus on the results of the March "spring fight" negotiations, if confirmed to achieve a virtuous cycle of wages - inflation, the Bank of Japan will consider changing the easing policy, including negative interest rates.。

At the end of last month, Takata, on the Bank of Japan's nine-member policy committee, said that the target of rising wages to stabilize inflation at 2% "has finally come to the stage where it is expected to be achieved."。Another member, Shunko Nakagawa, also said in a speech last week that Japan is now making real strides towards its 2 percent price stability target and can look forward to achieving a virtuous cycle of wages and prices。

In terms of inflation, according to the Ministry of Internal Affairs and Communications, Japan's national consumer price index (CPI) will be 105 in 2023..2, YoY growth 3.1%, the highest level since 1982。And according to a recent survey by Imperial Japan Database, Japan is expected to have between 10,000 and 1.50,000 kinds of food prices。This suggests that Japan's price levels have improved significantly, supported by the Bank of Japan's continued massive easing。

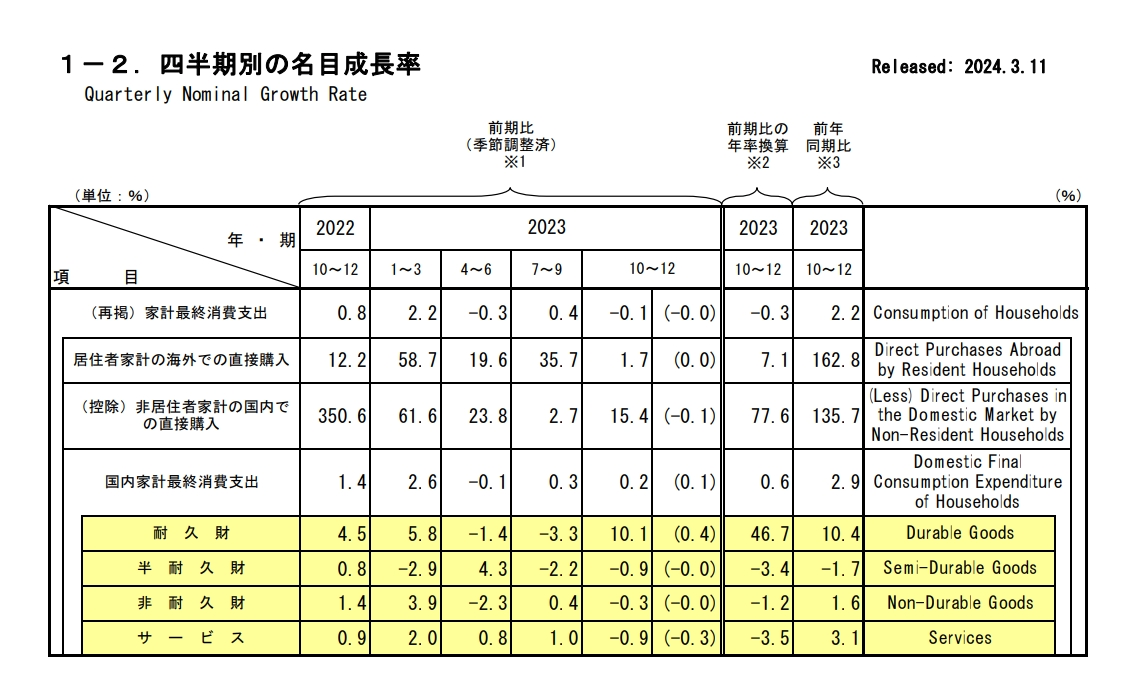

According to data released by the Cabinet Office on March 11, Japan's real GDP recorded a final annualized quarter-on-quarter value of 0 in the fourth quarter of last year..4%, compared with the initial announcement of - 0.4% major repairs。Against the backdrop of a small decline in consumption, Japan was able to temporarily emerge from a technical recession in late 2023 due to the excellent performance of the "buzzer" of capital spending.。

Expert: Limited substantial impact of negative interest rate policy exit

For this exit from the negative interest rate action, some analysts said that although the central bank raised interest rates for the first time in 17 years, but because the Japanese economy is still fragile, the central bank is expected to slow down the pace of interest rate hikes in the future, keeping interest rates near 0。

Analysts also said that the Bank of Japan's exit from negative interest rate policy is highly symbolic, but the actual impact on the economy is expected to be small.。

Xu Qiyuan, a researcher at the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, also said that the conditions for the Bank of Japan to withdraw from its negative interest rate policy are indeed maturing.。

There are at least three reasons, the first is that Japan's inflation rate has remained above 2 percent for the past two years.。This is very important to break the level of inflation that has been stagnant and even deflationary for the past 30 years.。

Second pointIt is the inflation expectations of the Japanese public that have been formed.。In the "spring fight" (spring labor negotiations), which began on March 15, the wages of Japan's largest trade union rose by more than 5%, more than 1 percentage point higher than last year's increase, so Japanese society gradually formed a wage and price spiral.。

Third pointis Japan's potential growth rate。We have seen the past two years also maintained at 1 percentage point, even 1.5 percentage points or so, that Japan's growth rate is also expected to remain above 1 percentage point this year, so these conditions together pushed Japan to allow the central bank to exit its negative interest rate policy。

Xu said it will definitely have some impact on the market, especially if it leads to downward pressure on the stock market。On the currency market, the yen may appreciate; on the bond market, government bond yields may rise。But these effects may be limited for a number of reasons, the most important of which is because we see Japan's negative interest rate policy, which covers a fairly limited range of negative interest rate deposits because it targets Japan's excess reserves。In the second half of last year, it was actually only 5 trillion yen (about $30 billion), so its impact on the market was more limited。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.