S&P 500: The Magnificent 7 Lead the Market

The S&P 500 is weighted by market capitalization, meaning that companies with larger market capitalizations have a greater impact on the index's performance.

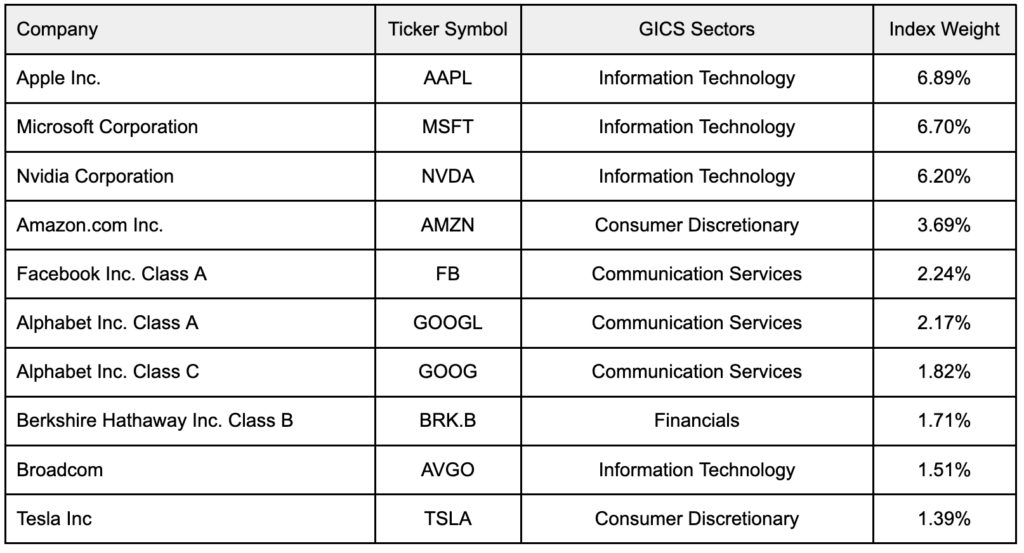

The S&P 500 is weighted by market capitalization, meaning that companies with larger market capitalizations have a greater impact on the performance of the index. So, even though the index contains 500 companies, a handful of giants dominate the entire index. Let's look at the contributors.

S&P 500 Heavyweights

Compared with Singapore's Straits Times Index (SGX: ^STI), the S&P 500 is significantly weighted towards technology companies. Stocks known as the "Big Seven" include Alphabet (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Meta (NASDAQ: META), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA) and Tesla (NASDAQ: TSLA) occupy a prominent position among the top ten contributors to the index, accounting for more than 31% of the weight of the S&P 500 Index, and have a huge influence on the index trend.

7 Tech Giants

Apple is the largest component of the S&P 500, with a market value of $3.48 trillion, followed by software giant Microsoft, with a market value of nearly $3.1 trillion. Nvidia, with a market value of more than $2.9 trillion, is next, benefiting greatly from the surge in demand driven by artificial intelligence.

Amazon is fourth, and the online retailer founded by billionaire Jeff Bezos has benefited greatly from the boom in cloud computing through its cloud computing business unit, Amazon Web Services (AWS).

Mark Zuckerberg, also a billionaire, continues to serve as CEO of Meta, a social networking company with a market value of $1.3 trillion, which owns popular platforms such as Facebook, Instagram, WhatsApp and Messenger.

The last member of the tech "trillion club" is Google's parent company Alphabet, with a market value of more than $2 trillion. Alphabet owns six products with more than 100 million users, including Android, Chrome, Gmail, Google Play, Google Search and YouTube. The laggard in this group is Tesla, led by Elon Musk, an electric car maker with a market value of about $670 billion.

Traditional Economy

Mainstay

Berkshire Hathaway (NYSE: BRK.B), led by famous investor Warren Buffett, recently broke the trillion-dollar mark and can be seen as a representative of the traditional economy.

Berkshire Hathaway owns many businesses, such as Burlington Northern Santa Fe, Berkshire Energy, and property and casualty insurance businesses.

In addition to the above businesses, Buffett's company also holds several smaller companies, including battery manufacturer Duracell, home building company Clayton Homes, underwear manufacturer Fruit of the Loom, manufacturing company Precision Castparts, etc. However, not all businesses belong to traditional industries.

Surprisingly, the "Oracle of Omaha" also has Apple as its largest portfolio holding, with a market value of $91.6 billion. Berkshire Hathaway also owns about $1.8 trillion in Amazon stock.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.