Japanese Stock Index Flash Crash Sparks Panic

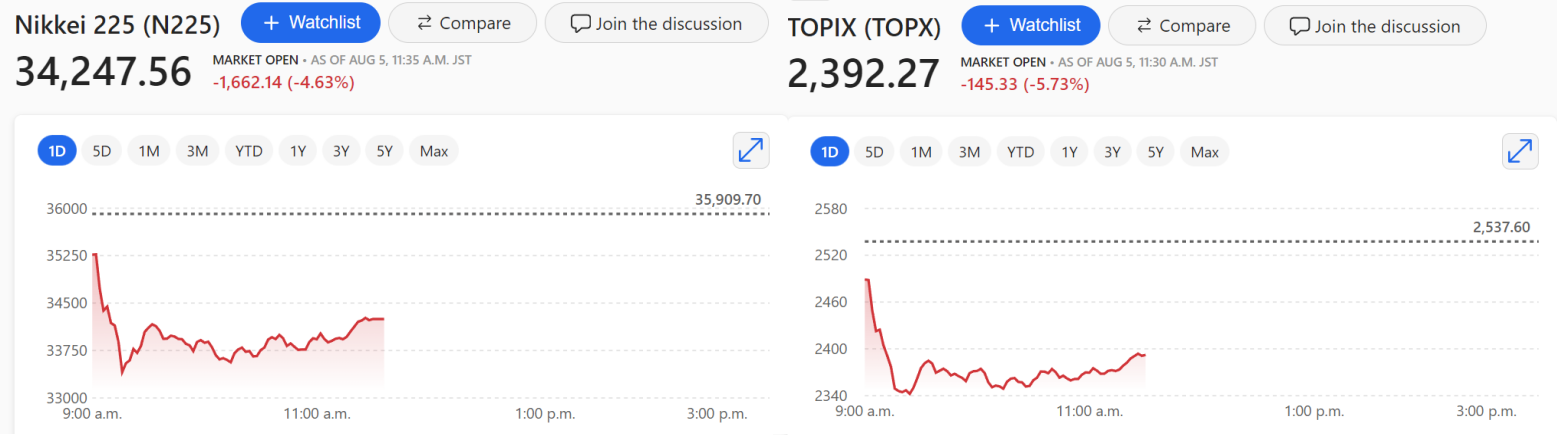

At the opening of trading on Monday morning, Japan's two main stock indexes, the TSE and the Nikkei 225, were both down sharply.

The Japanese stock market staged a flash crash in early trading on Monday (August 5th).

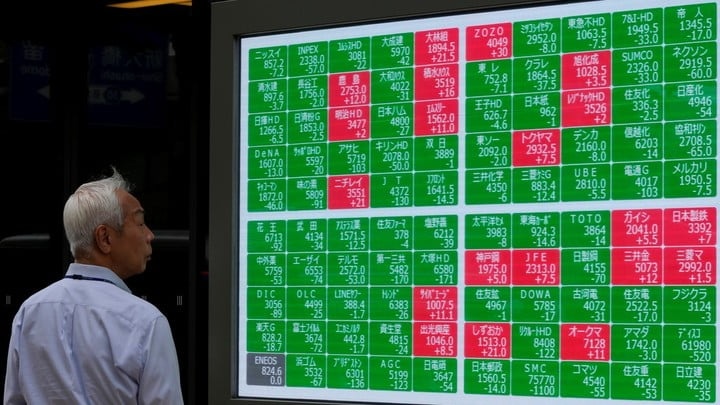

At the start of the morning, Japan's two major stock indexes - the TOPIX and Nikkei 225 - both plunged, and both fell by more than 7%. Among them, the TSE index also triggered the melting mechanism, suspended trading for ten minutes.

Both indexes then narrowed their losses and by the end of morning trading, the TOPIX was at 2,392.27, down 5.73%. The Nikkei 225 was down 4.63 percent at 34,247.56. Both indices are down 20 percent from their July highs.

The wild swoon in Japan's stock market also drove down stock indices in several surrounding regions. At the end of morning trading, Australia's S&P/ASX 200 was down 2.65 percent, South Korea's KOSPI was down 5.72 percent and India's SENSEX 30 was down nearly 2 percent.

Kyle Rodda, senior market analyst at Capital.Com, said, "We're essentially seeing a massive deleveraging as investors sell off assets to cover losses. The speed of this move caught me off guard and there's a lot of panic selling going on right now and that's what's causing asset prices to react non-linearly to fairly straightforward fundamental dynamics."

Last week, the Bank of Japan announced a 15 basis point rate hike, raising its policy rate to 0.25%, the second rate hike by the BOJ this year. The BOJ also said it would gradually reduce the size of its purchases of treasury bonds, tapering to 3.1 trillion yen in the first quarter of 2026 from about 5.7 trillion yen currently.

The BOJ rate hike has put some pressure on exporters. All 33 industry sectors in the Japanese stock market have declined to varying degrees since the BOJ rate hike.

While the rate hike has had some impact on the stock market, concerns about the U.S. economy appear to be a major factor in the Japanese stock market's plunge.

The U.S. nonfarm payrolls report released on Friday was unexpectedly weak. The report showed a sharp slowdown in U.S. job growth in July and the unemployment rate rose to 4.3%, the highest level in nearly three years, raising concerns about a recession.

On Monday, Goldman Sachs chief economist Jan Hatzius raised the probability of the U.S. falling into a recession in the coming year from 15 percent to 25 percent in his latest report. Goldman Sachs expects the Fed to cut interest rates by 25 basis points each in September, November and December. And it said a 50-basis-point rate cut in September is likely if August's jobs report is as weak as July's.

Traders are starting to raise their bets on a rate cut in 2024. Traders expect that the Fed could make as many as five rate cuts before the end of the year.

After the report was released, futures on the three major U.S. stock indexes were lower, with futures on the Nasdaq down more than 2% and futures on both the S&P 500 and the Dow down more than 1%. Meanwhile, U.S. Treasury yields also fell sharply.

Hideyuki Suzuki, managing director of SBI Securities, said, "The U.S. jobs data further added to the uncertainty surrounding the U.S. economy, and this, coupled with the continued strength of the yen, led to a sharp decline in the market."

Even insurance companies and banks, which were expected to benefit from the rate hike, are now among the biggest losers as global stock markets turn bearish. On Monday, Japan's banking index fell 12 percent, the worst performance among industry-classified indexes on the Tokyo Stock Exchange. Shares of Mitsubishi UFJ Financial Group slumped 21 percent at one point, the biggest intraday drop on record.

Foreign investors, long considered a major driver of Japan's stock market, sold a total of 1.56 trillion yen net of Japanese spot stocks and futures in the week ended July 26, according to the JSE. The TSE index fell more than 5 percent during that period, its biggest drop in four years.

Andrew Jackson, head of Japanese equity strategy at Ortus Advisors in Singapore, wrote in a report, "The latest round of massive sell-off in equity markets, led by technology stocks, influenced by the downturn in the U.S. market, has significantly altered expectations for Japanese stock market returns in the second half of this year."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.