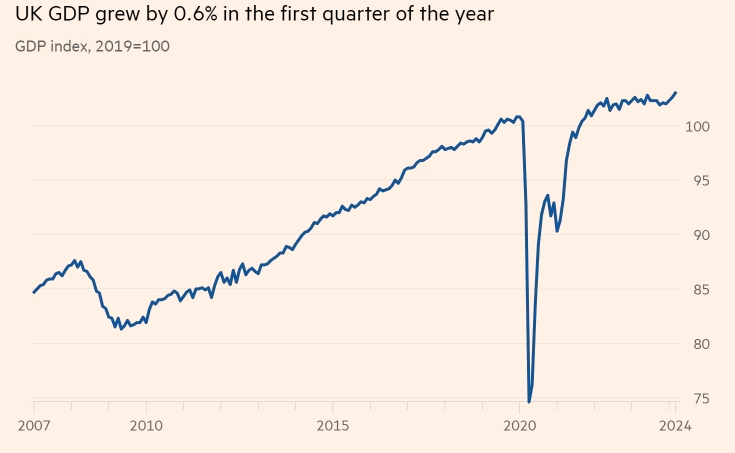

UK Economy Grows by 0.6% in Q1, Avoids Technical Recession

The economic data released this time is undoubtedly good news for UK Prime Minister Rishi Sunak, as he, along with the Chancellor of the Exchequer, has stated that the lives of voters are improving.

On May 10th, official data released by the UK Office for National Statistics (ONS) on Friday showed that the UK economy grew by 0.6% in the first three months of 2024, outperforming expectations and ending the mild recession that began in the second half of the previous year. The ONS stated that the UK economy welcomed a strong rebound in the first quarter of this year, aided by a broad and key service sector.

Before the data was released, economists had forecasted a GDP growth of 0.4% for the first quarter. The 0.6% quarterly growth is also the strongest expansion for the UK since the fourth quarter of 2021. Led by the service sector, the UK's output in March grew by 0.4% month-on-month, with wholesalers, the health sector, and the hospitality industry all performing well. This is significantly higher than the economists' forecast of 0.1% and follows another increase of 0.2% in February.

The economic data released this time is undoubtedly good news for UK Prime Minister Rishi Sunak, as he, along with the Chancellor of the Exchequer, has stated that the lives of voters are improving ("turned a corner"), and the released economic data has substantiated the Prime Minister's remarks. Currently, Sunak's Conservative Party is lagging behind the Labour Party by about 20 percentage points in the polls, and the re-election situation is precarious.

In the last quarter of last year, the UK briefly fell into a technical recession. At that time, the UK's GDP fell by 0.3% quarter-on-quarter, marking the second consecutive quarter of decline. Specifically, all three major industries of the UK economy shrank in the fourth quarter of 2023. The ONS stated that the service sector fell by 0.2%, manufacturing fell by 1%, and construction fell by 1.3%. Experts believe that the COVID-19 pandemic, the Russia-Ukraine conflict, and Brexit are the main reasons for the UK's economic downturn.

However, since the beginning of this year, with the increase in service sector activity, the UK's economic downturn has also come to an end. The UK's industrial activities have begun to increase, the service sector has rebounded, workers' wage levels have gradually exceeded the rate of inflation, and consumers' economic burdens have also decreased. The ONS stated that after two quarters of contraction, the UK economy has returned to positive growth in the first three months of this year.

Regarding this data, Liz McKeown, the Director of Economic Statistics at the UK Office for National Statistics, said, "The service sector has performed strongly, with retail, public transport, and health sectors all performing well. Car manufacturers also had a good quarter. It's just that the weakness in construction slightly offset these advantages."

UK Chancellor of the Exchequer Jeremy Hunt also believes, "There is no doubt that these have been difficult years, but today's growth figures prove that for the first time since the pandemic, the economy has fully recovered."

Ruth Gregory, an economist at Capital Economics, also said, "The unexpectedly strong GDP growth in March is the fourth increase in five months, indicating that the momentum of economic recovery is faster than we thought."

After the data was released, the British pound strengthened rapidly against the US dollar. Interestingly, just yesterday, the Bank of England still maintained the interest rate at its highest level in nearly 16 years and gave a pessimistic forecast for the UK economy: a growth rate of 0.4% for the first quarter and only 0.2% for the second quarter.

Currently, investors believe that there is about a 45% chance that the Bank of England will cut interest rates before June.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.