UK Retail Sales Data in March: Consumers Holding Back, Caught in a "Cost of Living Crisis"

Sunak needs to enhance the public's "good life feeling" to win back public opinion.

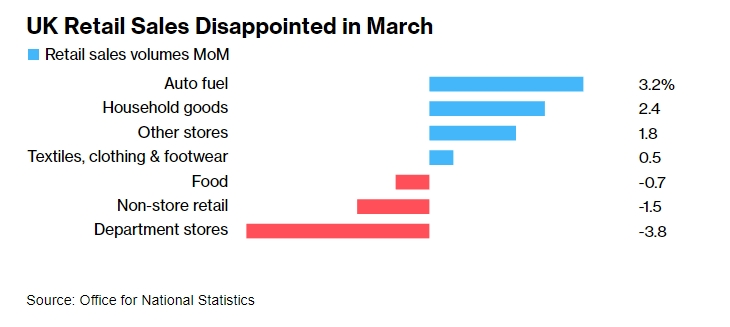

April 19th - Data shows that the UK's seasonally adjusted retail sales for March remained flat month-on-month, against expectations of a 0.30% increase; year-on-year, retail sales increased by 0.8%, which was also below the expected increase of 1.0%, with both figures missing expectations.

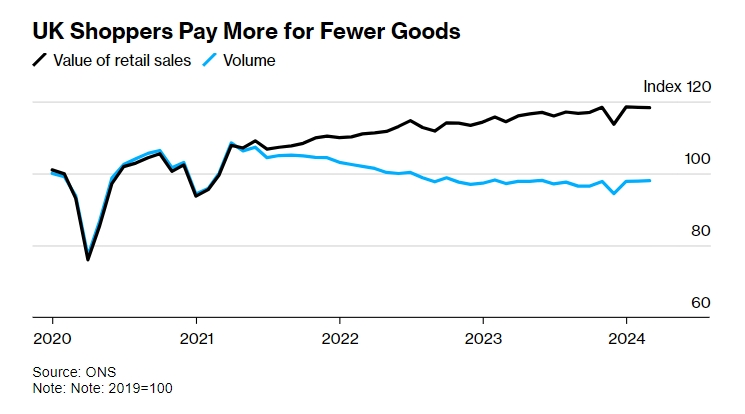

The underwhelming retail sales data in the UK is primarily attributed to price-sensitive consumers cutting back on spending in the food and department store sectors. Analysts say that this data further confirms the view that the UK's economic recovery post-pandemic is sluggish. Consumers are hard hit by inflation, and although wages are rising rapidly and the Bank of England is expected to cut interest rates soon, these factors have not yet quickly translated into an improvement in the quality of life for the British public.

After the data release, the pound's short-term change against the US dollar was minimal, maintaining a decline of 0.3% to the level of 1.2405. However, traders have increased their bets on a rate cut later this year, with the market fully pricing in the expectation of a 0.25% cut by the Bank of England in September.

The Office for National Statistics (ONS) stated that retail sales in the UK increased by 1.9% for the entire first quarter, contributing 0.09 percentage points to GDP. Surveys indicate that the overall UK economy is expected to grow by 0.2% in the first quarter.

Among the weak data, fuel sales in the UK provided support to prices. Excluding automotive fuel, the total sales in March only fell by 0.3%. In addition, the UK's retail sales data for March were also affected by heavy rains in the first half of the month. Retailers generally stated that they have gradually found a more normal consumption pattern compared to the pandemic period.

Regarding this data that fell short of expectations, Heather Bovill, the Chief Statistician at the Office for National Statistics, said: "Sales in hardware stores, furniture stores, gas stations, and clothing stores have all increased; however, the decline in food sales offset these gains, and department store retailers reported that rising prices affected transactions."

Phil Monkhouse, the UK National Manager at financial services firm Ebury, pointed out: "Today's retail sales data is somewhat disappointing, dashing retailers' hopes for an Easter crowd rebound. With retailers now facing two consecutive months of stagnation, the glimmer of hope following the unexpectedly impressive rebound in January seems to be fading."

Kris Hamer, Insight Director at the British Retail Consortium, believes: "Consumer spending remains constrained due to the high cost of living, and sales of large items such as furniture are still poor. Shoe sales were mainly affected by the bad weather."

It is worth noting that the Conservative Party, led by Prime Minister Rishi Sunak, has already fallen behind other parties in opinion polls. The media reports that Sunak needs to enhance the public's "good life feeling" to win back public opinion. Currently, including Tesco Plc, the UK's largest grocer, among many retailers are attracting consumers by lowering prices, and the level of store inflation in the UK has dropped to its lowest point in over two years.

In response, Linda Ellett, Head of Consumer Markets, Leisure, and Retail at KPMG UK, said in a statement released by the British Retail Consortium last week: "Despite this, consumer confidence in the UK remains fragile, and households continue to watch their budgets closely."

The predicament of the British not being able to spend freely is expected to continue for some time.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.