Finally here! The UK cuts interest rates for the first time in four years, with pleasing results in the battle against inflation

The rate cut will alleviate the pressure on borrowers but will also reduce the income of savers, as the central bank's benchmark interest rate serves as the anchor for the interest rates of commercial banks.

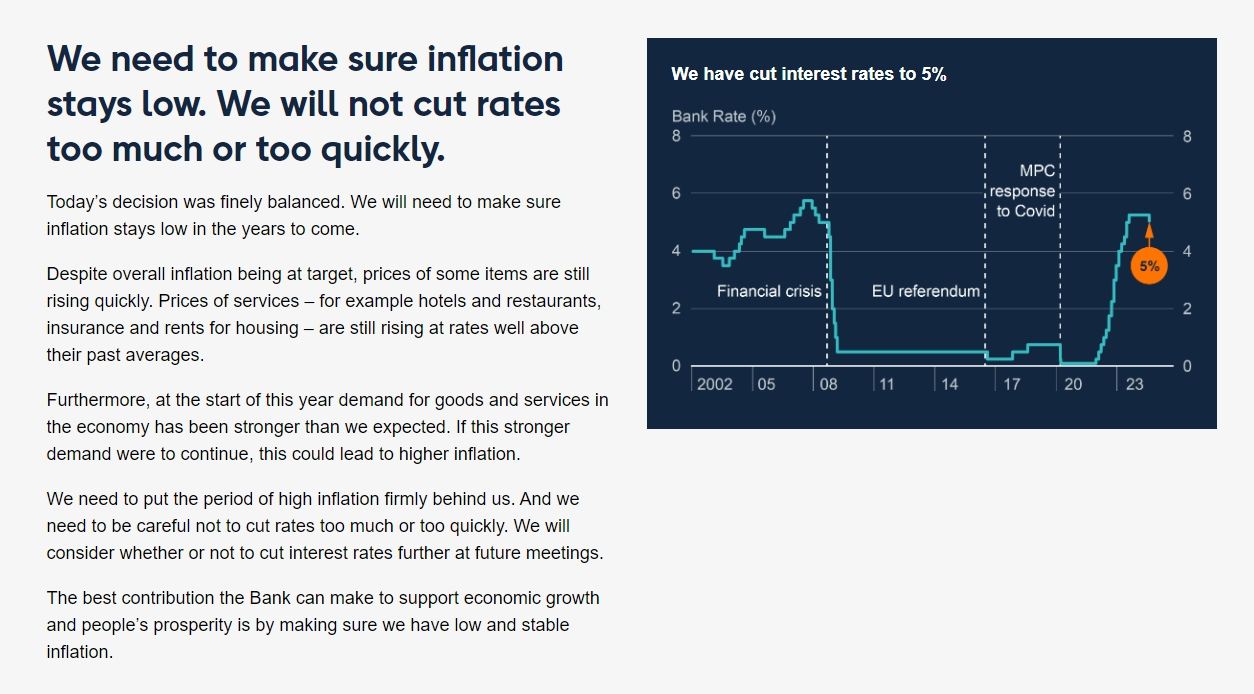

August 1st saw the continuation of the "Super Central Bank Week," with the Bank of England making its first rate cut in over four years, announcing a reduction of the benchmark interest rate from 5.25% to 5%.

Following the August policy meeting, the Bank of England declared that officials, with a fierce voting result of 5 to 4, ultimately decided to lower the interest rate by 25 basis points. Bank of England Governor Andrew Bailey, along with four other officials, cast the deciding votes to reduce the UK's base interest rate from a 16-year high.

The rate cut will alleviate the pressure on borrowers but will also reduce the income of savers, as the central bank's benchmark interest rate serves as the anchor for the interest rates of commercial banks.

The backdrop of this rate cut is the decline in the UK's inflation rate. After soaring to over 11% at the end of 2022, reaching a 40-year high, the inflation in the UK has been on a downward trend under the pressure of high interest rates, eventually returning to the 2% target set by the Bank of England.

In a brief statement, Bailey said, "The inflationary pressures have eased enough for us to cut rates. However, we need to ensure that inflation remains at a lower level and be cautious not to cut rates too quickly or by too much."

The climax of this Super Central Bank Week has been full of twists and turns. Among the world's major developed economies, the Bank of England and the European Central Bank have already taken the lead in cutting rates, and the Bank of Canada has also lowered its policy rate. Following the favorable second-quarter inflation figures, the Reserve Bank of Australia is also expected to start cutting rates soon.

The Federal Reserve continues to hold its position, with Powell stating the need for "more comprehensive data rather than a single point" to determine the sustained downward trend of inflation. However, he also hinted that officials will discuss rate cuts at the September meeting.

In contrast, the Bank of Japan, stimulated by wage growth and increased exports, is increasingly confident that the country's inflation will stabilize at the 2% level. This week, the country's monetary policy decision was to raise rates by 15 basis points and reduce the scale of government bond purchases.

After the Bank of England's rate hike announcement, analysts said they expect the Bank of England to cut rates again this year, but not next month. The pound has slightly recovered its losses.

In the interest rate statement, the Bank of England claimed that inflation risks "will remain biased to the upside throughout the forecast period," and that monetary policy needs to remain restrictive for a sufficiently long time until the risk of inflation returning to the 2% target in the medium term further dissipates.

The bank also believes that there is a long lag in the impact of interest rates on inflation, so the Bank of England is more focused on what it considers to be medium-term drivers of inflation: service prices, wage growth, and the overall supply and demand situation in the labor market.

Although the inflation in the service sector in June was much higher than the Bank of England's expectations, the bank attributed it to "volatile factors." In addition, the Bank of England has also significantly raised its expectations for the UK's economic growth, predicting that the UK's GDP will grow by 1.25% in 2024, far higher than the 0.5% forecasted in May, reflecting stronger growth than expected in the first half of this year.

According to market interest rates and model forecasts, the Bank of England expects the inflation rate to be 2.4% one year later, compared to the 2.6% forecast in May; it expects the inflation rate to be 1.7% two years later, compared to the 1.9% forecast in May.

Neil Jones, Senior Foreign Exchange Salesman at TJM Europe, said that the Bank of England's monetary policy outlook indicates a cautious attitude towards further rate cuts, which should mean a positive tone for the pound, with limited downside. However, the decline of the pound will only weaken its recent excellent performance, and its year-to-date return rate is still higher than that of other G10 currencies. This reflects the relatively high interest rates, the continuously improving economic outlook, and the stability of the British government after the general election.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.