UK inflation slows more than expected, 25 basis points rise in August

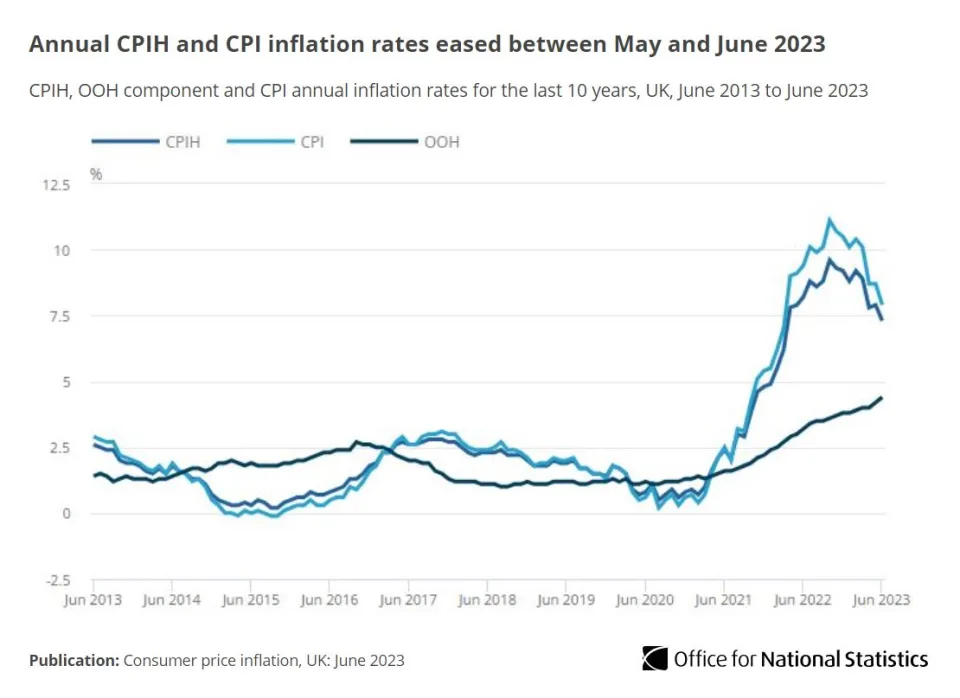

On July 19, local time, the Office for National Statistics (ONS) released inflation data for June.。Data show inflation slowing to 7 in June.9%, coming to a 15-month low。This is more than the market expected 8.2% is lower, also lower than the 8 in May.7%。

On July 19, local time, the Office for National Statistics (ONS) released inflation data for June.。Data show inflation slowing to 7 in June.9%, coming to a 15-month low。This is more than the market expected 8.2% is lower, also lower than the 8 in May.7%。

Specifically, one of the most closely watched indicators is the decline in core inflation to 6.9%, which excludes volatile food, energy, alcohol and tobacco prices。Last month the index reached 7..1%, a 31-year high。

While food inflation is up from 18 last month.3% to 17.3%, but still at an all-time high。The largest declines were in the milk, cheese and egg categories, from 27 in May..4% to 22.8%。Separately, auto fuel prices have also fallen sharply, dropping 22 percent in the year to June..7%。

The unexpected decline in UK inflation instantly led to a fall in the pound, with sterling inflation down about 0 against the dollar as of press time..27%, to 1.2904。

UK property stocks rebound after inflation figures come out。Mortgage rates will also rise less than previously expected because of market expectations。UK mortgage rates soar to 15-year high。Myron Jobson, of online investment platform Interactive Investor, said the change in market expectations "could mean the end of the chaos in the mortgage market in recent months."。

June's inflation data can be a relief for the UK, after four consecutive months of higher-than-expected inflation data。New data eases Bank of England rate hike next month 0.5% pressure, making the rate hike 0.25% more likely.。

Paul Dales, an economist at Capital Economics, said that while falling inflation was unlikely to prevent the Bank of England from raising interest rates next month, "it could lead to a 25 basis point hike instead of a 50 basis point hike."。

Matthew Ryan, head of market strategy at Ebury, said: "While it now looks more likely to raise interest rates by 25 basis points at the August meeting, we expect the Bank of England to maintain a hawkish policy stance for some time.。"

The current market believes that the Bank of England will raise interest rates by 25 basis points at its August 3 meeting (from 5% to 5.25%) is 65% likely, and the UK base rate is expected to peak in February 2024, at 5.About 8%。

So far, the Bank of England has raised interest rates 13 times in a row to curb inflation。

Despite the slowdown, inflation in the UK is currently the highest in the Group of Seven (G7)。U.S. inflation slowed to 3 percent in June, a 27-month low。Eurozone inflation slows to 5.5%, the lowest level in 17 months。Among major eurozone countries, Germany's inflation rate is 6.8% in France, 5.3% in Italy, 6.7%, Spain only 1.6%。

Paula Bejarano Carbo, associate economist at the National Institute for Economic and Social Research (NIESR), said: "It is worrying that these measures of underlying inflationary pressures continue to hold steady at around 7 per cent, well above the Bank of England's 2 per cent target.。"

Dales said: "Inflation in the UK is likely to remain higher than elsewhere for some time, but at least the UK is now following global trends.。Our forecast is that the core of the service sector CPI inflation will gradually slow down as the impact of previous interest rate hikes becomes apparent.。"

Chancellor of the Exchequer Jeremy Hunt said: "Inflation is falling and is at its lowest level since last March; but we are not complacent and we know that high house prices remain a big concern for households and businesses alike.。He also added: "The best and only way for us to ease this pressure and get the economy growing again is to stick to our plan to halve inflation this year.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.