UK retail sales data for August beat expectations and just kept policy rates unchanged yesterday

Warming weather boosts food and clothing sales.

On September 20th, the UK released its seasonally adjusted retail sales data for August. The data showed a month-on-month increase of 1%, higher than the 0.4% expected by economists. Additionally, the month-on-month retail sales rate for July was revised upward from the previously announced 0.5% to 0.7%.

Excluding automotive fuel, the UK's retail sales rate for August increased by 1.1%, higher than the 1.0% in July and significantly higher than the economists' forecast of 0.5%.

The Office for National Statistics stated that the unexpected growth in sales data was mainly due to the warmer weather, which boosted sales of food and clothing. Specifically, compared to a month ago, the sales of food stores increased by 1.8%, and the sales of non-food stores increased by 0.6%.

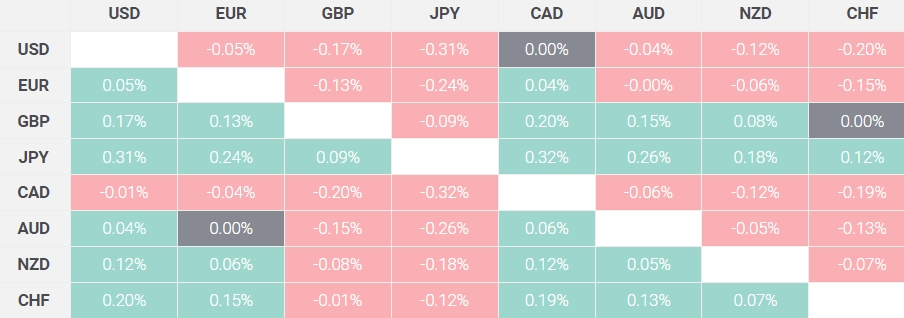

Following the release of the better-than-expected data, the pound immediately gained new buying interest. As of the time of writing, the pound has risen by 0.18% against the US dollar, approaching 1.3310.

In response to this data, Deloitte commented in a timely manner. Oliver Vernon-Harcourt, the head of Deloitte's retail division, said, "The long-awaited sunshine in August and the busy sporting events have given the UK retail industry a much-needed boost. Consumers have increased their spending on summer clothing series and outdoor social food. The first interest rate cut in four years last month has led to a rebound in the real estate market, which may also be one of the reasons for the increase in the sales of household goods."

Oliver also said, "Although many consumers remain cautious and choose to give up buying large items or luxury goods, some consumers still reward themselves with small luxury goods, thus promoting the sales of personal care and high-end food categories of small disposable goods."

He continued, "The better-than-expected sales growth has brought hope to retailers that more consumers will continue to consume in the coming months. However, many consumers are still waiting for the upcoming autumn budget results and further interest rate adjustments before they fully relax their purse strings. The 'golden quarter' is coming, and many retailers want to see how they perform during the busiest period of the year before they make more significant investments."

Yesterday, as expected, the Bank of England maintained the bank rate at 5.0% by a vote of 8 to 1, with one policymaker in favor of another rate cut. In August of this year, policymakers decided to cut rates by a vote of 5 to 4, with 4 votes in favor of maintaining the rate. The Bank of England's easing steps are slowing down.

The Bank of England emphasized the need to take a patient approach to further normalization, which still makes sense given the continued existence of potential price pressures. Today's better-than-expected retail data undoubtedly supports the central bank's idea.

In the resolution statement, Bank of England Governor Andrew Bailey said, "Over time, we should be able to gradually lower interest rates." He emphasized that this path will depend on whether price pressures continue to ease. "Maintaining low inflation is crucial, so we need to be careful not to lower interest rates too quickly or too much."

The market expects that by December, the Bank of England will cut interest rates by 41 basis points, down from the previous expectation of a 50 basis point cut.

In addition, the Bank of England also maintained the pace of reducing its balance sheet by 100 billion pounds ($132 billion) per year. This means that from October onwards, the amount of government bonds actively sold by the Bank of England over the next 12 months will drop significantly from the current 50 billion pounds to around 13 billion pounds.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.