The number of people applying for unemployment benefits per week is considered representative of layoffs in the United States.

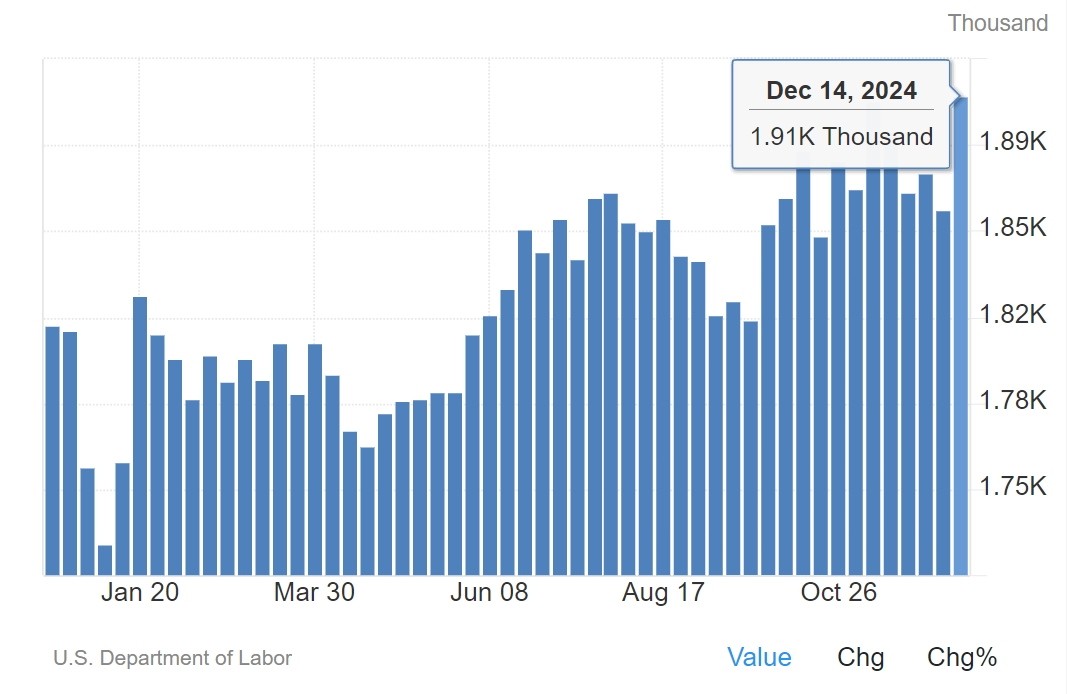

On December 26, the number of Americans applying for unemployment benefits remained stable last week, although the number of people continuing to claim benefits rose to its highest level in three years.

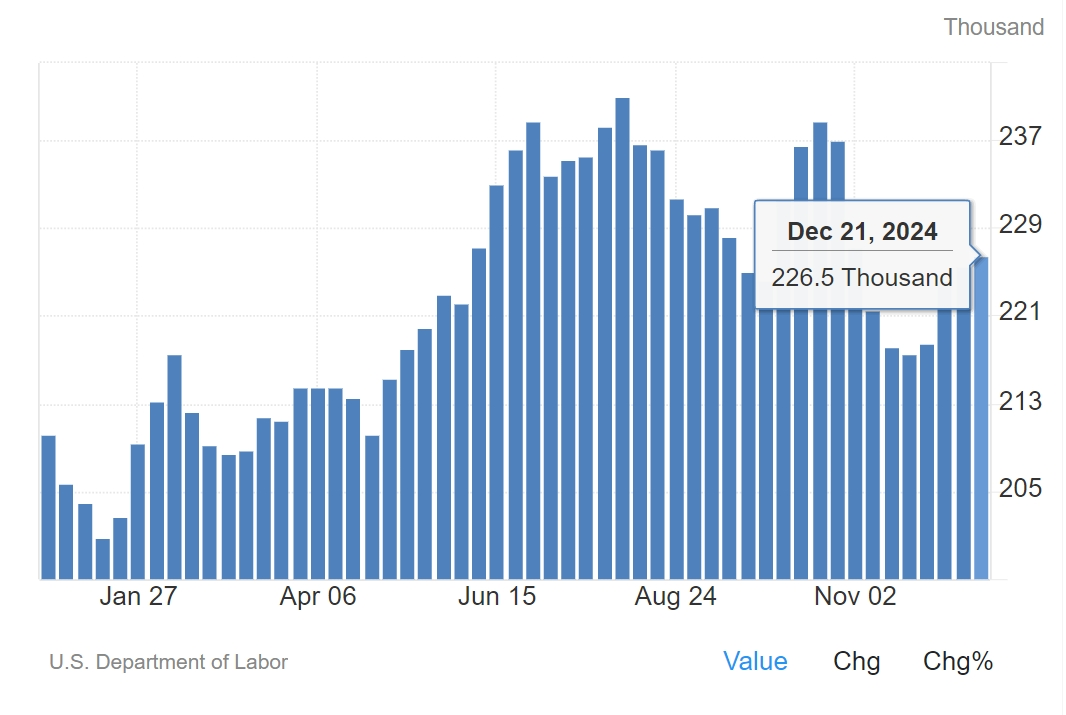

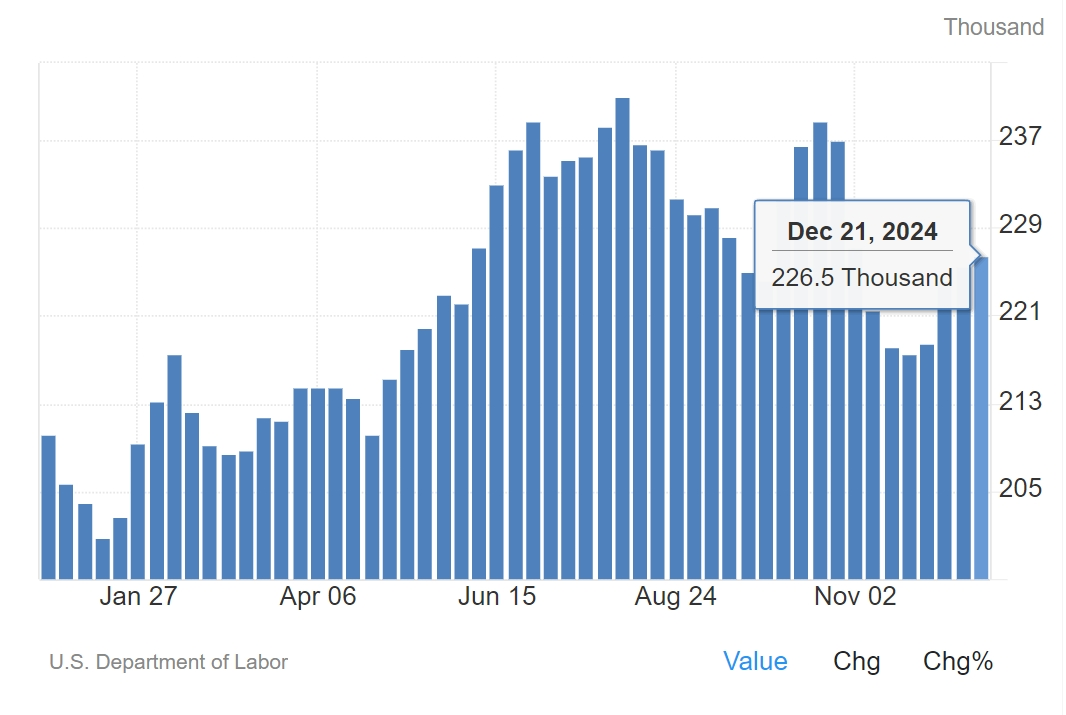

The Labor Department reported Thursday that unemployment claims fell by 1,000 to 219,000 in the week ending December 21, less than analysts 'forecast of 223,000.

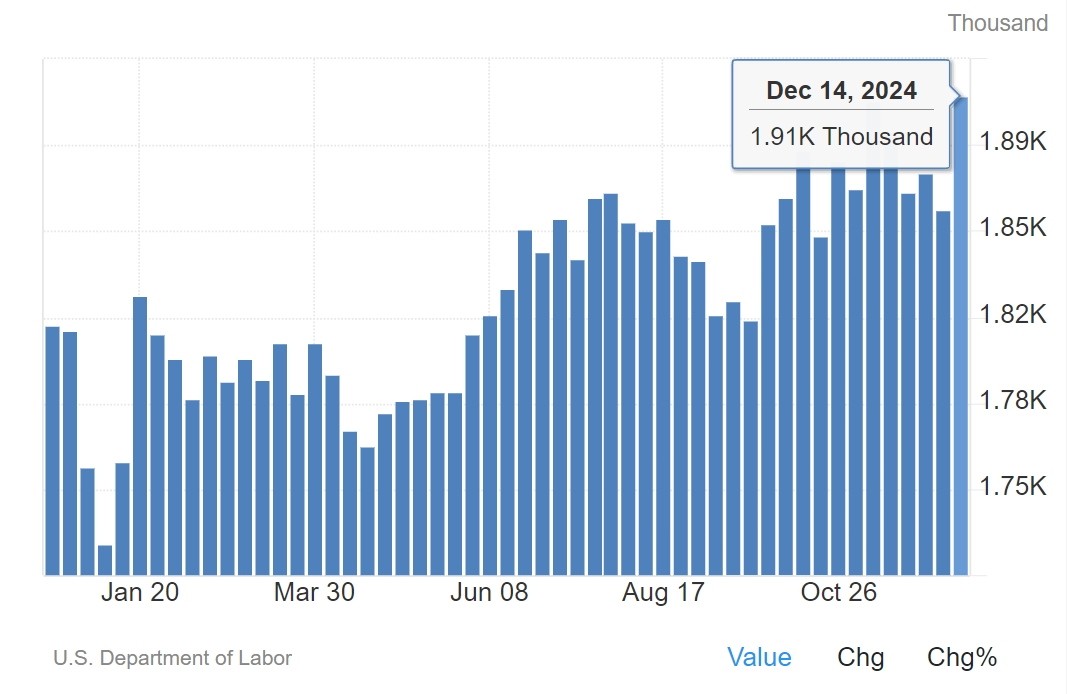

The number of people who continue to claim benefits, or the total number of Americans receiving unemployment benefits, increased by 46,000 in the week ending December 14 to 1.91 million.This exceeded analysts 'forecasts and was the highest level since the week of November 13, 2021, when the labor market was still recovering from the sharp job losses caused by the COVID-19 epidemic in the spring of 2020.

The rising number of people who continue to claim benefits suggests that some people who are receiving benefits are finding it more difficult to find new jobs.That could mean that demand for workers is shrinking, even though the economy remains strong.

The four-week average of weekly jobless claims, which could reduce some week-to-week fluctuations, rose slightly by 1,000 to 226,500.

The number of people applying for unemployment benefits per week is considered representative of layoffs in the United States.

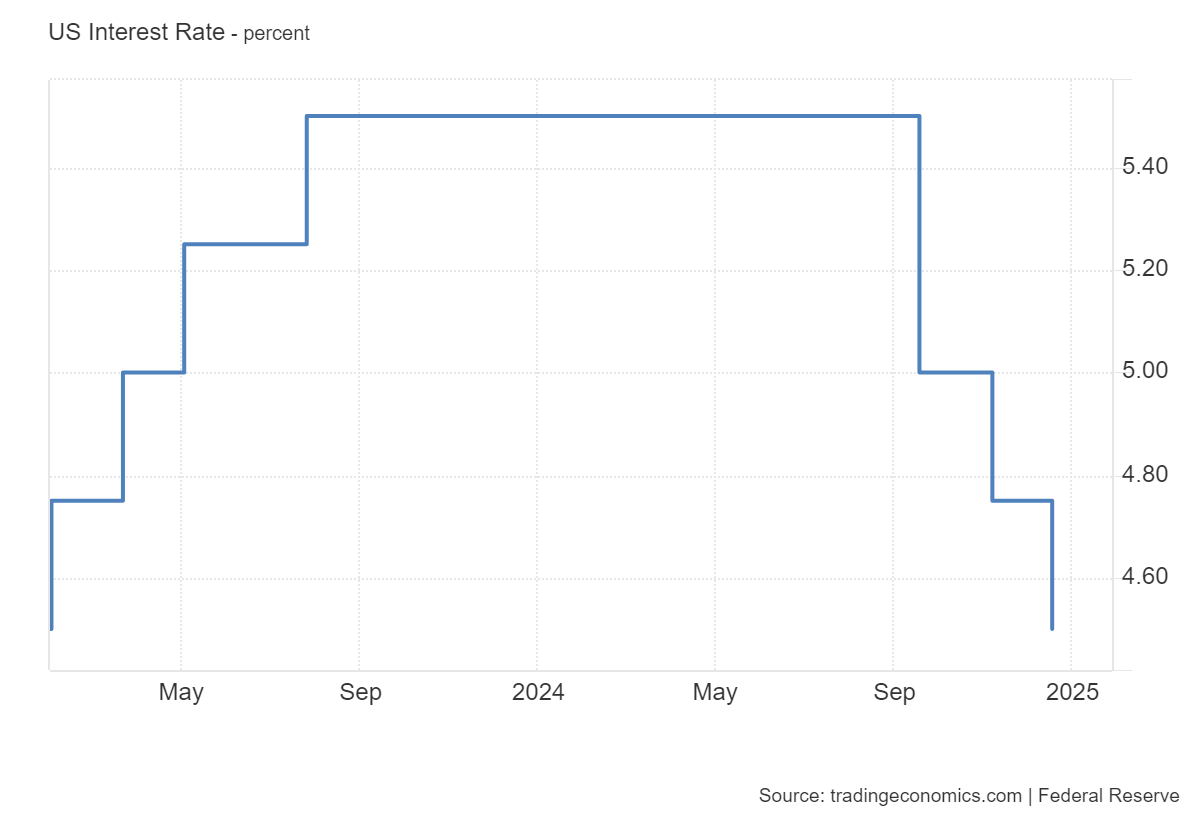

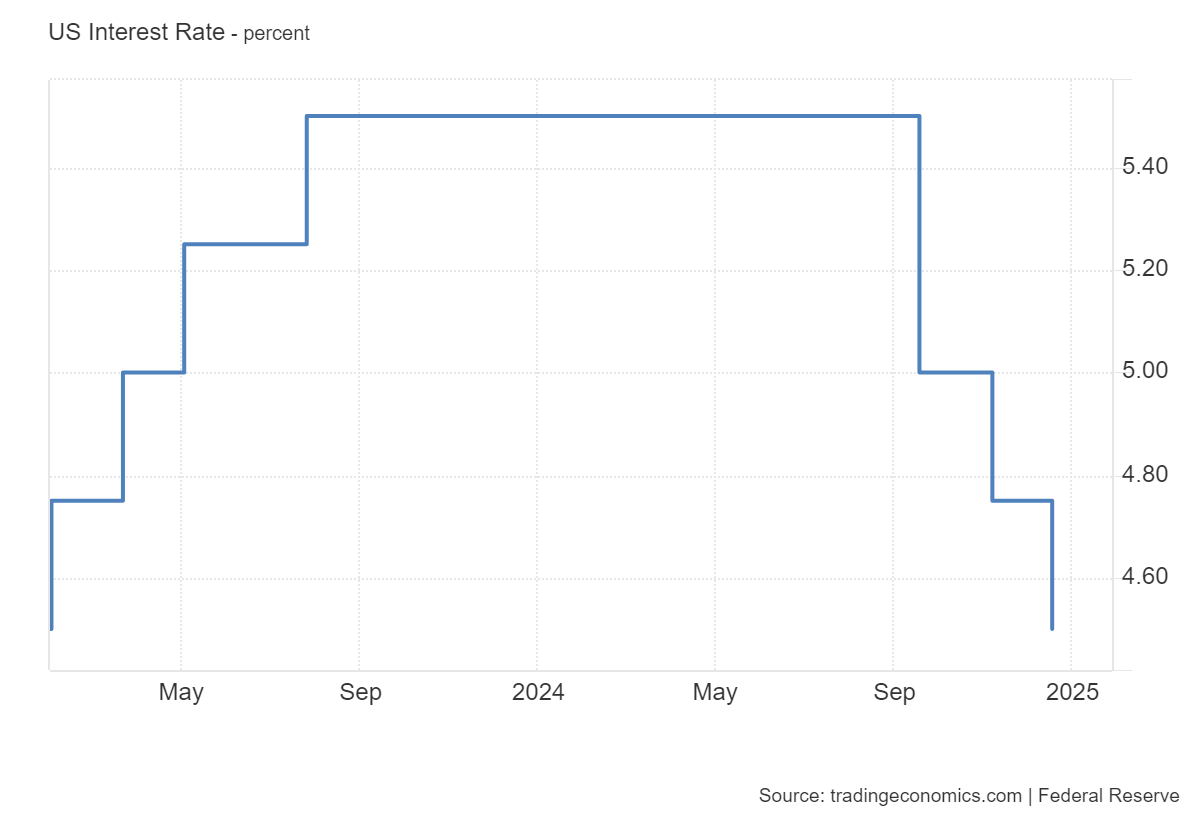

Although the labor market has shown some signs of weakness recently, it remains generally healthy and better than many economists predicted, considering that interest rates have been at high levels for years.The Federal Reserve implemented a series of interest rate hikes in 2022 and 2023 in an attempt to curb the highest inflation in four decades that occurred as the U.S. economy rebounded from a brief but sharp epidemic recession.

The Federal Reserve cut its benchmark interest rate for the third consecutive time last week in response to broadly falling inflation, although it remained above the U.S. central bank's 2 percent target.The Federal Reserve caught markets off guard when it predicted only two interest rates in 2025, lower than its previous four forecasts.

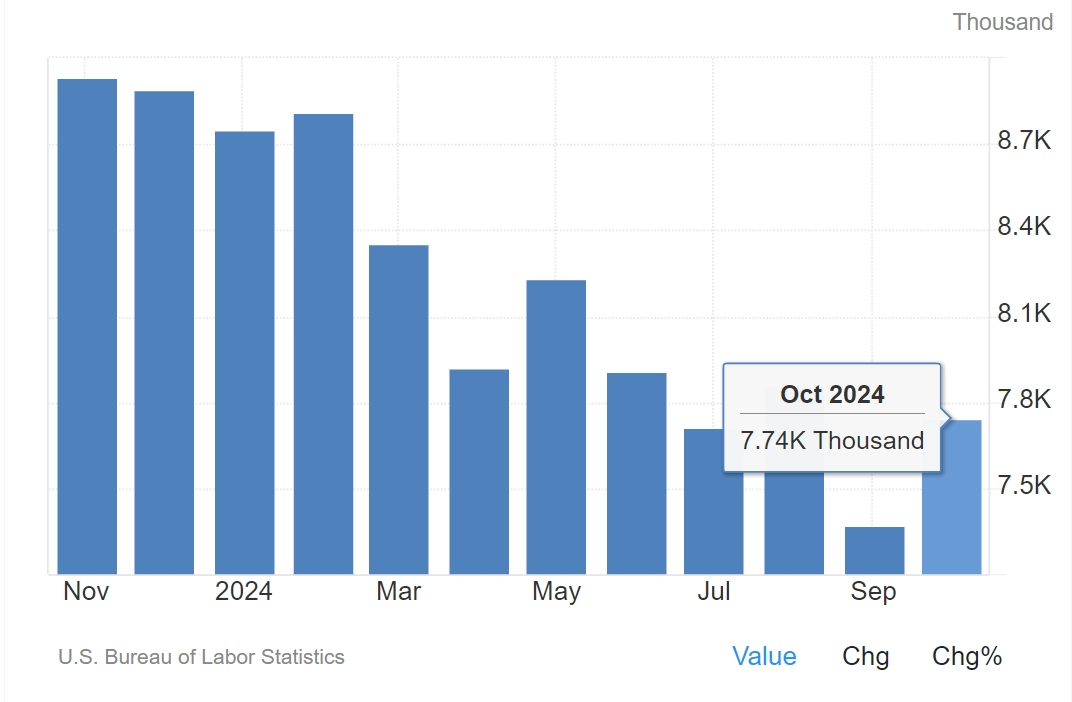

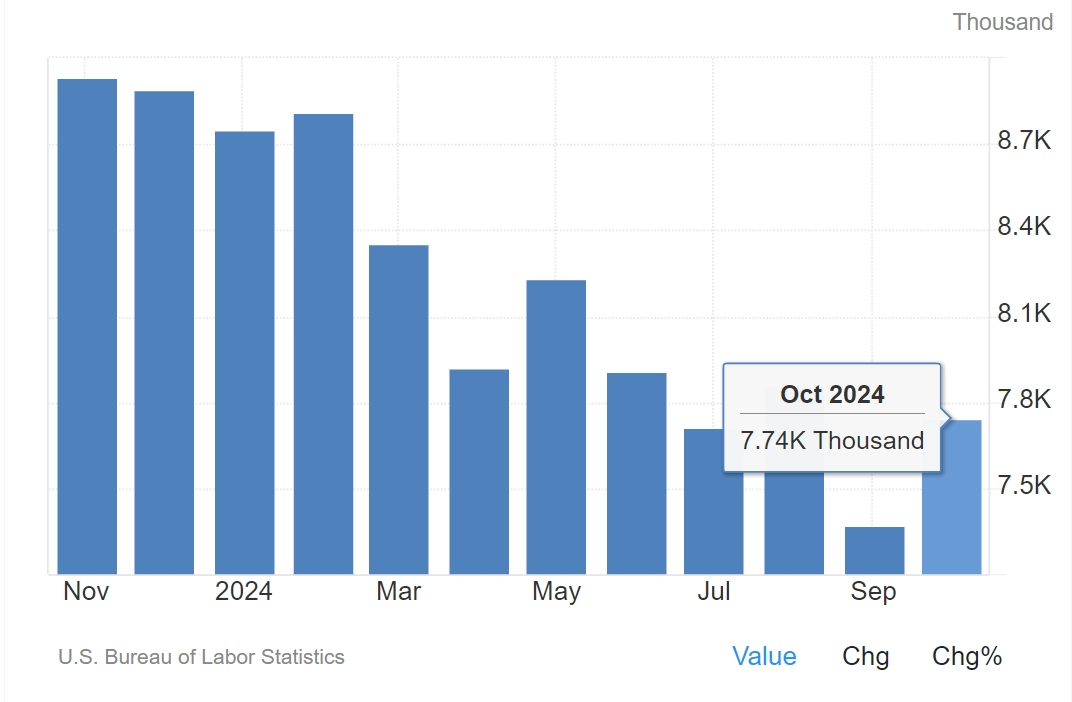

Earlier this month, the government reported that U.S. job vacancies rebounded to 7.7 million in October, rising from a three-and-a-half-year low of 7.4 million in September, a sign that companies are still seeking workers even as hiring has cooled.

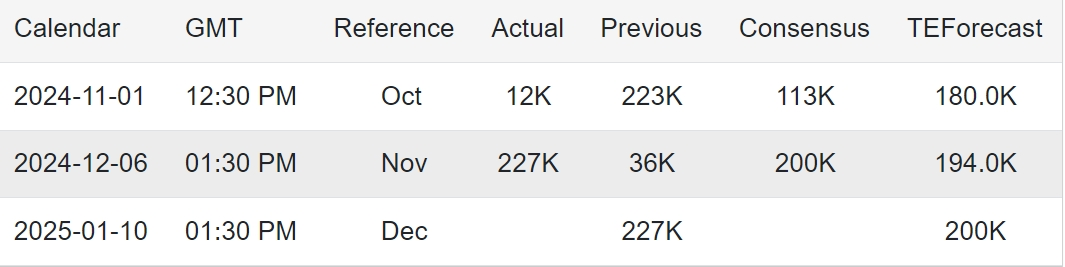

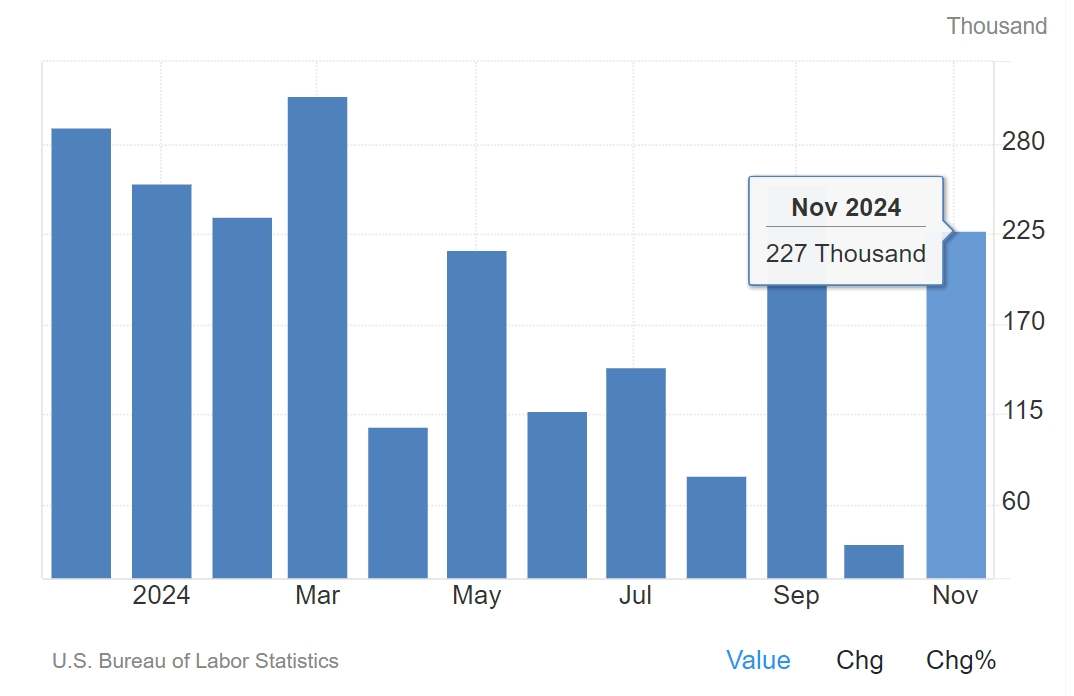

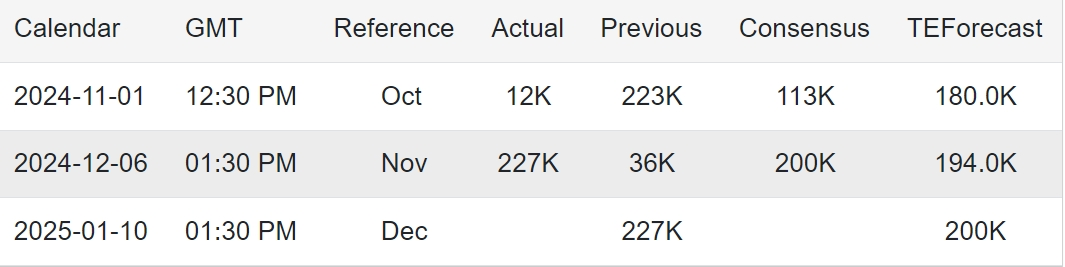

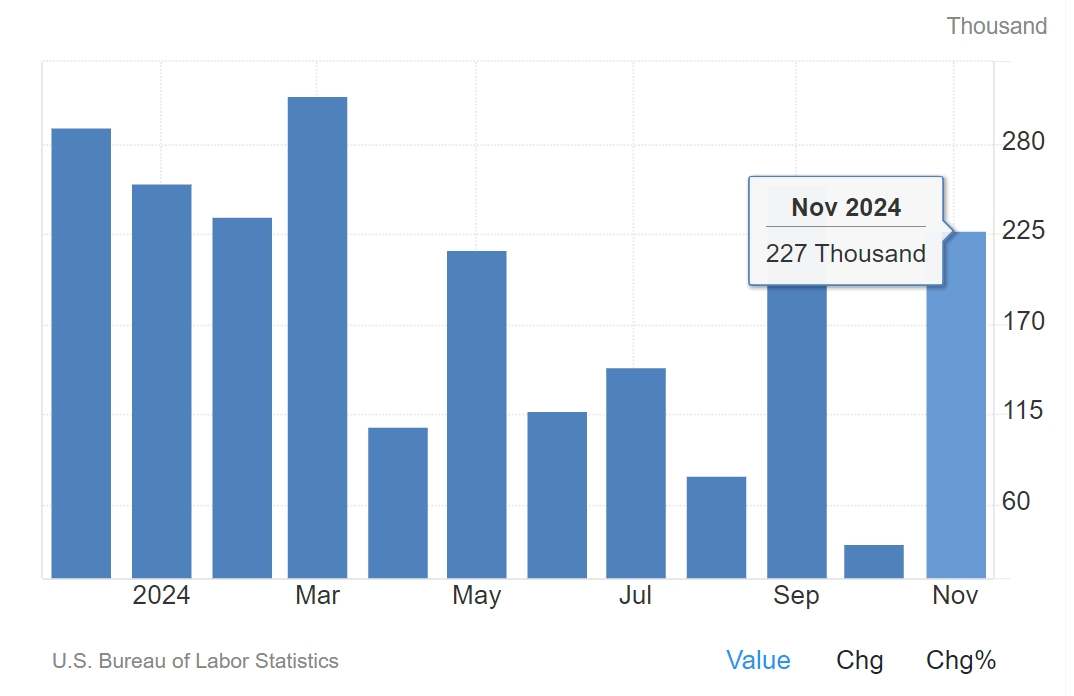

In November, U.S. employers added 227,000 jobs, following 36,000 in October, when strikes and the impact of hurricanes significantly reduced employers 'workforce numbers.The government also raised its estimates for job growth for September and October, adding a total of 56,000 jobs.

The government's December employment report will be released on January 10.