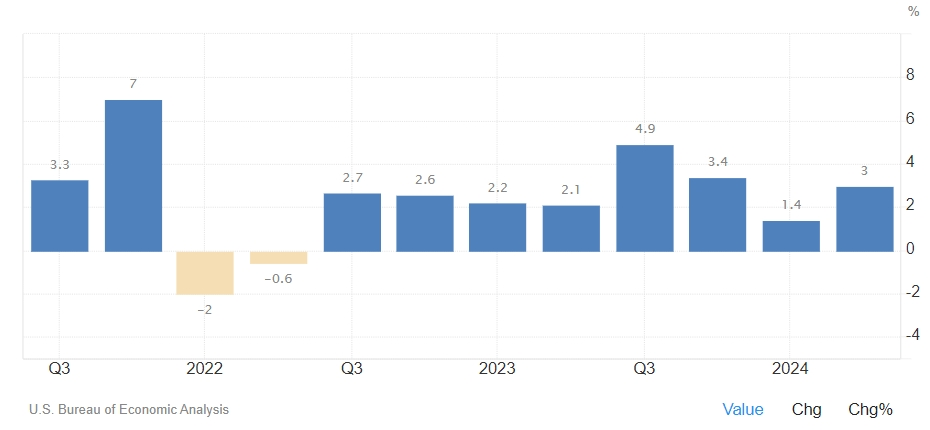

Strong growth in consumption and investment U.S. GDP revised up to 3% month-on-month in the second quarter

The data hit expectations that the United States would fall into recession.

On August 29th, the U.S. second-quarter real GDP annualized seasonally adjusted was unexpectedly revised up by 0.2 percentage points to 3%; the first-quarter growth rate was 1.4%; the U.S. second-quarter GDP deflator annualized seasonally adjusted was revised to 2.5%, both the expectation and the preliminary value were 2.3%.

This data has dampened market expectations of a U.S. recession.

After the data release, the U.S. dollar rose. The U.S. dollar against the Japanese yen, which is most sensitive to economic expectations, rose to a one-week high of 145.55, eventually rising by 0.1% to 144.77. The U.S. dollar against the euro also rose, with the single European currency falling by 0.4% to 1.1077. This week, the euro has fallen by 1.04%, the largest single-week drop since early April.

The U.S. dollar index rose by 0.3% to 101.35. This week, the U.S. dollar index has risen by a total of 0.6%, which is expected to be the largest single-week increase since early April.

Looking specifically at this data.

The U.S. second-quarter economic revision was mainly due to strong growth in personal consumption expenditure and corporate investment.

Personal consumption expenditure, which accounts for about 70% of the total U.S. economy, grew by 2.9%, an increase of 0.6 percentage points from the first estimate; non-residential fixed asset investment, which reflects the state of corporate investment, grew by 4.6%, with equipment investment growing by a significant 10.8%; residential fixed asset investment fell by 2%, after a substantial increase of 16% in the first quarter.

If calculated by contribution, the above two factors also significantly boosted the U.S. economy in the second quarter.

Personal consumption expenditure contributed 1.95 percentage points to the U.S. economic growth in the second quarter; government consumption expenditure and investment contributed 0.46 percentage points to the growth of the quarter; private inventory investment contributed 0.78 percentage points to the growth of the quarter; net exports dragged down the economic growth by 0.77 percentage points.

Analysts say that the recession panic triggered by the July non-farm data was short-lived and overblown, and the decline in the U.S. dollar also seemed a bit "too soft" compared to the aggressive rate cut pricing triggered by it. The 3% growth rate in the second quarter shows that the U.S. economy is still resilient under the current high interest rates and is expected to achieve a "soft landing."

Some analysts also believe that the risk of a U.S. economic recession may be exaggerated and does not support a more significant rate cut by the Federal Reserve. Goldman Sachs has reduced the possibility of the U.S. falling into a recession next year from 25% to 20%. The bank also said that if the non-farm data in early September is also good, it will be further reduced to 15%.

Deutsche Bank also said that if the labor market remains stable, the Federal Reserve may choose to gradually cut interest rates by 25 basis points, rather than a large one-time cut. However, if the labor market outlook worsens or there is a risk of economic downturn, the Federal Reserve may take more aggressive rate-cutting measures.

At present, the market is watching the U.S. core personal consumption expenditure (PCE) price index, which will be announced on Friday, as the Federal Reserve's preferred inflation indicator. If this indicator performs well, the possibility of the Federal Reserve cutting interest rates in September will greatly increase.

Yesterday, according to another official report, the number of people applying for unemployment benefits in the U.S. decreased by 2,000 in the week ending August 24th, adjusted seasonally to 231,000 people, lower than the 232,000 people predicted by economists beforehand. The U.S. economy remains resilient.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.