On the heels of Barclays Goldman Sachs expects the Fed to "stay put" in the next six months

Following Barclays, Goldman Sachs' U.S. interest rate strategist says the Fed will not cut rates as much this year as the market predicts。

It is reported that after Barclays, Goldman Sachs' U.S. interest rate strategist said that the Fed will not cut interest rates this year as much as the market forecast.。

Contrary to the market, Goldman Sachs believes that the Fed will "stay put" in the next six months.

Currently, the pricing of swap contracts tied to the date of the Fed's meeting shows that the Fed's policy rate will be about 70 basis points lower than the current rate by the end of the year。Goldman Sachs strategists, led by Praveen Korapaty, said in a note that they recommend buying the contract corresponding to the December Fed meeting because Goldman expects it to rise。

Goldman Sachs strategists also pointed out that after the Fed has carried out a series of interest rate hikes, there are usually two meetings to decide not to take any action on interest rates, so the most likely thing to happen in the next six months is that the Fed chooses to "stay put."。

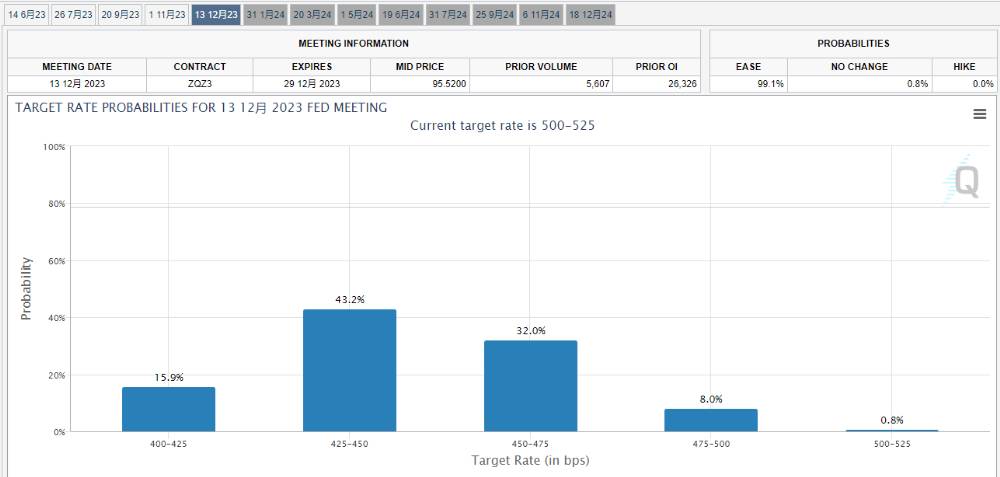

The report also said that this view does not match the degree of easing this year now priced in by the market.。According to the CME (CME) Fed observation tool shows that in June and July this year, the probability of the Fed "hold still" was 88% and 59%, respectively..7%, while the probability of maintaining current interest rates in September and November is 28.4% and 5.6%。And the closer you get to the end of the year, the higher the probability that the market will expect a rate cut。

Barclays advises clients to cut expectations for rate cuts this year, hedge funds expect Fed to keep rates high

In addition to Goldman Sachs, strategists at Barclays made similar comments last week.。Last week strategists at Barclays advised clients to cut their pricing expectations for this year's rate cut, suggesting that at 95.06 The price is short this August U.S. federal funds rate futures.。

The latest futures position data from the Commodity Futures Trading Commission (CFTC) seems to indicate that hedge funds expect the Fed to keep interest rates higher for longer.。Before last Wednesday's Fed meeting, hedge funds held their largest short positions in U.S. Treasury futures on record。At the same time, a noteworthy point about last-cycle options is that the rate cuts in SOFR (Guaranteed Overnight Funding Rate) futures pricing are gradually diminishing。

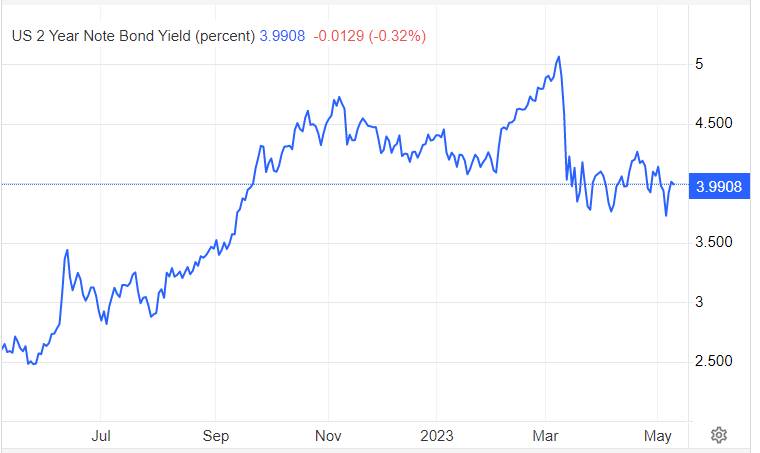

2-year U.S. bond yields higher this week, Wednesday and Thursday will meet U.S. inflation data

Yields on the interest-sensitive two-year Treasury note rose 9 basis points on Monday。Earlier, a survey of the Fed's senior credit officers showed that U.S. credit markets had tightened only slightly。As of press time, today's two-year U.S. Treasury yield is at 3.9908。

Last week, the Federal Reserve released the minutes of the May Federal Open Market Committee (FOMC) monetary policy meeting, raising the target range for the federal funds rate by 25 basis points to 5% to 5%..Between 25%, in line with market expectations。

The U.S. CPI and PPI for April will be released on Wednesday and Thursday, so this week will enter a critical period in the pricing of the Fed's interest rate policy this year。Bank of America expects U.S. CPI to grow by 0 in April.39%; core inflation grew 0.34%。

Currently, the probability of the Fed maintaining current interest rates by December of this year is only zero, according to the Fed's observation tool of the CME (CME).8%, the probability of a 25 basis point, 50 basis point, 75 basis point, 100 basis point rate cut is 8.0%, 32.0%, 43.2% and 15.9%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.