UK unemployment rate unexpectedly falls in second quarter, no rate cut expected in September

Markets expect the Bank of England to hold off at its September meeting, followed by another rate cut in November.

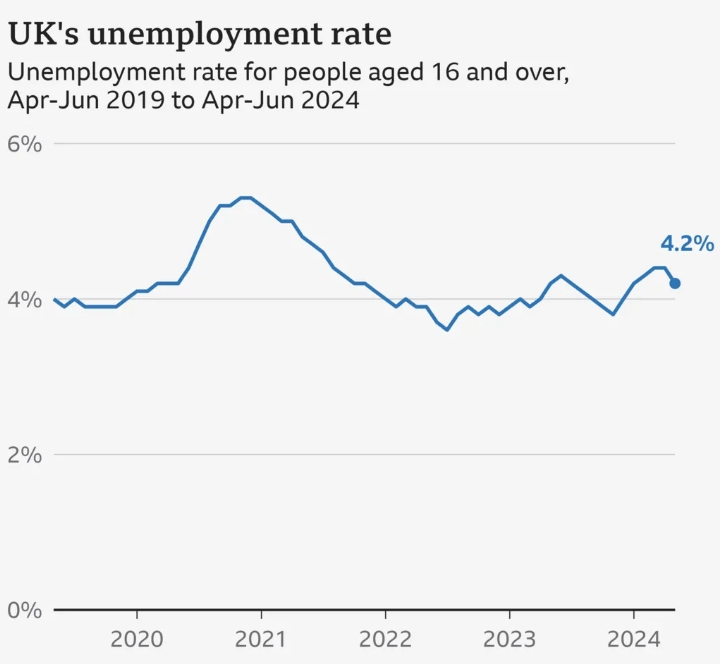

On August 13th, the latest data released by the UK Office for National Statistics showed that the unemployment rate in the UK unexpectedly dropped to 4.2% in the second quarter, far below the expectations of economists and the Bank of England's previous forecasts.

Against the backdrop of companies increasing their recruitment efforts, the number of employed people surged by 97,000, far exceeding the expected 3,000, demonstrating the resilience of the UK economy.

Despite some questioning the reliability of the labor force survey, for investors, this data is interpreted as a potential inflation signal of a strong economy—the decline in the unemployment rate and the increase in the number of employed people pose a new challenge to the Bank of England's monetary policy decisions. Against the backdrop of current global economic uncertainty, the Bank of England's continued interest rate cuts have become a focus of market attention.

After the data was released, the British pound rose by 0.3% against the US dollar, exceeding 1.28, becoming the best-performing currency in the G10 group. The weak employment data in the United States in recent weeks contrast sharply with the UK, further highlighting the resilience of the UK economy.

However, the regular wage increase in the UK for the second quarter fell to 5.4%, the lowest year-on-year increase since the summer of 2022. The total compensation increase, including bonuses, also fell sharply from 5.7% to 4.5%, largely driven by one-time bonuses paid to National Health Service (NHS) employees last year.

While the number of employed people rose across the board, there was a substantial decline among young people aged 16 to 17 in the second quarter. In addition, in July, the number of employees in enterprises increased by more than 24,000, more than twice the predicted increase by economists, showing the enterprises' optimistic attitude towards the labor market.

Regarding this data, Nomura Securities said that investors may question the weak US labor market and the sluggish GDP growth in the eurozone, but the UK does not seem to face this problem. "The UK labor market data and economic activity data are still strong, supporting our view that there is a difference between the Federal Reserve and the Bank of England."

On August 1st, the Bank of England announced an interest rate cut for the first time in more than four years, deciding to reduce the interest rate by 25 basis points to 5%.

The Bank of England believes that the CPI increase in May and June was at the target of 2%, and it is expected that the CPI will rise to about 2.75% in the second half of this year. This is due to the gradual exit of last year's energy price decline from the annual comparison base, more clearly revealing the persistence of domestic inflationary pressure. So far this year, GDP has rebounded significantly, but the underlying momentum seems to be weak.

The Bank of England expects that as the inflation rate falls and many inflation expectation indicators normalize, the momentum of wage and price increases will continue to weaken. As GDP falls below potential levels and the labor market further loosens, the economy will experience a certain degree of idle capacity. Due to the restrictive stance of monetary policy, domestic inflationary pressure in the UK is expected to gradually subside.

However, the Governor of the Bank of England refused to comment on the timing of the next interest rate cut.

On September 19th, the bank will issue another interest rate decision. The market expects that the Bank of England will hold its position at the September meeting and then cut interest rates again in November. Bank of England officials said that they will act cautiously in the future while assessing the strength of domestic price pressures.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.