U.S. July CPI Release: A Data That's Neither Good Nor Bad

The current Fed rate cut is almost a foregone conclusion, and it is the quality of the employment data that determines the magnitude of the rate cut.

A highly anticipated set of data.

Following the cold reception of the non-farm data in July, the global carry trade unwinding, and the stock market crash, the market is in urgent need of a moderate inflation data to soothe the mood. The PPI data in the United States in July has already sounded the prelude, and the market is looking forward to finding more confidence in interest rate cuts in the CPI data of the same month.

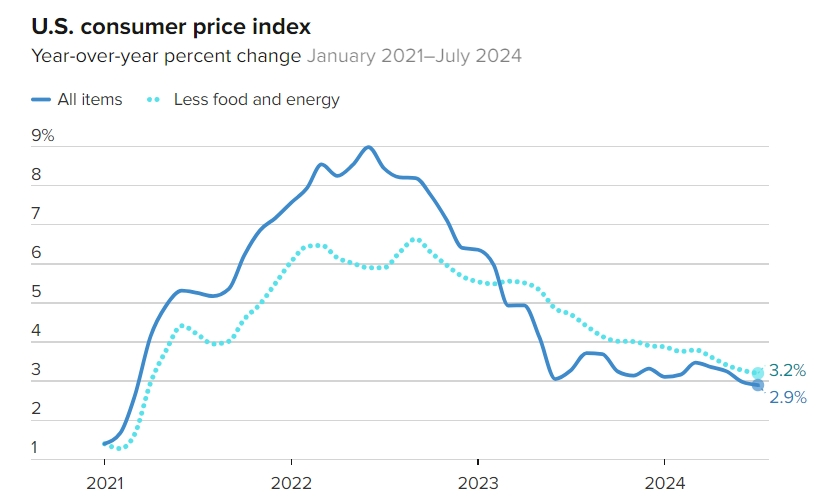

On August 14th, the U.S. Department of Labor released the Consumer Price Index (CPI) data for July, showing that the CPI increased by 0.2% month-on-month and 2.9% year-on-year, which is the smallest year-on-year increase since March 2021. The core CPI, which excludes the fluctuations of food and energy prices, increased by 0.2% month-on-month and 3.2% year-on-year, which is the smallest increase since April 2021.

How to evaluate this data? It's not so good as to make the market think that the United States is about to fall into a recession, but it's not so bad as to make the market firmly believe that the Federal Reserve will start raising interest rates again.

Let's look at this data in detail.

The rise in housing costs accounts for the vast majority of the increase in CPI, which is contrary to the market's expectation of easing housing costs, indicating that the inflationary pressure in the housing market may last longer than expected.

Although car prices continue to fall, the rise in car insurance costs shows that even if prices fall in some commodity areas, the cost pressure in the service industry may still be rising.

The decline in medical, clothing, and core commodity prices indicates that inflation is indeed showing signs of weakness in some areas, which may herald a broader easing of price pressures.

After the data was released, Huajin Securities said that the core CPI in the United States cooled down slightly again in July, with the main drag shifting from the previous oil-related items to items closely related to wages. The structural change in core inflation in July will largely ease the market's worries about the rapid recession of the U.S. economy, and the overall trend of residents' consumption demand is still relatively stable.

Huafu Securities stated that the inflation in the United States is likely to continue the downward trend in the third quarter, opening up space for the Federal Reserve to cut interest rates for the first time in September: Looking forward, the base of the CPI in August-September 2023 is relatively high, and assuming a 0.2% increase, the CPI in August-September is expected to fall to around 2.7%.

After the inflation data in July was released, the market's expectations for the Federal Reserve's target interest rate path remained basically unchanged, still expecting a 100 basis point cut this year, which is more dovish than the Federal Reserve's guidance.

Market analysts generally believe that the further cooling of inflation provides room for the Federal Reserve to cut interest rates at the September meeting.

The well-known asset management company Principal Asset Management said after the data was released: "Today's CPI data eliminates any remaining inflationary obstacles that may prevent the Federal Reserve from starting the interest rate cut cycle in September, but the data also shows that there is no urgency for a 50 basis point cut."

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, said: "Although inflation is declining, some areas are still stubborn. We must closely monitor inflation data and employment data."

After inflation declines, some institutions believe that the market should pay more attention to employment data. If the employment data continues to decline, it may more smoothly open the door for the United States to cut interest rates.

Xiao Jinchuan, the Chief Analyst of Huaxi Securities, pointed out that the premise for the Federal Reserve to accelerate the interest rate cut is a significant slowdown in labor market demand. A neutral scenario is to cut interest rates once every quarter by 25 basis points before the core inflation clearly drops to around 2%, to keep the restrictive interest rate to continue suppressing inflation towards 2%.

The conditions needed for the Federal Reserve to accelerate the interest rate cut process may be a continuous deterioration of the labor market for 2-3 months, such as a significant continuous decline in job vacancies and a continuous increase in the rate of layoffs initiated by companies.

The macroeconomic team of Minsheng Securities analyzed that the current interest rate cut by the Federal Reserve is almost certain, and it is the quality of the employment data that determines the magnitude of the cut.

At present, according to the CME "Fed Watch," the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 63%, and the probability of cutting by 50 basis points is 37%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.