Mixed Fortunes for U.S. ADP & Initial Jobless Claims; Will Today's Non-Farm Data Be the Decisive Blow?

Markets turned to non-farm payrolls data released later today to find more evidence of the extent of the September rate cut.

On September 5th, the United States released two employment reports with mixed outcomes.

Firstly, the U.S. employment figures for August were announced by ADP, a data known as the "little non-farm payroll" in the United States. Although this data has diverged from the non-farm data at times this year, it still holds some reference value for the market before the non-farm data is released.

The data revealed that the U.S. ADP employment only increased by 99,000 people in August, marking the lowest record since January 2021, significantly below the expected 145,000 and the previous figure of 122,000. This "poor" employment data echoed the U.S. job vacancy data announced on Wednesday, which also hit the lowest point since January 2021. Both of these lagging indicators are suggesting one thing: the U.S. labor market is cooling down.

Upon closer examination of the ADP data, it's not as bad as it seems. The annual salary of employees on the job increased by 4.8%, roughly the same as in July. Additionally, despite a slowdown in hiring, out of the 10 industries surveyed, only three experienced layoffs, while the remaining seven saw varying degrees of growth.

Among them, the education and health services sector added 29,000 positions; the construction industry added 27,000 positions; other services added 20,000 positions; the financial activities sector added 18,000 positions; trade, transportation, and utilities added 14,000 positions; the mining industry added 8,000 positions; and the entertainment industry added 11,000 positions.

The sectors that experienced layoffs were professional and business services, manufacturing, and information services, with reductions of 16,000, 8,000, and 4,000 people, respectively.

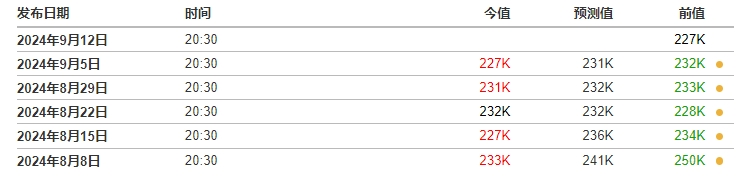

Another data set announced yesterday, the U.S. initial jobless claims for the week ending August 31st, stood at 227,000, the lowest level since early July, somewhat redeeming the employment data. Compared to the ADP data and job vacancy data, the initial claims data has a later cutoff time, providing a more accurate reflection of the recent labor market conditions.

The data also showed that the number of continuing jobless claims in the U.S. dropped to a three-month low, reaching 1.838 million, again below the expected 1.869 million, and decreased from the previous figure.

The release of the two employment data sets once again sparked a rise in risk-aversion sentiment, with U.S. Treasury yields falling in the short term and hitting a daily low, only to rise again after the release of the better-than-expected services PMI data, subsequently hitting a daily high. Among the three major U.S. stock indices, only the Nasdaq closed higher, with the S&P 500 falling by 0.3% to 5,503.41 points; the Dow Jones fell by 0.54% or 219 points to 40,755.75 points; the Nasdaq rose by 0.25% to 17,127.66 points. The VIX fear index closed down by 6.66%, reporting at 19.90.

Currently, the market is turning to the non-farm data to be announced later today for more clues on the extent of interest rate cuts in September.

Regarding the current employment situation, Chicago Fed President Goolsbee stated that the long-term trends in the labor market and inflation data have proven that the Federal Reserve should begin to lower interest rates soon and gradually ease monetary policy over the next year.

He also mentioned that the policy is currently at the most restrictive level of the entire tightening cycle, which began in early 2022. "If we maintain tightness for a long time, we will have to deal with issues in our mission of employment, which means that high interest rates will harm the labor market."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.