Foreign money is returning to Indian stocks after a sharp decline in the stock market.

Foreign investment is returning to the Indian stock market.

On December 10, compiled data showed that foreign funds were returning to the Indian stock market after a sharp decline in the Indian stock market due to growing optimism about interest rate cuts.

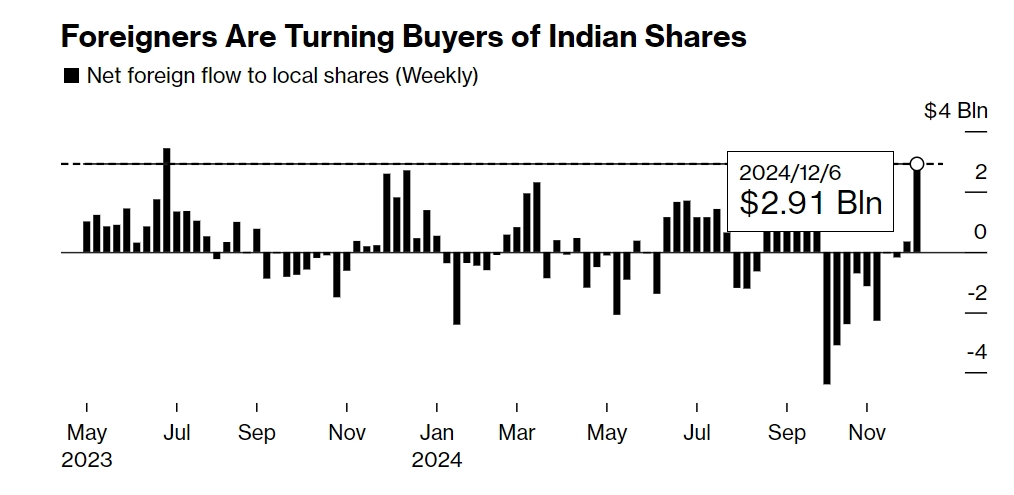

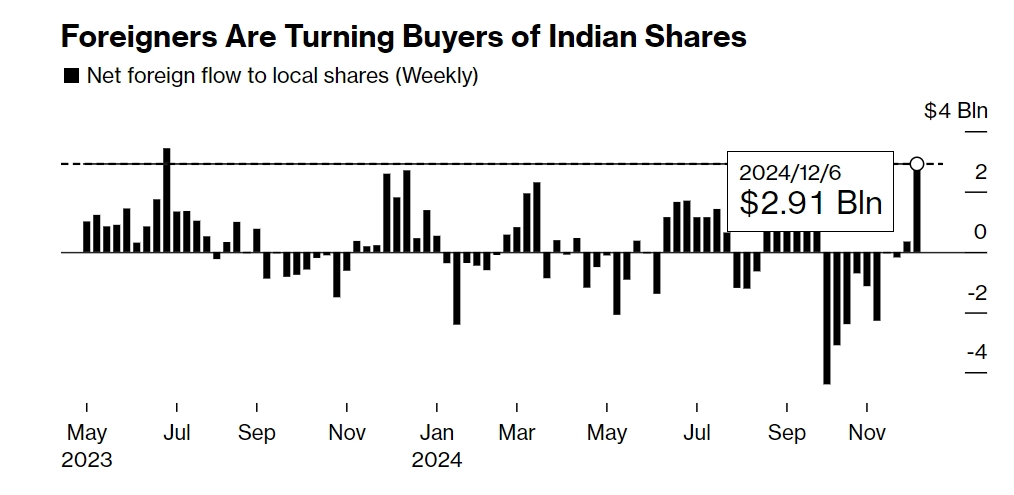

According to statistics, in the week ending December 6, overseas investors net purchased nearly US$3 billion in Indian stocks, the highest since June last year.This is the second consecutive week of buying after a $14 billion sell-off in the previous eight weeks.

The massive influx of funds has brought positive results.In early December, Indian stocks posted their best weekly gain since June, with the benchmark Nifty index rising 2%, echoing the Central Bank of India's decision to cut the cash reserve ratio on Friday.

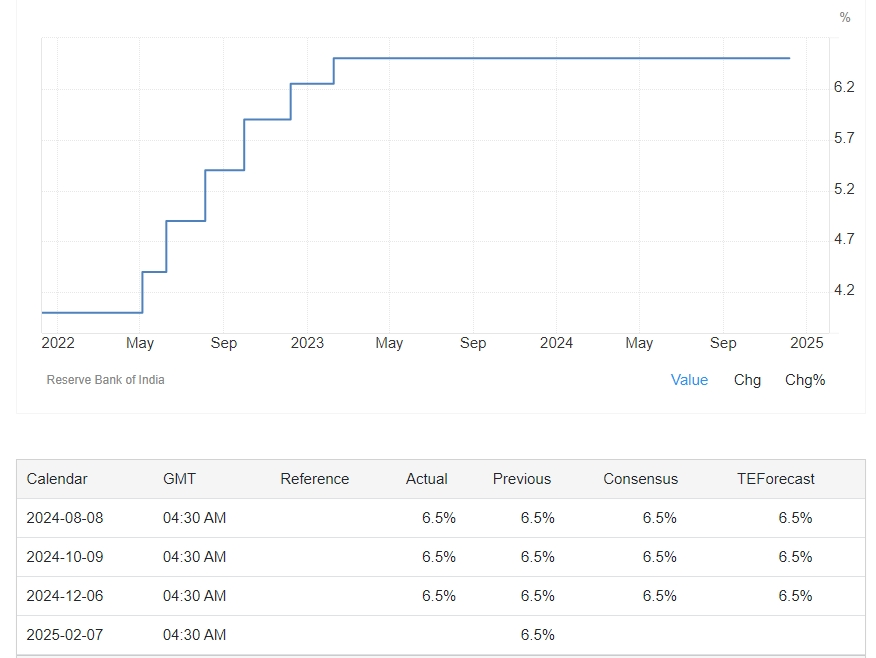

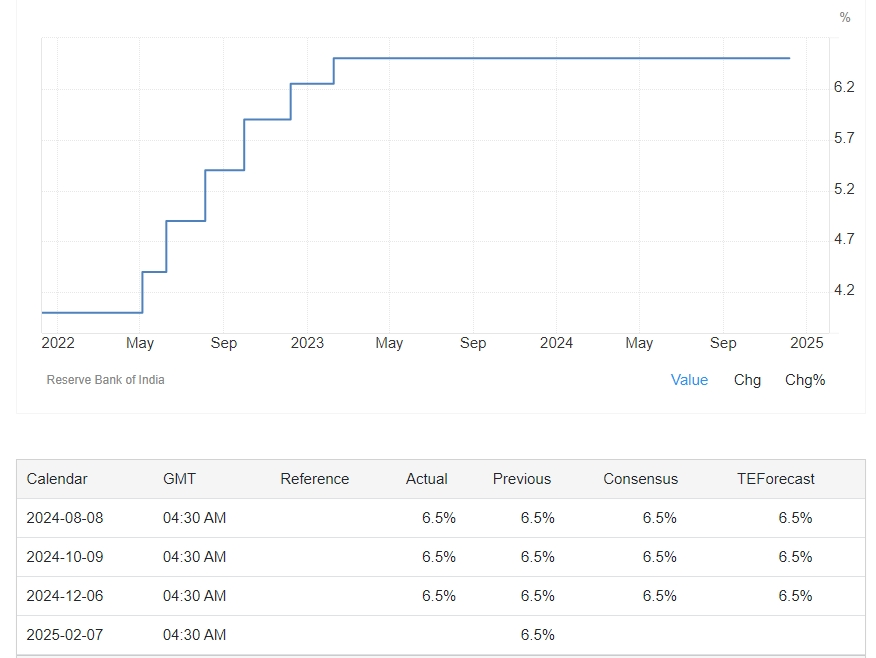

The Bank of India's Monetary Policy Committee decided to maintain the repo rate at 6.5% in line with expectations; and cut banks 'cash reserve ratio (CRR)-the proportion of deposits banks must deposit with the Bank of India-by 50 basis points to 4%, enhancing economic liquidity to address potential cash shortages.

At the same time, the RBI also said it would allow banks to raise deposit rates for Indians living abroad to attract foreign exchange to stop the rupee's devaluation.

The market believes that the next round of interest rate cuts has begun, and the seasonal positive effects around the end of the year are also conducive to long positions in stocks.

According to Motilal Oswal's latest customer notes, the agency is now betting on two major themes: consumer discretionary goods and electronic component manufacturers.Niket Shah, the company's chief investment officer, is bullish on companies that offer low-cost non-essential items such as jewelry and clothing.He predicts that the Indian government may issue more subsidies to the public to boost economic growth and thus increase spending.

He also focuses on opportunities in the electronic components industry, where production-related incentives and possible technology sharing in China could serve as catalysts for profitable growth.

On the negative side, Indian drug contract manufacturers suffered a setback on Monday after the United States failed to pass the Biosecurity Act.Shares of Syngene International and Neuland Laboratories fell the most.Investors are closely watching the stance of U.S. President-elect Trump on the issue when he takes office next month.

Indian stocks were little changed at the opening of the day as investors remained cautious while waiting for key Indian and U.S. inflation data to be released later this week.

As of press time, the NSE Nifty 50 index rose 0.02% to 24,622.55 points; the BSE Sensex index fell 0.02% to 81,500.77 points.

Eight of the 13 major sectors in the Indian stock market rose, but the gains were not large.Small-cap stocks, which are broader and more domestically focused, rose 0.5%, while mid-cap trading was flat.