US July PPI rises modestly September rate cut further

As soon as the PPI data came out, the market's confidence in the September rate cut went further.

August 14th, another significant data release.

The United States released the July PPI data that tracks production costs. At the juncture of the Federal Reserve's interest rate cut, every piece of data related to prices is particularly important.

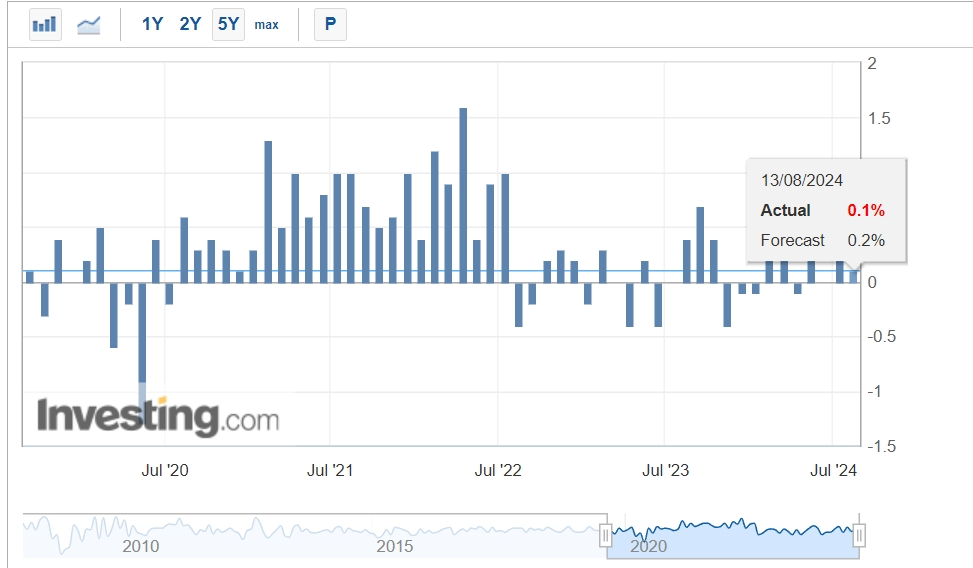

The data shows that the U.S. PPI rose by 0.1% month-on-month in July and 2.2% year-on-year, lower than market expectations, indicating that inflationary pressures continue to ease. The core PPI remained flat compared to the previous month and rose by 2.4% compared to the same period last year. The core PPI data excludes the impact of food and energy price fluctuations and is a price indicator that better reflects the underlying inflation level.

Looking at specific industries, the U.S. service prices fell by 0.2% month-on-month in July, the largest decline since March 2023, while the prices of goods rose by 0.6% month-on-month, with prices slightly picking up. Energy prices increased by 1.9%, and food prices increased by 0.6%. This indicates that despite some fluctuations in individual items, the upward pressure on the production costs of U.S. companies has been somewhat alleviated against the backdrop of gradually stabilizing supply chains and slowing demand.

Once the PPI data was released, the market's confidence in the interest rate cut in September took a step further.

Yesterday, U.S. Treasury yields fell, and the stock market rose. Investors believe that the weak PPI data may prompt the Federal Reserve to more actively reduce borrowing costs this year.

Jack McIntyre, a portfolio manager at the well-known investment institution Brandywine Global Investment Management, said that the weak PPI report has relieved the market. Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, also expressed the possibility of cutting interest rates before the end of 2024.

There are also institutions that say there is no need to rush to cut interest rates in September.

Investment institution FWDBONDS said that although the July PPI report did not meet expectations in terms of the increase, there was no sign of PPI deflation, which gave Federal Reserve officials some breathing space and made them not rush to make a decision on interest rate cuts. The U.S. Department of Labor's report also shows that most of the components that make up the Personal Consumption Expenditures (PCE) price index are favorable, which may allow the U.S. central bank to pay more attention to the labor market rather than the price index.

It is worth noting that the U.S. unemployment rate in July has also reached 4.3%, the highest point in nearly three years. However, economists generally believe that this data is not enough to trigger a panic about a recession. In fact, the Small Business Confidence Index of the National Federation of Independent Business (NFIB) in the United States has risen for the fourth consecutive month, showing that businesses are gradually regaining confidence in the future economy.

Overall, the moderate rise in the July PPI data, along with a slight increase in the unemployment rate, has provided the Federal Reserve with more flexibility in formulating monetary policy. The market generally expects that the Federal Reserve will consider cutting interest rates at the meeting in September, but the specific extent and speed of the cut will still depend on the future release of the Consumer Price Index (CPI) and retail sales data.

From a longer-term perspective, although inflationary pressures have eased in the short term, the Federal Reserve still needs to closely monitor the long-term trend of inflation and changes in the labor market to ensure stable economic growth. At the same time, companies also need to continue to cope with challenges in terms of prices, interest rates, and labor costs, and find strategies to maintain competitiveness in the constantly changing market environment.

As of the time of writing, according to CME's "FedWatch": The probability of the Federal Reserve cutting interest rates by 25 basis points in September is 46%, and by 50 basis points is 54%. The probability of the Federal Reserve cutting interest rates by a total of 50 basis points by November is 29.6%, by 75 basis points is 51.2%, and by 100 basis points is 19.2%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.