U.S. July "terror data" ignited the market Na indicators to achieve six consecutive gains

This powerful data shattered expectations that the United States would enter a recession in the short term.

A data report that ignites the market.

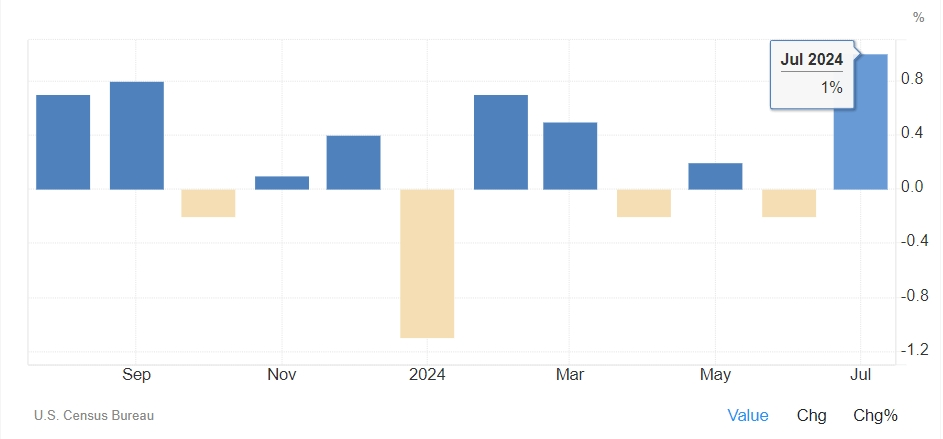

On August 15, the US Department of Commerce released retail sales data for July. As one of the most important and timely pieces of data in the United States, the release of retail sales data often causes significant market fluctuations and is known as the "terrifying data" in the US.

According to the published data, US retail sales in July increased by 1% month-on-month, the highest since January 2023, with sales in automobiles, electronics, food, and other categories all showing varying degrees of growth.

Even when looking at the smaller items, this data appears almost "flawless". Sales of automobiles and parts rose by 3.6% month-on-month; sales of electronics and home appliances increased by 1.6%; food sales increased by 0.9%; building materials sales grew by 0.9%; and health care product sales increased by 0.8% month-on-month.

Only the sales of clothing products fell by 0.1% month-on-month, and the sales of sports equipment, musical instruments, and books fell by 0.7%, dragging down the data, but the overall impact is not significant.

This strong data shattered the expectation of the US entering a recession in the short term, and the three major US stock indices rose in response, with both the Nasdaq and S&P 500 achieving a six-day increase.

As of the close, the Dow Jones increased by 554.67 points, a rise of 1.39%, to 40,563.06 points; the Nasdaq rose by 401.90 points, a rise of 2.34%, to 17,594.50 points; the S&P 500 index increased by 88.01 points, a rise of 1.61%, to 5,543.22 points.

The share prices of tech giants such as Tesla and Nvidia have risen sharply, showing investors' optimistic attitude towards the technology sector. In particular, Tesla has upgraded its electric pickup Cybertruck and suspended orders for the rear-wheel-drive version, showing the company's adaptation to the current production situation and expectations for future adjustments.

At the same time, the financial reports of major US retailers have also boosted market confidence. Walmart, the world's largest retailer, saw a 4.2% year-on-year increase in same-store sales and raised its annual profit forecast, further confirming the resilience of consumer spending. Doug McMillon, CEO of Walmart, said there is currently no sign of overall consumer weakness.

Institutions have also joined in to cheer for the US stock bulls.

Mona Mahajan, a senior investment strategist at Edward Jones, also said that the retail sales data for July helped ease market concerns about the US economy falling into a recession. She added that although consumers may be cooling down, they have not collapsed.

Peter Cardillo, Chief Market Economist at Spartan Capital Securities, pointed out that the retail sales data is key, indicating that the vitality of US consumers is much stronger than expected, which reduces the concern about a recession and is good news for the stock market, but may not be for the bond market.

However, despite the strong retail sales data, there is still uncertainty in the US labor market.

The unemployment rate in July rose for the fourth consecutive month to 4.3%, causing market concerns about whether the Federal Reserve has cut interest rates too late. However, the number of initial jobless claims announced last week was 227,000, lower than expected, showing the robust side of the US labor market.

Analysts say the labor market is slowly cooling down, contrary to the more drastic slowdown expected. At the same time, consumer spending continues to drive the "American exceptionalism" narrative. Overall, the current situation means that the Federal Reserve may start easing policy in September, but there is no need to rush to cut interest rates by 50 basis points. Although the prospect of reducing the amount of interest rate cuts in the past has put pressure on the stock market, this time, the idea that a recession is not imminent has driven the stock market up. This is ultimately entirely good for the stock market.

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said that when there are signs of cooling in the labor market, the Federal Reserve cannot be "late" in easing monetary policy. As inflationary pressures ease, policymakers also need to recognize the Federal Reserve's responsibility to maintain full employment.

It is worth noting that Bostic has voting rights in the FOMC committee this year, and he is open to cutting interest rates in September.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.