Britain's May inflation hit a glorious target, but interest rate cuts have to wait

UK inflation has reached its target level despite the Bank of England's painstaking efforts.But markets say the Bank of England is still unlikely to cut interest rates when it announces its decision tomorrow.

Before the Election, UK Inflation Rate Falls to BoE's Target for the First Time in Nearly Three Years

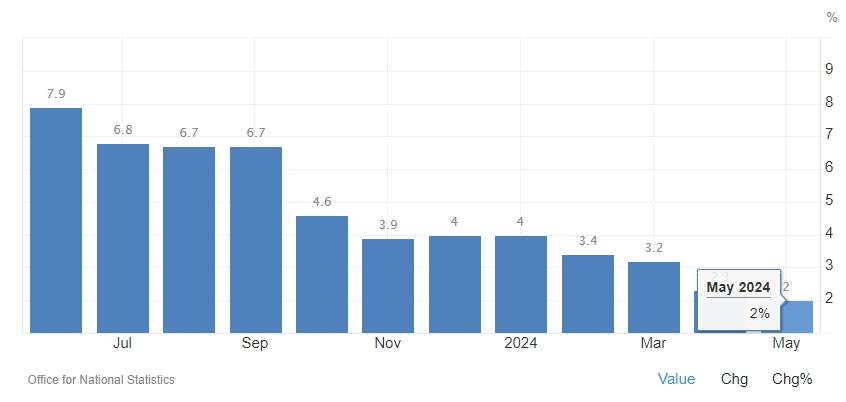

On June 19, according to data from the Office for National Statistics (ONS), the annual rate of the Consumer Price Index (CPI) in May fell to 2.0% from 2.3% in April, hitting the Bank of England's (BoE) target level of 2%.

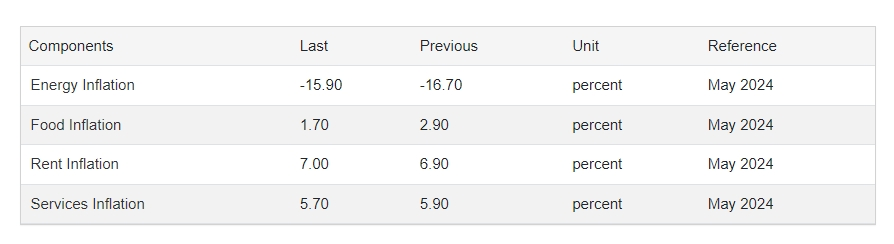

The monthly rate recorded an increase of 0.3%, the same as in March; the core inflation rate dropped to 3.5%, down from 3.9% in April, aligning with expectations. In the services sector, closely monitored by the BoE, May inflation was 5.7%, also lower than the previous month's 5.9%. Since the services sector dominates the UK economy, it could directly impact overall inflation.

The ONS stated that the biggest reason for the price decline was the drop in food prices. According to the latest data released by UK market research company Kantar on Tuesday, unusual adverse weather in the UK led to the slowest growth in grocery sales in nearly two years. In the four weeks ending June 9, UK grocery sales grew by only 1.0%, marking the 16th consecutive month of declining inflation.

The largest contributor to overall price increases was the catering and hospitality industry. The ONS noted that after a rise in the UK's minimum wage, there was a surge in consumption in this sector. Additionally, rent and fuel costs were significant factors driving up service prices.

Despite the BoE's arduous efforts to bring UK inflation to its target level, the market suggests that the BoE is still unlikely to cut interest rates when it announces its decision tomorrow.

Zara Nokes, a global market analyst at JPMorgan Asset Management, stated that due to still overheated service sector inflation, UK inflation might not stay at the 2% level for long.

Azad Zangana, Senior European Economist and Strategist at Schroders, also warned that as the UK gradually removes the energy price cap, inflationary pressures may gradually emerge in the second half of the year.

The National Institute of Economic and Social Research (NIESR) stated that although this data is positive news, they expect inflation to rebound starting from June.

Analysts predict that by the end of this year, UK inflation will rise back to 2.4% before fully slowing to the 2% target.

Additionally, the UK will hold a general election on July 4. Before the election battle, the BoE is expected to keep interest rates unchanged to avoid influencing the election outcome. Traditionally, rate setters have avoided making public statements during the campaign period, although they have previously expressed concerns about potential inflation indicators.

Polls indicate that the opposition Labour Party is set to achieve a landslide victory in this election.

Currently, economists expect the BoE to cut interest rates in August, while the market has fully priced in a rate cut in November. The probability of a rate cut in September is only 50%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.