UK services inflation in June far exceeds central bank expectations, interest rate cut in August in doubt

Almost at the same time as the inflation report was released, traders significantly reduced their bets on a rate cut next month, cutting the possibility of a rate cut on August 1 from 40% yesterday to 25%.

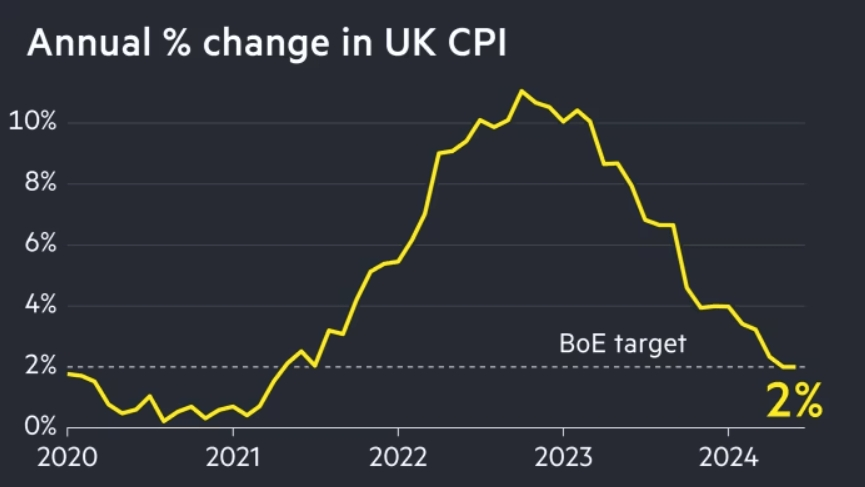

On July 17, the UK Office for National Statistics released inflation data for June. The data showed that the UK's Consumer Price Index (CPI) increased by 2% year-on-year in June, matching the previous value; core inflation grew by 3.5% year-on-year, in line with the figure for May, and consistent with market expectations.

Overall, the nominal inflation in the UK for June continued to hover around the Bank of England's 2% target level, but it was slightly higher than the economists' forecast of 1.9%.

In terms of categories, the UK's service sector inflation reached as high as 5.7% in June, far exceeding the Bank of England's own forecast of 5.1%.

As a key indicator monitored by the Bank of England, the persistently high service sector inflation has intensified the market's pessimistic view of the prospects for a rate cut. Analysts say that with this inflation indicator, officials might think that although inflation has returned to the target level, it may not stay there for long. There is still a risk of a rebound in UK inflation.

Yael Selfin, Chief Economist at KPMG UK, said that despite the UK inflation data staying within the target range this time, the honeymoon period may not last. According to KPMG's latest analysis report, the UK inflation rate could rise back to 3% by the end of the year. Huw Pill, the Bank of England's Chief Economist, also expressed concern about "the lingering inflationary forces in the labor market and the service sector."

Almost at the same time as the inflation report was released, traders significantly reduced their bets on a rate cut next month, cutting the possibility of a rate cut on August 1 from 40% yesterday to 25%. The pound quickly strengthened, erasing the day's losses, with a short-term jump of 0.1%, and the pound-to-US dollar exchange rate rose towards 1.3000.

In addition, the UK's hotel and catering prices rose by 6.3% year-on-year in June, higher than the 5.8% in May, also contributing to inflation. The UK Office for National Statistics said that the year-on-year increase in hotels and catering was almost entirely due to the rise in hotel room prices, with the monthly growth rate reaching a terrifying 8.8%.

The main factors dragging down inflation in June came from clothing and footwear, followed by the decline in used car prices. The pressure of food inflation also continued to ease, further reducing the burden on UK households. The UK's food and non-alcoholic beverage prices rose by 1.5% year-on-year in June, the lowest in nearly a year. Since the high point of 19.2% in March 2023, UK food prices have been falling for 15 consecutive months.

Another hidden concern for the downward trend of UK inflation is the country's hot labor market. Survey reports say that the "tight labor market and significant increase in the minimum wage" in the UK are still forcing companies to pay higher wages to attract employees, and the additional labor costs may be passed on to consumers through higher product prices, which could indirectly raise the level of inflation.

At present, Bank of England officials have maintained the benchmark interest rate at a 16-year high for nearly a year, and other officials, including Pill, have said that before the central bank eases monetary policy, they hope to see more concrete evidence that price pressures are subsiding. If the UK really starts to cut interest rates next month, it will undoubtedly be good news for the new Prime Minister of England, Keir Starmer, and the Labour Party he leads.

Tomorrow, the UK will also release employment data for June, and economists expect that the regular wage growth rate in the UK will fall below 6% for the first time in 20 months. Although this figure is still far above the target level that central bank officials can tolerate, in any case, the slackening of the labor force will have a negative impact on price increases, which may strengthen the confidence of decision-makers to lower interest rates.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.