U.S. January 2024 PCE report: data in line with expectations, but inflation worries remain

The latest PCE inflation data shows that the road to progress in the fight against high inflation is bumpy。

Another blockbuster data comes out ahead of the Fed's March decision。

U.S. January PCE data in line with expectations U.S. three indices closed higher

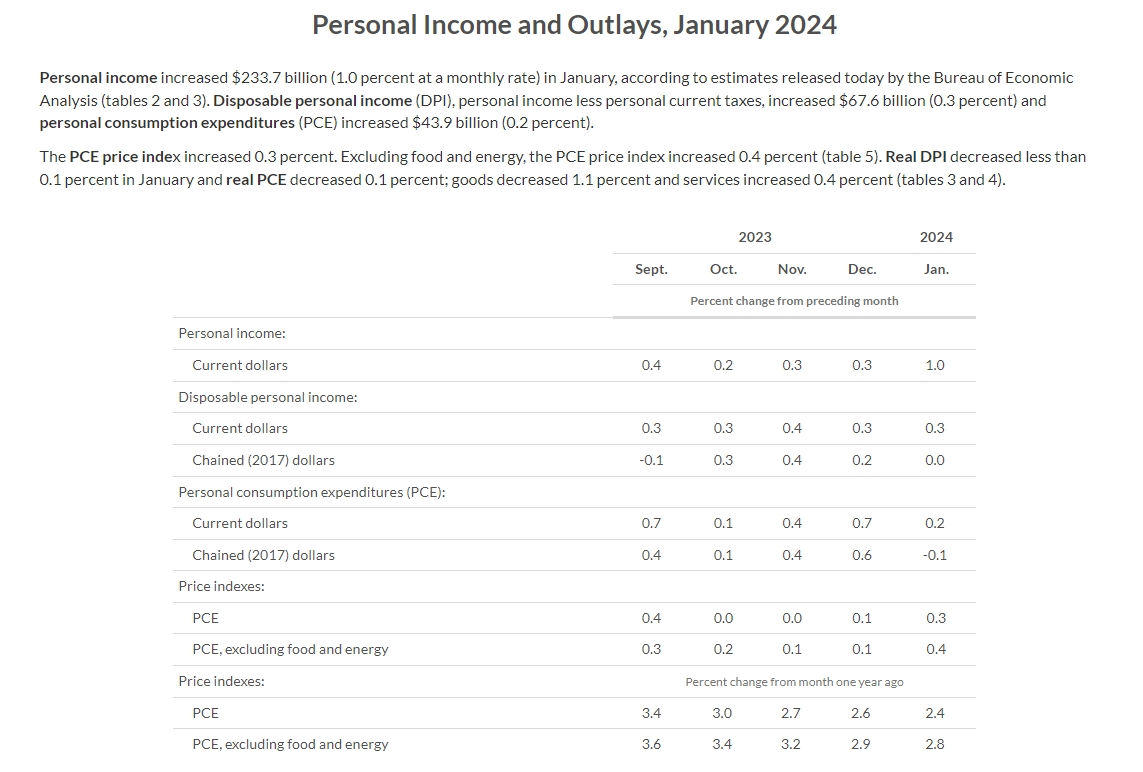

On February 29, local time, the Fed's favorite inflation indicator, the core PCE price index, was released, with data showing that the year-on-year growth rate of the core PCE price index fell back to 2 in January 2024..8%, in line with market expectations, the smallest increase since March 2021;.2% Rebound to 0.4%, in line with the expected 0.4%, the largest increase since April 2023。

The US economy is resilient。U.S. personal income unexpectedly rose 1% in January, well above expectations of 0.3%。Decrease in expenditure 0.1%, expected growth of 0.2%。The January price index, as well as personal income growth, reflect that as the economy slowly emerges from the shadow of the epidemic, Americans are slowly moving from consumption to services.。

It is worth noting that although the U.S. core PCE price index grew at its lowest year-on-year rate since February 2021 in January, its overall PCE index and core PCE index remained above the Fed's 2% target。In addition, many inflation data also rebounded in January, January CPI, PPI data are more than expected, which led many institutions to January inflation data as an outlier under the influence of seasonal factors, the market turned to focus on the next February inflation data。

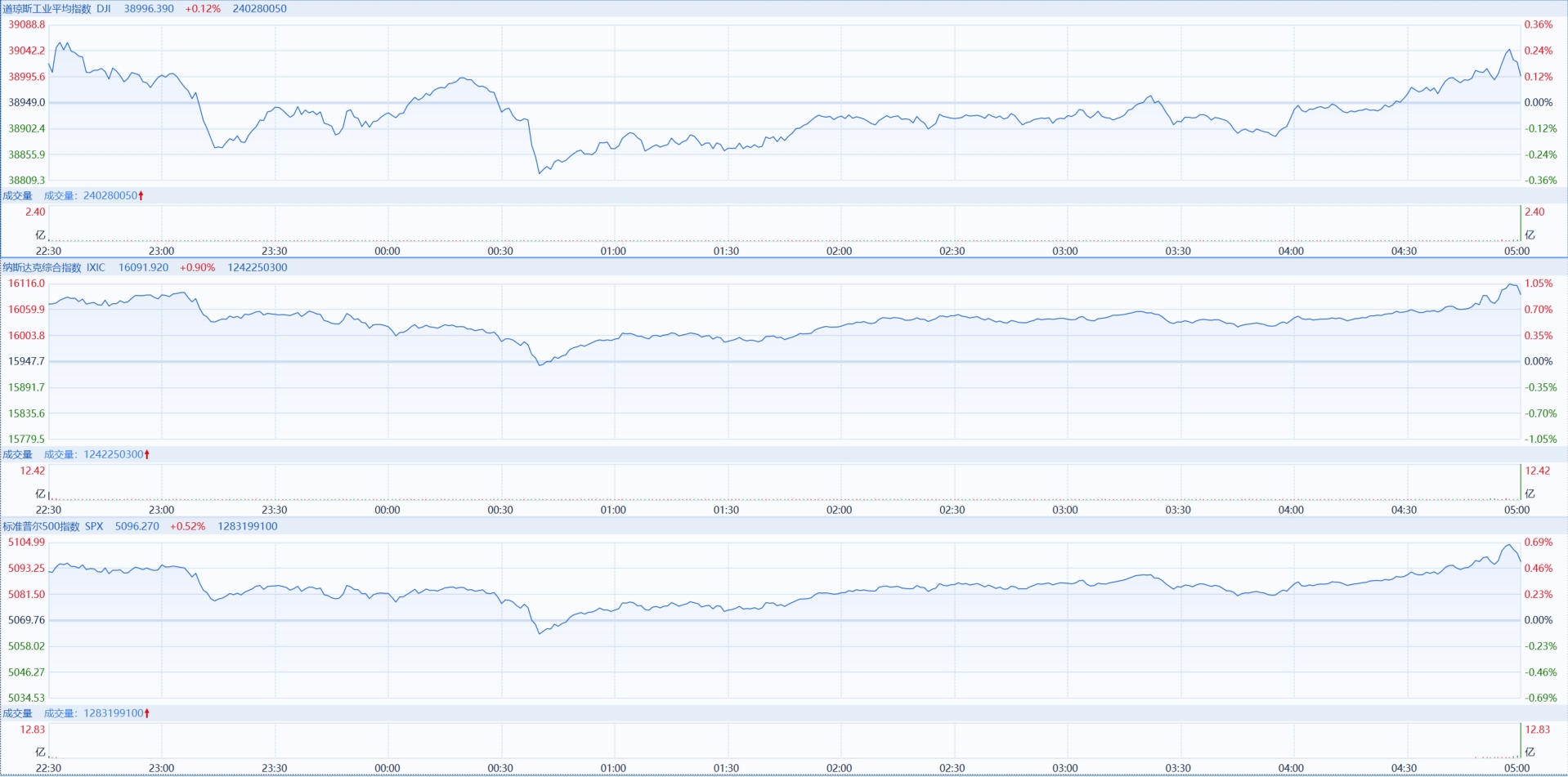

Still, temporarily in-line inflation data eased market concerns。U.S. stocks closed overnight, with the three major U.S. indexes collectively rising, with the Dow up 0.12%, Nasdaq up 0.9% to a new closing high, S & P 500 up 0.52%。

U.S. economy continues to be hot, interest rate cut is expected to be postponed

Commenting on the inflation report, Stephen Gallagher, chief US economist at Societe Generale, said: "Overall, (the report) was in line with expectations and some of the market's biggest concerns did not emerge.。The point is that we're not seeing the kind of broad-based inflation that we were more worried about before。"

For his part, David Alcaly, chief macroeconomic strategist at Lazard Asset Management (Lazard Asset Management), said: "The fiery inflation data in January added to uncertainty and pushed back expectations of a rate cut.。But it's still likely to be a speed bump, and while there may be more short-term volatility in market rhetoric, the depth of any rate cut cycle will ultimately be more important than when it starts。"

A number of senior Fed officials also spoke yesterday, among them, Atlanta Fed President Raphael Bostic (Raphael Bostic) said in his latest speech that inflation has not yet reached the target, it is too early to declare victory。

The latest PCE inflation data shows that the road to progress in the fight against high inflation is bumpy。Overall, however, Bostic believes that the slope of inflation is still declining, with inflation falling significantly more than he expected。If things go as he expects, it may be appropriate for the Fed to start lowering interest rates in the summer。

Like Bostic, Chicago Fed President Austan Goolsbee said in a statement Thursday that he expected a rate cut later this year, but did not specify when.。

Along with other news released yesterday, the U.S. personal savings rate was 3 in January..8%, slightly higher than in December, but down a full percentage point from June 2023 levels。This suggests that consumers are continuing to cut their savings as prices remain high。

Separately, U.S. businesses remain reluctant to make layoffs, according to Labor Department's initial request report。First-time U.S. jobless claims for the week ending Feb. 24 were 21, data showed..50,000, an increase of 1.30,000, higher than Dow Jones' estimate of 210,000, but still largely in line with recent trends。However, consecutive jobless claims with a one-week lag showed just over 1.9 million, an increase of 4.50,000, higher than FactSet's estimate of 1.88 million。

A number of fiery data put together, raising concerns that inflation will continue to rise, and if the trend continues, it may affect the Fed's rate hike process。In terms of data selection, PCE data is more representative than CPI data。The CPI data is more of a mechanical basket price measure, while the PCE data is more relevant to the actual purchases of U.S. residents。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.