Wall Street to start T+1 settlement next week

The transition to T+1 securities settlement in the United States will take place on 28 May 2024, officially.

The transition to T+1 securities settlement is set to officially take place on May 28, 2024, with preparations underway by U.S. stock exchanges and numerous financial firms for the potential complexities it may bring.

What is T+1 securities settlement?

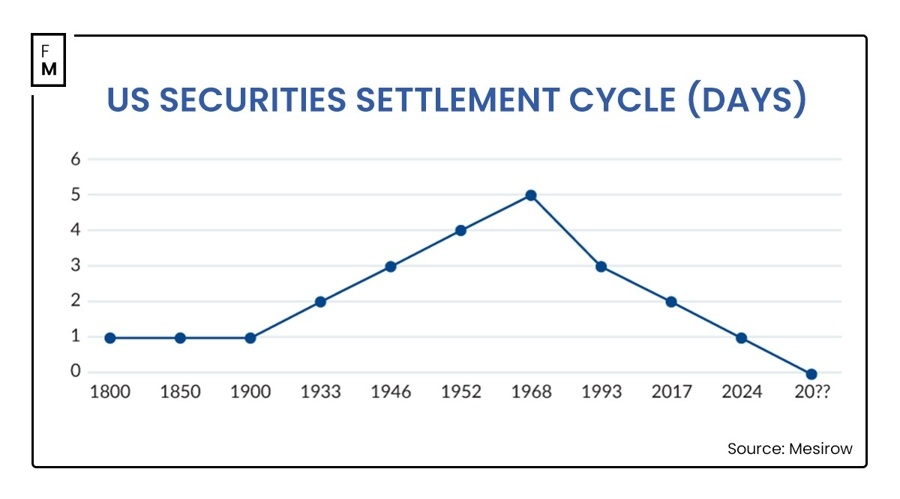

T+1 securities settlement refers to shortening the standard settlement cycle for most securities transactions from two business days after the trade date (T+2) to one business day after the trade date (T+1). The T+1 cycle will apply to stocks, corporate and municipal bonds, ETFs, certain mutual funds, and other securities traded on exchanges. Under T+1, for example, if you buy or sell a security on a Tuesday, the trade must settle completely by the end of Wednesday.

The shift to T+1 is expected to reduce counterparty risk in trading and potentially increase automation in post-trade processes. However, this will require market participants to update systems and processes to comply with the compressed timeline, which industry representatives say may be associated with new, previously unknown risks.

Cboe prepares for transition to T+1

In its latest communication, Cboe Global Markets has stated its readiness to transition to the shortened standard settlement cycle, effective from May 28, 2024. "Cboe Global Markets will also shorten the ex-dividend or ex-rights period for stock trades," the exchange explained.

Currently, Cboe begins trading ex-dividend the day before the record date for dividends or other distributions. With the introduction of the new settlement cycle, ex-dividend trading will occur on the same day as the record date.

While other major U.S. exchanges such as the New York Stock Exchange and Nasdaq have not yet issued similar statements, they are certainly also preparing for or have already prepared for the transition. U.S. self-regulatory organizations have also announced preparations, including FINRA, which reported adoption of appropriate rules at the end of February 2024.

Forex risks remain unresolved

The transition of the U.S. securities market to a T+1 settlement cycle has raised concerns about foreign exchange (FX) risk, particularly for the millions of foreign investors trading on Wall Street, whose capital now amounts to $25 trillion. Time zone differences between global markets make managing forex cycles under the new settlement regime more challenging.

Nearly a year ago, the forex division of the Global Financial Markets Association released a report titled "Forex Considerations for T+1 U.S. Securities Settlement," emphasizing increased risks to trading funds reliant on forex settlement, as matching, confirmation, and trade settlement must occur within local currency cut-off times, which may be more difficult to achieve under a faster settlement cycle.

The close of the trading week has become a major focus, as U.S., European, and Asian markets prepare to shut down, often resulting in a sharp decrease in liquidity in currency markets. The reduction in available funds further exacerbates the situation, as these markets are also closed on weekends, leaving little room for any interim adjustments if needed.

The convergence of these factors has led to increased concerns about the potential impact of the T+1 settlement cycle on forex risk management and the ability of market participants to access the necessary trading funds in a timely manner.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.