Will the global status of the US dollar be shaken?

Currency diversification has been a long-term trend in global financial transactions and trade, but the dollar may not lose its dominance in the short term.

Recently, speculation about a significant decline in the US dollar has garnered widespread attention in the financial world. Some observers even suggest that the dollar may lose its status as the world's primary reserve currency. This prediction stems from a range of factors, including the trend of China and a few trading partners beginning to use the yuan for commodity transactions and some countries exploring the possibility of a common currency.

This article will conduct an in-depth analysis of this issue, exploring the future trends of the dollar and its impact on the global economy.

Analysis of Dollar Performance

Changes in the Dollar Index

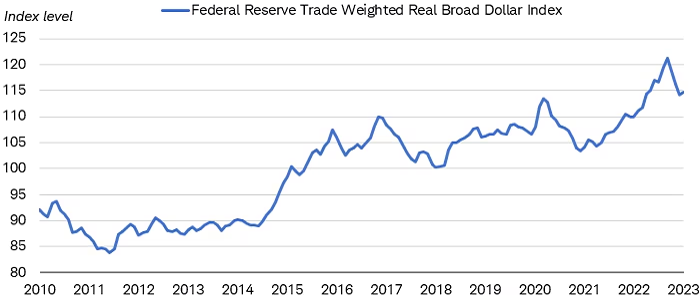

The dollar index is an indicator measuring the value of the dollar against a basket of other major currencies. Despite recent fluctuations, the real value of the dollar remains at a relatively high level in the long run. This is mainly attributed to the strong performance of the US economy and the dollar's status as a global reserve currency. According to data from the Federal Reserve, both the real and nominal values of the dollar have declined by approximately 8% to 10% since the end of last year.

Over the past decade, the dollar has experienced a relatively strong bull market, benefiting from relatively high US interest rates, increased capital inflows, and its status as a safe-haven asset. This has led to a 1.4-fold increase in the value of the dollar from 2011 to 2022 (adjusted for inflation). Despite recent declines, the long-term upward trend of the dollar remains stable.

The chart below illustrates the trend of the Federal Reserve's trade-weighted real broad dollar index since 2010. The index has risen from below 85 points in 2011 to a peak exceeding 120 points by the end of 2022.

Scale of Foreign Holdings of US Treasury Securities

The scale of foreign holdings of US Treasury securities is an important indicator of demand for the dollar. Although some countries may diversify their foreign exchange reserves, US Treasury securities remain the preferred choice for global investors.

Since 2013, the scale of foreign holdings of US Treasury securities has continued to grow, indicating sustained demand for the dollar. In 2022, the United States attracted the largest-scale foreign direct investment, with most of it flowing into the stock market.

Status of the Dollar as a Reserve Currency

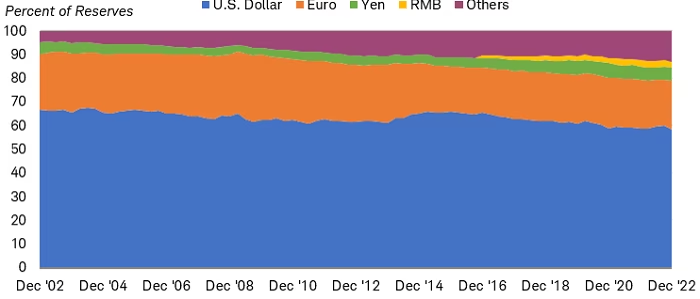

Although some countries have begun to explore diversifying their reserve currencies, the dollar remains the dominant reserve currency globally. Despite a slight decrease in the global reserve share of the dollar, it still accounts for approximately 60%, far higher than other currencies. The depth and liquidity of the dollar market, as well as the status of the United States as the world's largest economy, make it difficult to replace the dollar with other currencies.

Challenges Facing the Dollar

Rise of Other Currencies

With the rise of the Chinese economy, the yuan is gradually becoming internationalized. Some emerging market countries have also begun to explore using the yuan for international trade settlements. These trends may pose challenges to the dollar's status in the future, but replacing the dollar as the global reserve currency will require time and more international recognition.

Global Economic Uncertainty

Global economic uncertainty may affect the performance of the dollar. Factors such as trade tensions, geopolitical tensions, and the COVID-19 pandemic could lead to changes in global investors' demand for the dollar.

In addition, uncertainty in US domestic policies may also affect the dollar's performance.

Future Outlook for the Dollar

Long-Term Stability

The global economy may move towards multi-currency development, which may benefit emerging market countries. However, achieving this goal requires many structural reforms, including reducing trade and investment barriers and strengthening investor protection.

Although the dollar may face some short-term fluctuations and challenges, in the long run, it remains one of the world's major reserve currencies. Its depth and liquidity, the strong performance of the US economy, and global investors' trust in the dollar will continue to support its status.

The chart below shows the composition of global foreign exchange reserves represented by the dollar, euro, yen, yuan, as well as other reserve currencies such as the Swiss franc, Canadian dollar, Australian dollar, and pound sterling. As of the end of 2022, the dollar's share of global reserves was approximately 60%, down slightly from about 67% in 2002.

Diversification Trend

With the development of the global economy, the trend of diversification may accelerate. Some countries and regions may increase their use of other currencies, but the dollar will still be one of the main currencies for global trade and financial markets.

Conclusion

For investors, the uncertainty of the dollar's trend may bring both opportunities and challenges. On the one hand, a weaker dollar may increase the attractiveness of global assets, especially for emerging market countries.

On the other hand, a weaker dollar may also lead to instability in global markets, posing risks to investors. Therefore, investors should develop appropriate investment strategies based on their risk preferences and investment goals, and closely monitor changes in the dollar's trend.

Meanwhile, governments should enhance cooperation to promote global economic stability and sustainable development, and collectively address the challenges and opportunities that the dollar's trend may bring.

In summary, although the dollar may experience moderate declines in the near future, we believe that the likelihood of the dollar losing its status as the world's primary reserve currency is low. The dollar remains one of the world's major reserve currencies, and its position is unlikely to be seriously shaken in the short term. However, investors should closely monitor changes in the dollar's trend and adjust their investment strategies according to market conditions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.