Xiaomi Q2 Revenue and Net Profit Exceed Expectations; SU7 Targets 120,000 Units for Full-Year Sales

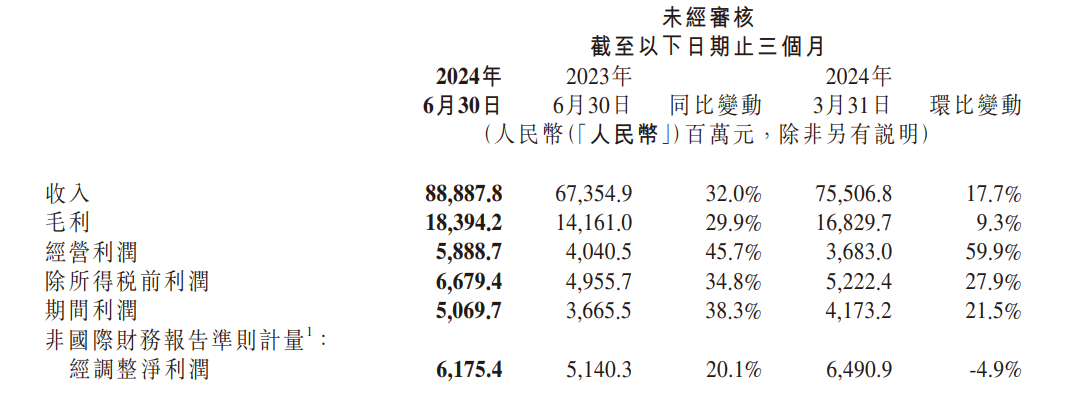

The earnings report showed that Xiaomi's total revenue for the second quarter reached 88.9 billion yuan, significantly higher than analysts' expectations of 85.8 billion yuan, recording a year-on-year increase of 32.0%. Adjusted net profit was 6.18 billion yuan, up 20.1 percent year-on-year, again above analysts' expectations of 4.8 billion yuan.

On August 21st, Xiaomi Group released its Q2 2024 financial results. As a result of the stellar results, Xiaomi's stock price opened higher the next day and closed up nearly 9%.

According to the report, Xiaomi's total revenue for the second quarter reached 88.9 billion yuan (RMB, the same below), significantly higher than analysts' expectations of 85.8 billion yuan, recording a year-on-year growth of 32.0%, the fourth consecutive quarter of year-on-year growth.

Net profit was 5.1 billion yuan, compared with 3.7 billion yuan in the same period last year. Adjusted net profit was 6.18 billion yuan, up 20.1 percent year-on-year, also above analysts' expectations of 4.8 billion yuan. Xiaomi's chairman Lei Jun said it was the best quarterly report in the company's history.

With the launch of the Xiaomi SU7 electric car, Xiaomi has divided its entire business into two main segments to reflect the company's “human-vehicle-family ecosystem” strategy: the cell phone x AIoT segment and the innovative business segment, such as smart electric cars.

Mobile x AIoT Segment Performs Solidly

Let's take a look at how Xiaomi's Mobile x AIoT segment performed in the second quarter.

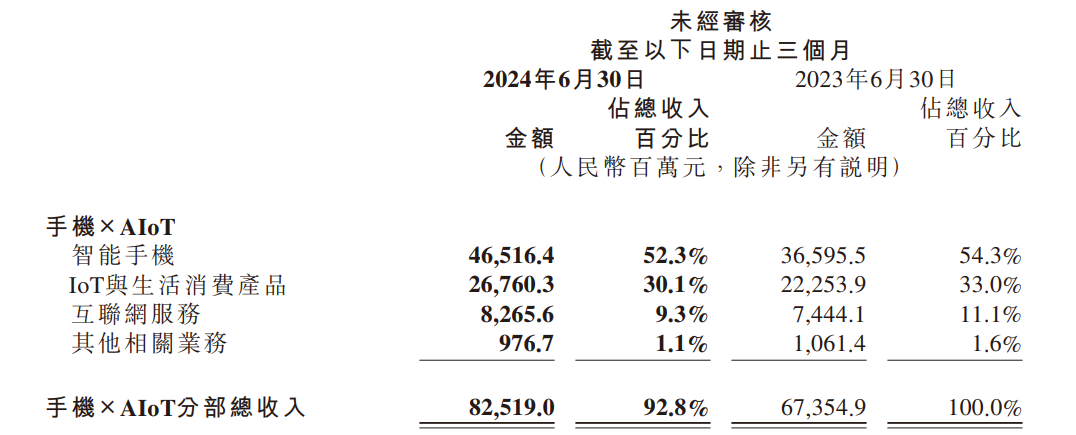

Xiaomi's Mobile x AIoT segment includes smartphones, IoT and consumer lifestyle products, internet services and other related businesses. In the second quarter, the segment's revenue was 82.5 billion yuan, up 22.5% year-on-year, with a gross margin of 21.1%. The business segment now accounts for 92.8% of Xiaomi Group's total revenue.

● Smartphones

In the second quarter, Xiaomi's smartphone business revenue was 46.5 billion yuan, up 27.1% year-on-year, with a gross margin of 12.1%.

Xiaomi's global smartphone shipments were 42.2 million units, up 28.1% year-on-year. According to Canalys data, shipments in the global smartphone market rose 11.9 percent year-on-year in the second quarter. Among them, Xiaomi's global shipments ranked a solid third, with a market share of 14.6 percent.

In the second quarter, Xiaomi smartphones performed well in several global markets. In mainland China, the shipment ranking returned to the top five, and the market share increased by 0.8 percentage points year-on-year to 14.2 percent. Latin America ranked in the top two for the first time in terms of shipments, with a 2.1 percentage point year-on-year increase in market share to 18.6 percent. Southeast Asia moved up to second place in terms of shipments, with a 3.1 percentage point year-on-year increase in market share to 17.2%. The Middle East's shipment ranking held steady at No. 2, with a significant year-on-year market share increase of 4.1 percentage points to 21.2%. The ranking in Africa held steady at number three, with a 3.1 percentage point year-on-year increase in market share to 11.7 percent.

In response to the significant increase in market share for Xiaomi's smartphones in a number of countries and regions around the world, Lu Weibing, president of Xiaomi Group, said in a conference call that this was mainly due to the company's adherence to its technology strategy, good supply chain management to withstand rising costs brought about by competition in the market, as well as continuing to do high-end.

We practiced high-endization in China first, and after we succeeded, we pushed high-endization overseas,” Lu said. Therefore, this year, you will see Xiaomi's overseas high-end progress is also very good.”

Lu also said that he believes Xiaomi's market share will gradually increase in the future. He said, “There may be some fluctuations from quarter to quarter, and the reason for such fluctuations may be that the release time of the mainstream products of each brand is not quite the same, but I think year-on-year, in the long term, we are still very confident.”

● IoT & Consumer Lifestyle Products Business

Xiaomi's IoT and Consumer Lifestyle Products business reported record revenue of 26.8 billion yuan in the second quarter, up 20.3 percent year-on-year, with gross margin improving 2.2 percentage points year-on-year to 19.7 percent.

The record-high revenue of this business was mainly attributable to the increase in revenue from smart large home appliances in mainland China, flat panels in overseas markets and wearable products in global markets. In particular, revenue from the large appliances business increased by 38.7% year-on-year, tablet revenue increased by 67.6% year-on-year and wearable products revenue increased by 31.0% year-on-year.

As of June 30, 2024, the number of connected IoT devices (excluding smartphones, tablets and laptops) on Xiaomi's AIoT platform reached 822.0 million, representing a year-on-year increase of 25.6%. the number of monthly active users of the Mi Home App increased by 16.8% year-on-year to 96.9 million in June 2024.

● Internet Services

In the second quarter, Xiaomi's Internet business revenue reached a record high of 8.3 billion yuan, up 11% year-on-year, led by growth in advertising revenue. Meanwhile, gross profit margin reached 78.3%, up 4.2 percentage points year-on-year.

In the second quarter, Xiaomi realized advertising business revenue of 6 billion yuan, up 16.9% year-on-year. Meanwhile, Xiaomi's game business revenue came to 1 billion yuan.

In June 2024, Xiaomi's global monthly active users reached 676 million, up 11.5% year-on-year. Among them, the number of monthly active users in mainland China reached 164 million, up 10.1% year-on-year.

For offshore Internet services, revenue realized in the second quarter rose 32.9% year-on-year to 2.7 billion yuan, accounting for 32.1% of the company's overall Internet service revenue, up 5.3 percentage points year-on-year.

Smart Electric Vehicle Division Growing Rapidly

Xiaomi's Smart Electric Vehicles and Other Innovative Businesses segment includes the Smart Electric Vehicles business and other related businesses.

In the second quarter, total revenue from this business segment amounted to 6.4 billion yuan, and this business component now accounts for 7.2% of Xiaomi Group's total revenue. Of this, 6.2 billion yuan was generated from smart electric vehicles and 200 million yuan from other related businesses.

The segment recorded a loss of 1.8 billion yuan as it is still in the high investment stage. However, the segment's gross margin performed well at 15.4%. Xiaomi's first time to build a car, the delivery of the first quarter after the gross profit margin achieved double-digit, so the outside world is very surprised.

In this regard, Lu Weibing summarized several reasons. One is the bullishness and support of suppliers. He said: “Our main partners are very optimistic about millet's future development of the car, so they gave us a very good customer orientation from the beginning, and based on this orientation they also gave us some better business conditions. This is the first factor that I think is more important.”

Secondly, Xiaomi adheres to the “explosive product strategy”. Based on this strategy, Xiaomi hopes to use the scale of one car to surpass the scale of several cars of the same industry, and thus realize the economy of scale. Third, millet in the cell phone and other industries in the deep plowing for many years accumulated management capabilities. Lu Weibing said, “These management capabilities have brought us a lot of management dividends.”

In addition, Lu Weibing also said that millet car subsequent gross margin gradually to the good is a definite trend. On the one hand, Xiaomi sent a number of rights and benefits to the owners of the initial order, and some of the rights and benefits have been canceled in subsequent orders. On the other hand, Xiaomi has been continuously upwardly adjusting this year's sales target in recent times, and the BOM (bill of materials) cost comes down when production rises.

Xiaomi mentioned in its earnings report that the Xiaomi Auto factory has started double-shift production in June 2024, and has carried out production line tuning and maintenance in July 2024, and is continuing to expand its production capacity. Xiaomi expects to complete the cumulative delivery of 100,000 new Xiaomi SU7 series vehicles ahead of schedule in November 2024, and the Company will also sprint towards a new target of 120,000 cumulative new vehicle deliveries for the full year of 2024.

In order to cope with the continuous delivery of Xiaomi cars, the construction of related supporting facilities is also being stepped up.

In terms of sales and service network construction, as of June 30, 2024, Xiaomi has opened 87 automobile sales stores in 30 cities in mainland China. In terms of intelligent driving, Xiaomi has opened City Pilot Assist (City NOA) in 10 cities in mainland China on June 6, and continues to enhance the comfort and efficiency of City NOA through OTA upgrades. Xiaomi plans to open City NOA in August 2024 across the country.

During the second quarter, Xiaomi SU7 series delivered 27,307 new vehicles. The company disclosed that the ASP of Xiaomi's smart electric cars is $228,644 per vehicle. With this calculation, Xiaomi's car has a single-car loss of over $60,000 per car.

But this calculation of single car loss is not fair to millet. Because the automobile industry belongs to the category of heavy industry, the upfront cost is high, because it is necessary to invest a lot of money for factory construction, technology research and development, recruiting personnel, store construction and so on. So for the millet car has just started to deliver a quarter, the loss is too normal.

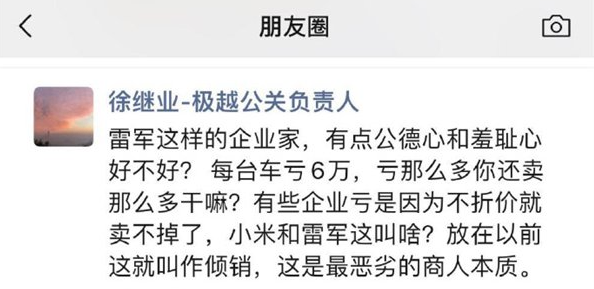

Nevertheless, the information “single car loss of more than 60,000” still attracted the attention of some people. According to a screenshot of a WeChat circle of friends circulating on the Internet, Xu Jiye, head of public relations of the pole, blasted millet's loss of money to sell the car this behavior, and said this is dumping. Extreme Yue is a car brand that is a collaboration between Baidu and Geely.

For the loss of millet car, Lei Jun also responded on Weibo that “building a car is very bitter, but success must be cool, millet car is still in the investment period, I hope everyone understands.”

Xiaomi's research and development expenditure in the second quarter increased by 20.7% year-on-year to 5.5 billion yuan due to the increasing research and development expenditure related to innovative businesses such as smart electric cars. However, Xiaomi's cash flow position remains robust, with cash reserves as of June 30, 2024 reaching RMB 141 billion.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.