International Remittance Comparison of Xoom vs Western Union vs Wise

What are the advantages of Xoom, Western Union, and Wise remittance services compared to each other?

With the increasing demand for global trade and personal cross-border payments, choosing an efficient and cost-effective international remittance service provider has become crucial.

This article delves into the characteristics, services, and key data of three well-known companies to help financial readers better understand their respective advantages and suitable scenarios.

Western Union

Founded in 1851, Western Union is one of the largest providers of cross-border payment solutions globally. Renowned for its extensive agent network and efficient electronic financial systems, the company offers fast and secure remittance services to users worldwide.

In China, Western Union operates over 27,000 agent locations, supporting cash pickups, Alipay transfers, and other methods to ensure swift remittance.

Key Features:

- Receipt Speed and Methods: Offers options for real-time and within minutes receipts, supporting various methods including cash, bank transfers, and electronic payments.

- Remittance Fees: Transparent and specific rates based on the remittance amount and method, accessible for user query on the website or app.

- Exchange Rate Advantage: Provides competitive exchange rates to minimize unnecessary currency exchange losses.

Xoom (PayPal’s Subsidiary)

Xoom specializes in providing convenient cross-border payment services. As a wholly-owned subsidiary of PayPal, Xoom leverages PayPal's global payment platform and technological prowess to achieve fast and secure fund transfers.

Xoom supports remittances to over 160 countries and regions, allowing customers to remit funds via bank accounts, credit cards, debit cards, or PayPal accounts.

Key Features:

- Remittance Speed and Security: Offers near-instantaneous receipt services ensuring rapid fund delivery to recipients.

- Global Coverage: Supports remittances in multiple currencies, facilitating cross-border payments and receipts for global users.

- Customer Service: Provides round-the-clock customer service and technical support through PayPal's customer support system.

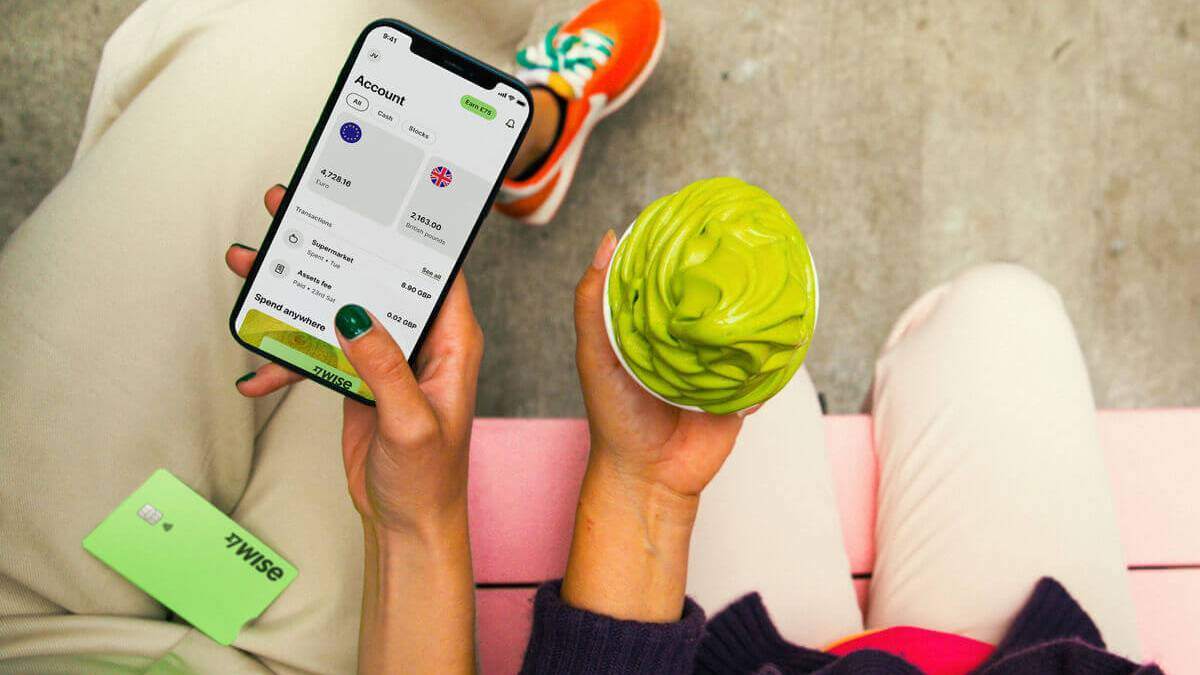

Wise

Formerly known as TransferWise, Wise is a UK-based financial technology company dedicated to reducing the cost of international remittances and improving transfer efficiency.

By establishing partnerships with global banks, Wise enables local bank transfers, avoiding traditional bank transfer fees and delays.

Key Features:

- Transparent Fee Structure: Provides real-time exchange rates and low-cost remittance fees, enabling clear understanding of transaction costs.

- Convenient Registration and Operation: Supports quick registration via social accounts or email, offering a user-friendly experience.

- Global Bank Partnerships: Collaborates with multiple global banks to ensure fast and reliable local bank transfer speeds.

Key Data Comparison

| Company | Remittance Fees | Receipt Time | Remittance Methods | Receipt Methods |

|---|---|---|---|---|

| Western Union | Variable based on amount | Within minutes | Electronic channels, agent locations | Cash, Alipay, UnionPay cards |

| Xoom | Variable based on amount | Within seconds | Bank accounts, credit cards, debit cards, PayPal accounts | Bank accounts, debit cards, credit cards, PayPal accounts |

| Wise | Variable based on amount | Within seconds | Bank transfers, debit cards, credit cards | Wise accounts, bank cards, Alipay, WeChat |

- Remittance Costs and Exchange Rates: Xoom and Wise generally offer more transparent and favorable fees and rates compared to Western Union. For instance, Wise typically ensures funds arrive within seconds with advantageous exchange rates.

- Receipt Methods: All three companies support various receipt methods including bank accounts, debit cards, and Alipay, catering to diverse recipient preferences.

- Service Features: Western Union stands out with its extensive agent network and quick receipt times, Xoom is preferred for its integration with PayPal and rapid remittance speeds, while Wise attracts users with its transparent fee structures and streamlined operational processes.

In summary, Western Union, Xoom, and Wise each possess unique strengths and suitable applications.

Western Union excels with its global agent network and fast receipt times, Xoom is favored for its tight integration with PayPal and rapid transaction speeds, and Wise attracts users with transparent costs and efficient operations.

Choosing the right international remittance service provider should align with individual needs and priorities to ensure efficient and economical transfers.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.