美联储经济状况褐皮书:市场急切等待的安慰剂

在这个时点,市场急切地需要一个“安慰剂”,来稳住市场的鸽派预期,而这份经济状况褐皮书,来的真是恰到好处。

当地时间9月6日,美联储公布了最新一期截至8月28日的经济状况褐皮书。根据褐皮书,在7、8两个月份中,美国的经济和就业市场整体温和,通胀逐步放缓。薪资方面,许多企业预计短期内美国的薪资增速将整体减慢,这也为通胀的进一步下行提供信心支持。

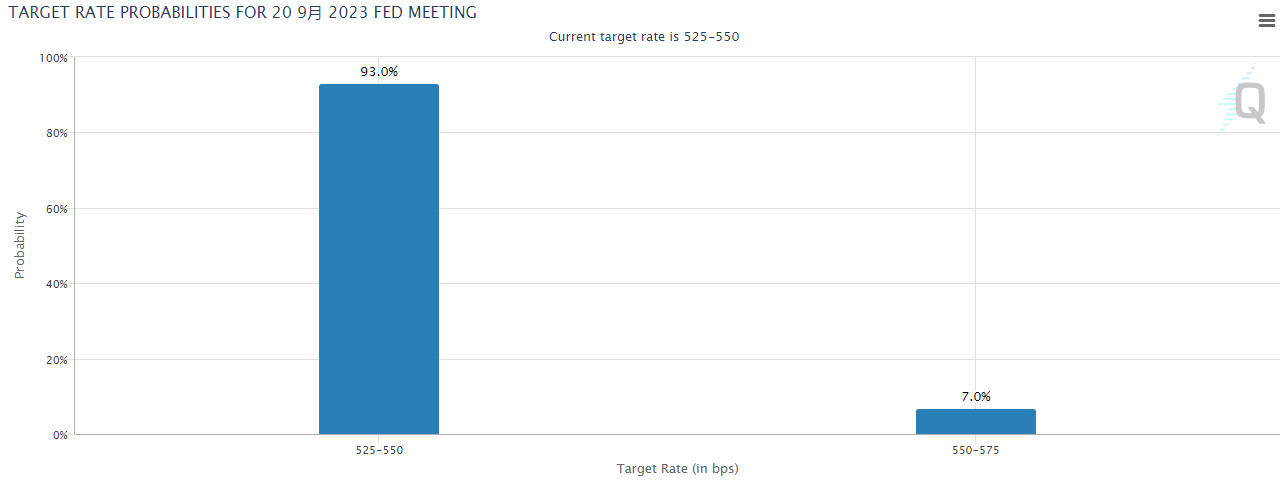

美联储议息会议在即,市场对美联储将在本次会议暂停加息的期望渐浓。据CME美联储观察,交易员押注美联储在9月按兵不动的概率一度超过了90%,这代表美联储可能将年内或存的另一次加息延后至第四季度。

正当一切似乎都板上钉钉的时候,在八月底举行的一年一度的杰克逊霍尔央行年会上,美联储主席杰罗姆·鲍威尔(Jerome Powell)的意外放鹰扰乱了市场。这位“通胀斗士”表示,目前美国的价格水平仍然过高,美联储将致力于实现并维持足够严格的货币政策立场,以便随着时间的推移将通胀降至这一水平。

在这个时点,市场急切地需要一个“安慰剂”,来稳住市场的鸽派预期,而这份经济状况褐皮书,来的真是恰到好处。

由美国储蓄下跌导致的消费景气度减弱绝不是空穴来风。事实上,早在今年6月,美联储官网就曾发布过一篇名为《疫情期间的超额储蓄:历史视角下的国际比较》的论文。根据其测算,美国的超额储蓄很可能已经在2023年一季度耗尽。近日,根据旧金山联储测算,截至今年6月末,美国家庭持有的超额储蓄已不足1,900亿美元。

在这种情况下,美国民众已经开始减少了非必须品的消费。褐皮书指出,虽然许多地区的新车销量确实有所增长,但是根据联系人的分析,新车销量的增加更多是由于库存的充足,而不是消费者需求的增长。此外,大多数地区表示,消费者贷款余额已经有所增加,一些地区甚至报告消费者贷款拖欠率上升,这也指向美国人的储蓄不足问题。

就业方面,和近期公布的数据一致,美国的劳动力市场已经开始显露出疲态。尽管招聘放缓,但大多数地区表示,由于技术工人的供应和申请人数量仍然受到限制,劳动力市场的不平衡仍然存在。几个地区的工人保留率有所提高,但仅限于制造业和运输业等某些行业。

此外,许多受访者在描述工资增长时表示“下半年将会有所不同”。大多数地区的劳动力成本压力增长加剧,上半年超出预期。但几乎所有地区都表示,企业重申了之前未实现的预期,即工资增长在短期内将普遍放缓。

根据近期公布的非农数据,虽然在8月,美国的非农就业人数仍然增加了18.7万人,超出了经济学家们的预期。但是,根据公布数据,美国劳工部将6、7两个月的就业人数合计下修了11万人。同时,美国8月的同比时薪涨幅也有所下降,同比仅为4.3%,低于7月的4.4%。

美联储关心的价格方面,褐皮书显示,大多数地区报告价格增长总体放缓,其中制造业和消费品行业放缓的速度更快,这无疑是一个好消息。但是,根据报告,有几个地区在过去几个月间的财产保险费用急剧增加。多个地区的受访者表示,由于企业难以转嫁成本压力,投入价格增长放缓幅度小于销售价格增长幅度,几个地区的利润率因此下降。

褐皮书的调查也和美国物价的实际情况一致。上周,美国7月的PCE物价指数同比增长3.3%;剔除食品和能源后的7月核心PCE物价指数年率为4.2%,和市场预期一致。LPL Financial首席经济学家杰富瑞·罗奇(Jeffrey Roach)表示:“尽管该数据的具体细节有些令人失望,但它强化了关于美联储不会在9月份改变其维持利率不变计划的市场猜测。”

按照惯例,美联储每年将会发布8次经济状况褐皮书,汇总的是12家地区储备银行对全美经济形势进行摸底的结果。该文件对美联储的货币政策制定具有重要的参考价值,公布时间一般为美联储议息会议的两周前,被市场认为是美联储利率决议的风向标。

根据议程,美联储9月议息会议将于本月19至20日召开。值得注意的是,目前市场押注美联储将利率稳定在5.25%-5.5%的区间的概率仍然高达93%。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。