日本央行9月暂停加息 下一次加息或是12月

若是12月不加息,明年年初也会继续进行加息行动。

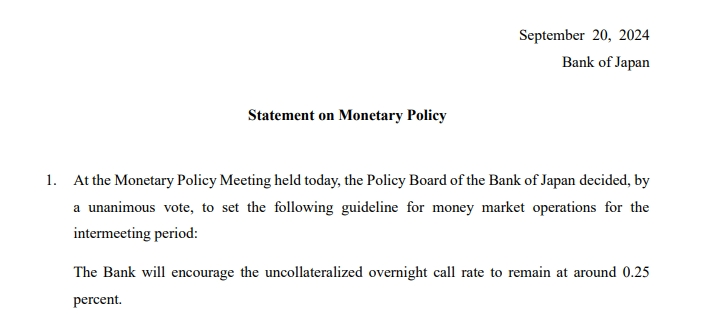

9月20日,日本央行央行货币政策会议决定,维持当前0.25%的政策利率(无担保隔夜拆借利率)不变,和市场预期保持一致。

在随后的声明中,央行继续保持谨慎观点。

央行先是指出了日本经济在近期发生的一些积极变化:价格上涨,私人部门消费出现改善迹象,就业和收入水平上升;由于企业利润增加,商业投资也出现了上升趋势。

随后,央行同样也对近期出现的隐忧进行说明,而这也是该行保持不继续加息的原因,包括出口、工业生产和公共投资停滞不前、住房投资依旧疲软等。

价格方面,日本央行认为,服务价格的上涨带动CPI同比上升,不包括生鲜食品的整体CPI上涨了2.5%至3%,在合适的范围内。该行还预测,未来日本的经济增长将保持在潜在水平线以上,CPI将在2025财年继续攀升。

利率决议公布后,汇市率先反应。欧元/日元交叉盘走低,并远离前一天触及的两周高点160.00,该点位也为市场重要心理关口。现货价格在最后一小时跌至158.00点附近,但仍局限在前一天的较宽区间内。美元/日元也从142.62下跌至142.32。

值得一提的是,欧洲央行刚刚在上周进行了周期内的第二次降息,而美联储则是在本周刚刚超预期降息50个基点。

在利率决定后的记者会上,日本央行行长植田和男表示,日本经济正在温和复苏,尽管出现了一些疲软迹象。考虑到目前实际利率仍处于极低水平,如果日本经济和价格前景得以实现,将相应地继续提高政策利率,调整政策宽松的力度。

植田和男称,“如果经济发展符合我们的预期,我们将继续加息的想法没有改变。”

植田和男还强调,将以极高的紧迫感监测经济和市场趋势。必须密切关注金融市场和外汇市场,以及其对日本经济和物价的影响。由于近期外汇波动导致价格上行风险有所降低,因此在货币政策决策上还有一些时间。通胀超出预期的风险在某种程度上已经减弱。

他还表示,目前日本央行尚无具体时间表来确认海外经济对日本央行前景的影响所需的时间。需要密切关注美国经济是否能够实现软着陆,还是面临更为严峻的调整。日本央行正处于加深对中性利率的理解、同时关注加息对经济影响的阶段。

另外,根据今日公布的数据,日本8月通胀连续第四个月加速增长,核心CPI同比增长2.8%,超过了央行2%的既定目标,为进一步加息留下空间。

受政策和数据双重提振,今日日经225指数飙升1.53%,收报37,723.91点;JPX-日经400指数涨0.94%,收报24,123.88点。日经指数创下自8月中旬以来的最佳单周表现。

芯片板块大幅反弹(和美股芯片板块一致),相关行业指数本周累计上涨1.57%;芯片制造设备巨头东京电子股价飙升5.32%,涨幅排名今日前五。丰田汽车收涨0.9%,本田汽车上涨 0.84%。优衣库的所有者 Fast Retailing上涨了4.16%,由于其在日经指数中的权重较大,按加权点数计算,Fast Retailing成为今日日经指数上涨的最大支撑。

随着决议公布,市场将目光转向日本央行往后的政策行动。日本央行在 3 月份结束了负利率政策,并在7月份将短期政策利率上调至0.25%。随后,日本央行多位官员最近的言论表明,日本央行将在今年年底前再次加息。

目前,多位分析师表示,日本央行下一次的加息时间点为12月;若是12月不加息,明年年初也会继续进行加息行动。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。